Income Withholding And Wage Garnishment

Commissions bonuses workers comp benefits and pensions can be garnished as well according to the federal office of child support enforcement.

Income withholding and wage garnishment. 13 2020 the federal minimum wage is 7 25 and 30 times that is 217 50. This list is not exhaustive. Income from virtually any source can be vulnerable. A wage garnishment is any legal or equitable procedure through which some portion of a person s earnings is required to be withheld for the payment of a debt.

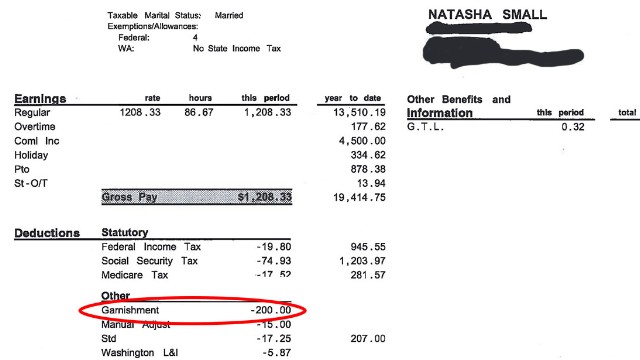

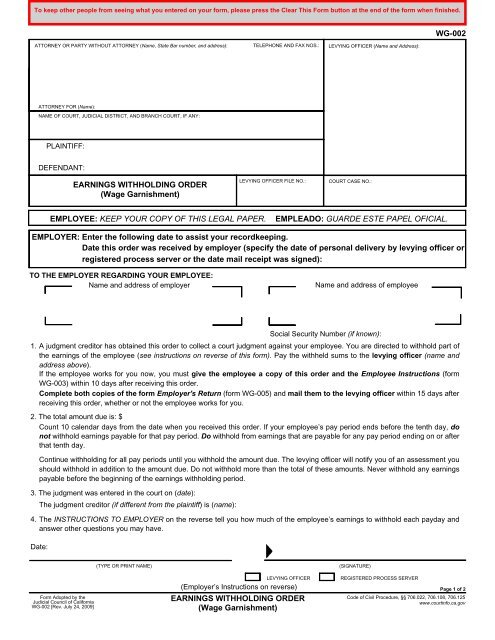

Since 200 is less than 582 50 the maximum wage garnishment would be 200. Additionally 25 of the disposable earnings from the commission payment may be garnished or 450 1 800 25 450. If you re having trouble getting an employer to garnish an employee s wages a court order can compel them to do so. Click for help with tax liability wage garnishments an employer who receives an earnings withholding order form wg 002 or an earnings withholding order for elder or dependent adult financial abuse form wg 030 is legally required to withhold part of the employee s earnings.

An employee who has disposable earnings of 370 a week has 140 withheld per week pursuant to court orders for child support. The process of wage garnishment in arizona begins when the court issues an income withholding support order against the noncustodial parent following the custodial proceedings of a divorce. In fact nearly 75 percent of all child support collections nationwide come from employers. Income deduction orders are commonly used in chapter 13 bankruptcy cases and to satisfy child support obligations currently all court orders for child support include an automatic income deduction order.

Withhold from a person s earnings in response to a garnishment order and the ccpa s protection from termination because of garnishment for any single debt. Support arrears can be garnished from other sources of income in addition to regular wages. 6 subtract 217 50 from your total weekly wages of 800 and you get 582 50. Thus 25 of each week s disposable earnings from the draw 75 in this example may be garnished.

Similar to a wage garnishment order an income deduction order requires your employer to withhold a certain amount of money from your wages to satisfy your financial obligations. Income withholding is similar to wage garnishment and works identically the only difference is that with an income withholding order your employer holds back your paycheck and after withdrawing the appropriate amount of money forwards the check to the state disbursement unit which then forwards the reduced check to you. This support order mandates child support garnishment and is sent to the noncustodial parent s employers or administrators of income who in turn are required to garnish the noncustodial parent s wages. Individuals who earn disposable income under 217 50 per week do not receive any wage garnishment.

Wage garnishments for tax liability like earnings withholding order for taxes state tax liability form wg 022.