Income Withholding Child Support Wisconsin

Order for families getting services from their local child support agency must be stated in dollar amounts such as 300 each month.

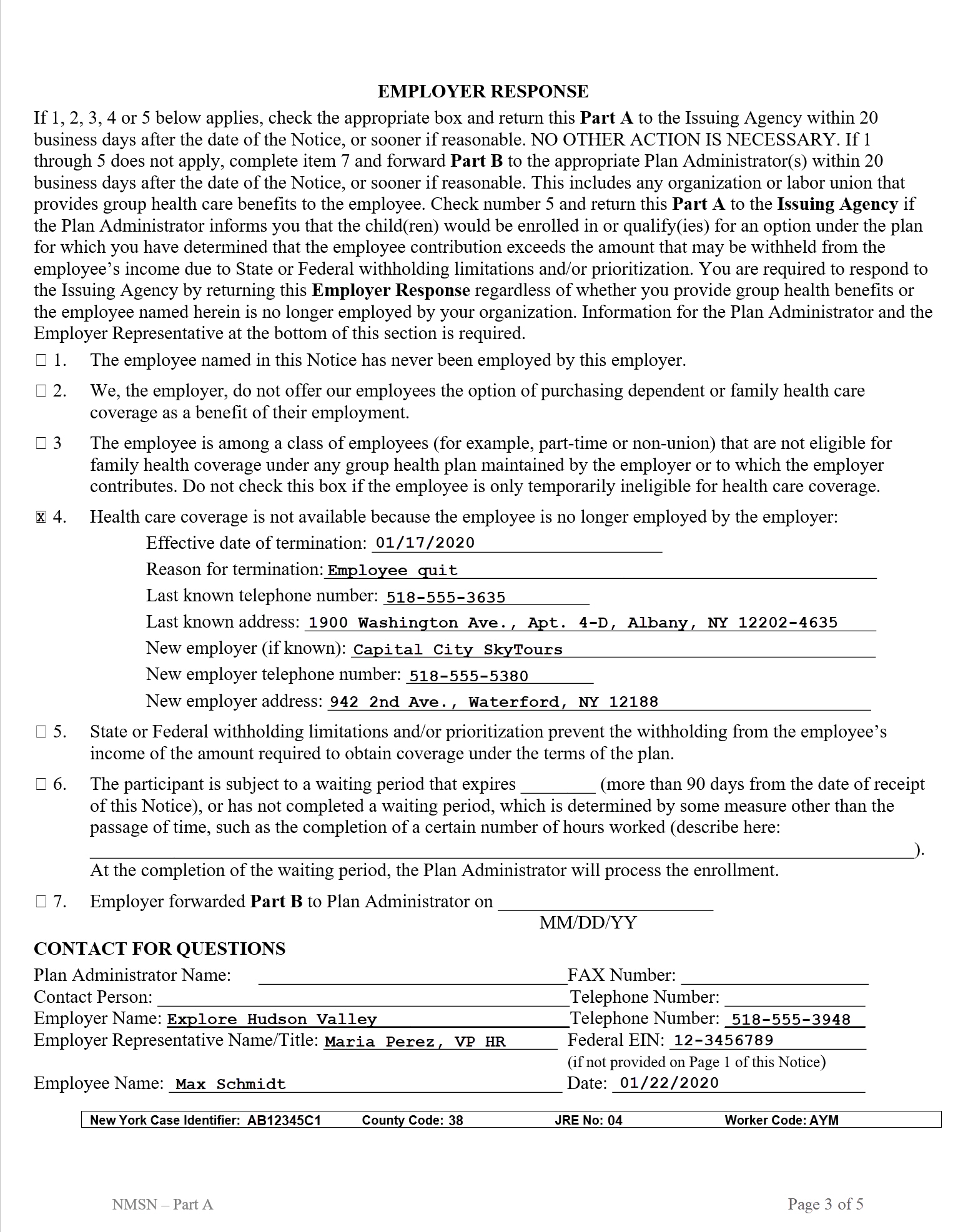

Income withholding child support wisconsin. The child support program collects almost 75 of support for wisconsin families through income withholding. Calculating withholding amounts for child support insurance premiums and past due support within ccpa limits and withholding priorities. An important component of the wisconsin child support program is the state statutory requirement that all orders for child support maintenance and family support include a provision for immediate income withholding by the payer s employer. This page talks about initial efforts used by child support agencies to collect past due child support.

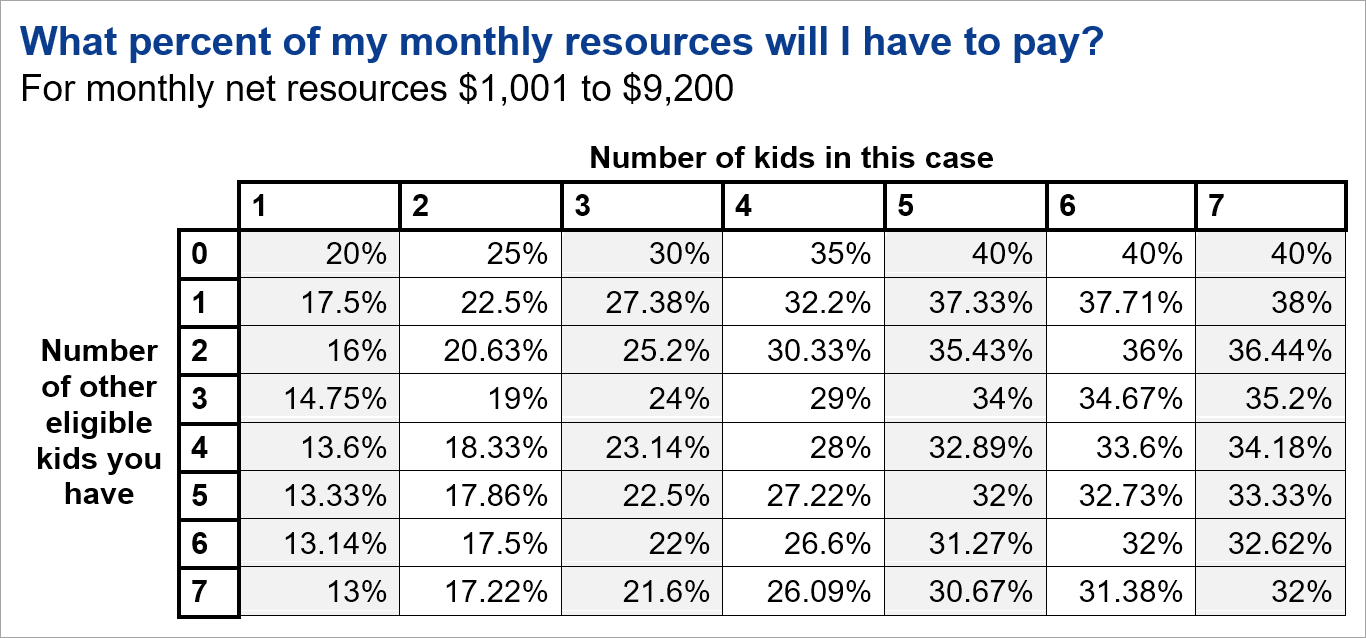

The dollar amount is based on the percentage of income standards. By partnering with child support you can assure that you are staying in compliance and you are actively involved in the goal to ensure that children receive the support they need and deserve. Wisconsin law requires interest charges of 0 5 per month 6 a year on past due support. Income withholding notice for pay period totals.

If income withholding orders are received from a private collection agency send the withholdings to the wisconsin support collections trust fund or another state s official disbursement unit when appropriate. Compensation checks pension payments and social security disability income benefits. Income withholding timelines new income withholdings may take up to 30 days for support payments to start coming out of your paycheck. Bcs is in the process of updating information on this site to conform to those changes.

Income withholding for employers and payroll providers. Gross income is 500. Child support may also be withheld from unemployment payments workers. Ending child support under wisconsin law a parent s duty to support his or her child continues until age 18 or age 19 if the child is.

This will ensure your employee received full credit for the child support withheld by you. 150 for current support. 50 for health care premium. 75 for past due support.

The administrative code chapter dcf 150 child support percentage of income standard was amended effective july 1 2018.