How To Prepare Cvp Income Statement

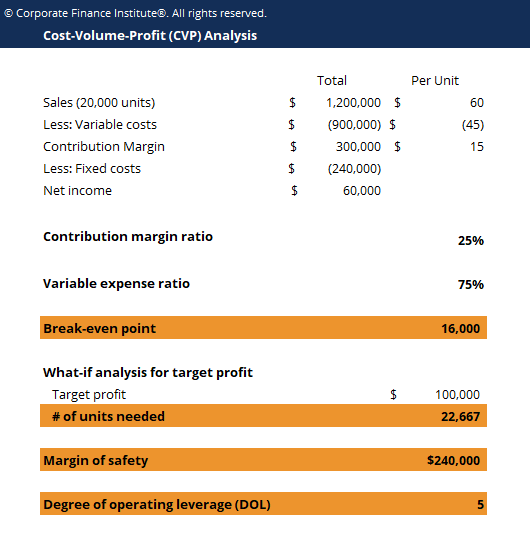

In cost volume profit analysis or cvp analysis for short we are looking at the effect of three variables on one variable.

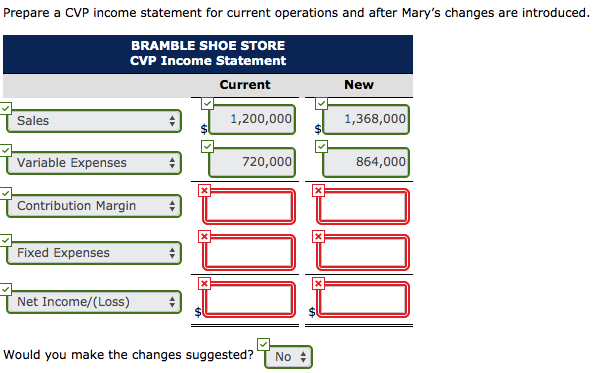

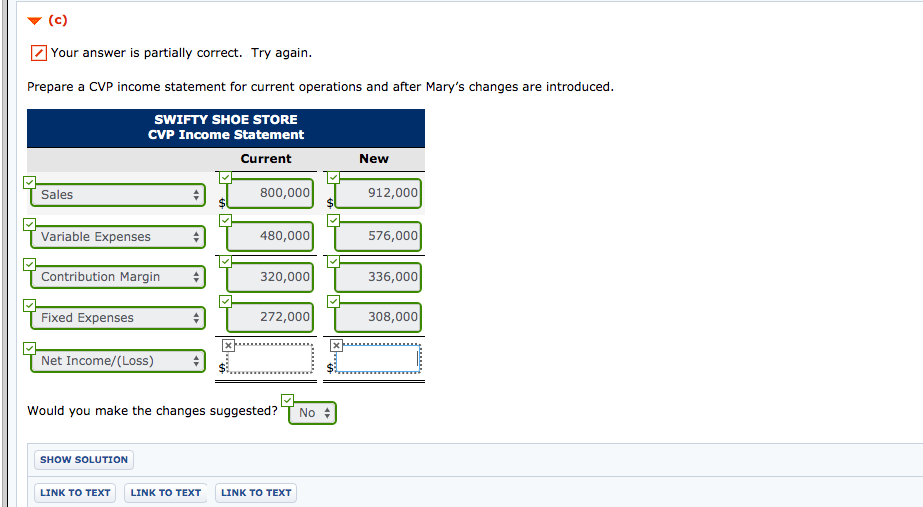

How to prepare cvp income statement. The remaining 20 000 units are in finished goods inventory at the end of year 2. Prepare a cvp cost volume profit income statement for current operation and after mary s changes are introduced current cvp income statement sales 20 000 x 40 800 000 variable expenses 480 000 contribution margin 320 000 fixed expenses 270 000 net income 50 000 cvp income statement after mary s changes. When running a business a decision maker or managerial accountant needs to consider how four different factors affect net income. Comparative income statement format of abc limited for the period ended 2016 and 2017.

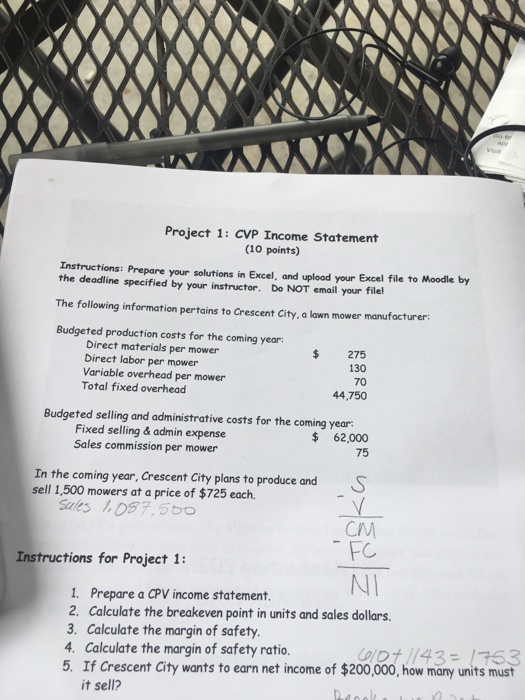

The resulting value is sometimes referred to as operating income or net income. Please show all the work i need the formulas to plug into excel instructions. Cost volume profit analysis helps you understand different ways to meet your net income goals. The contribution margin income statement is a useful tool when analyzing the results of a previous period.

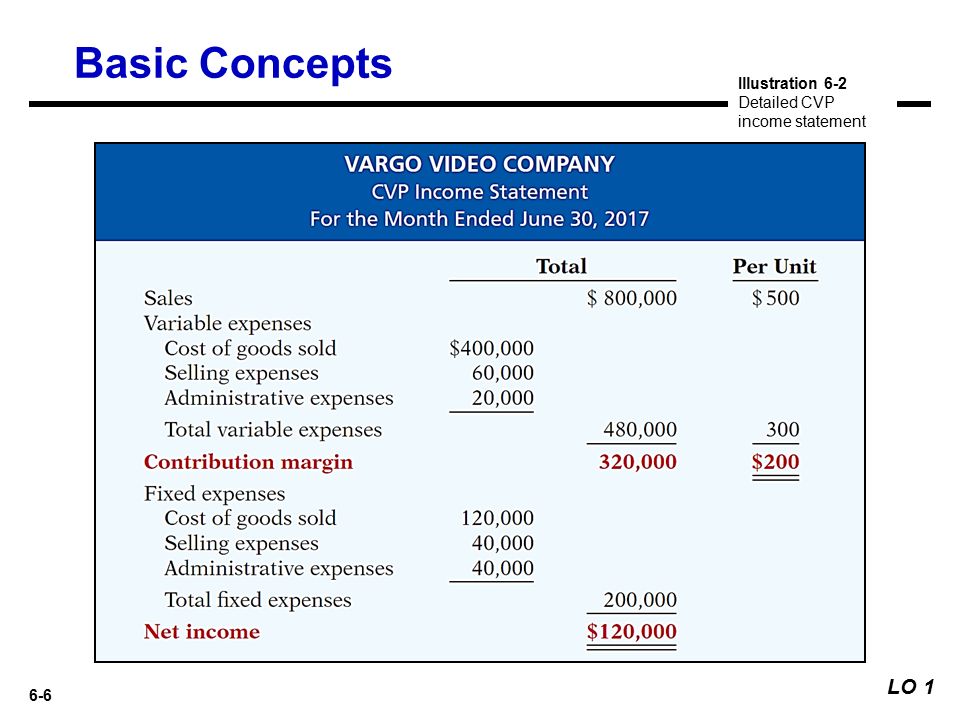

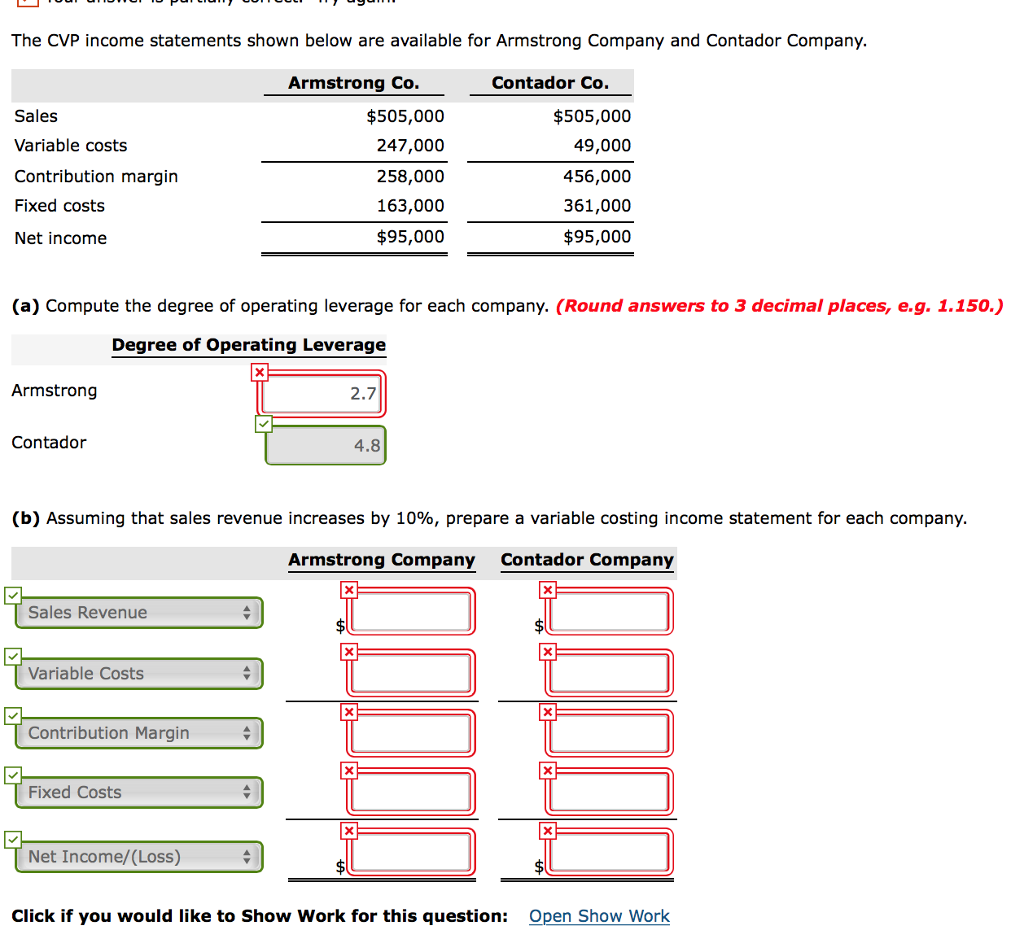

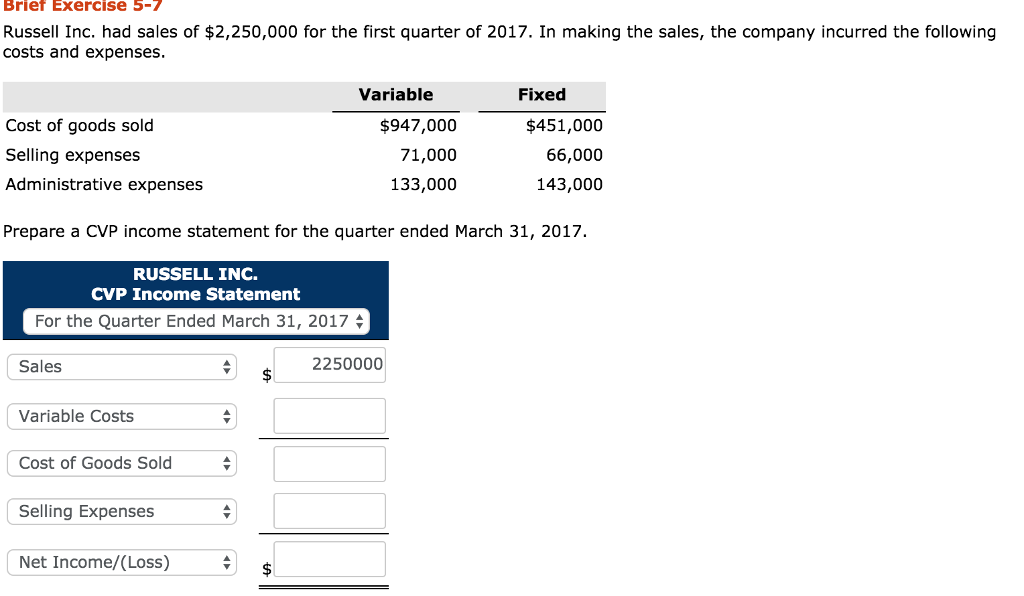

Cvp analysis estimates how much changes in a company s costs both fixed and variable sales volume and price affect a company s profit this is a very powerful tool in managerial finance and accounting. Contribution margin indicates how sales affects profitability. In variable costing income statements all variable selling and administrative expenses group with variable production cost. The regular income statement follows the order of revenues minus cost of goods sold and gives gross margin while revenues minus expenses lead to net income.

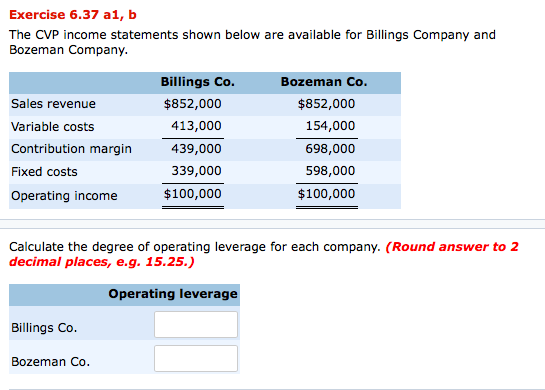

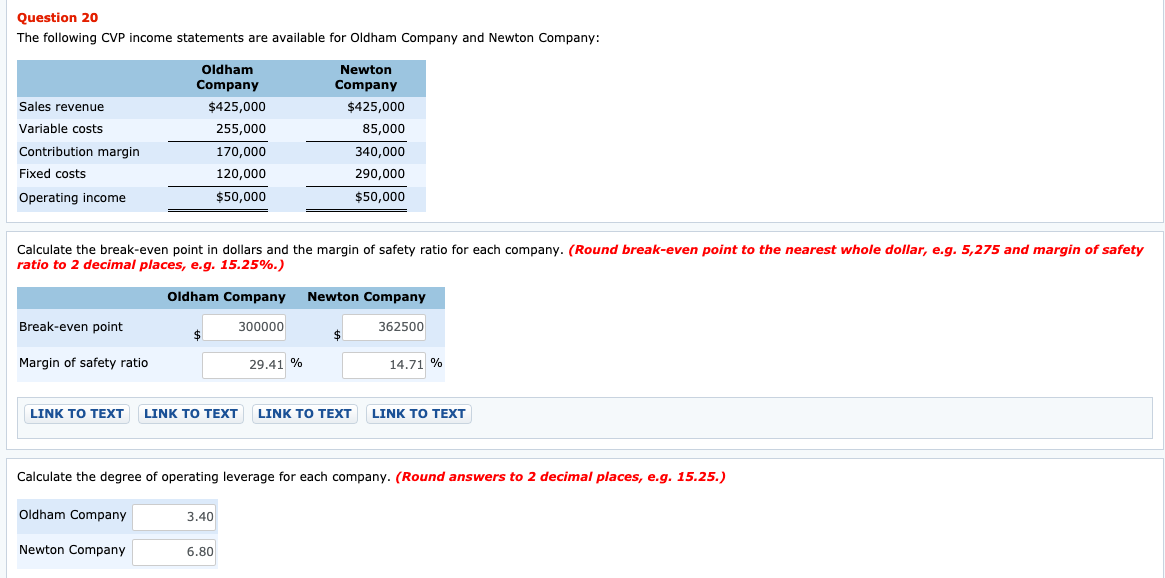

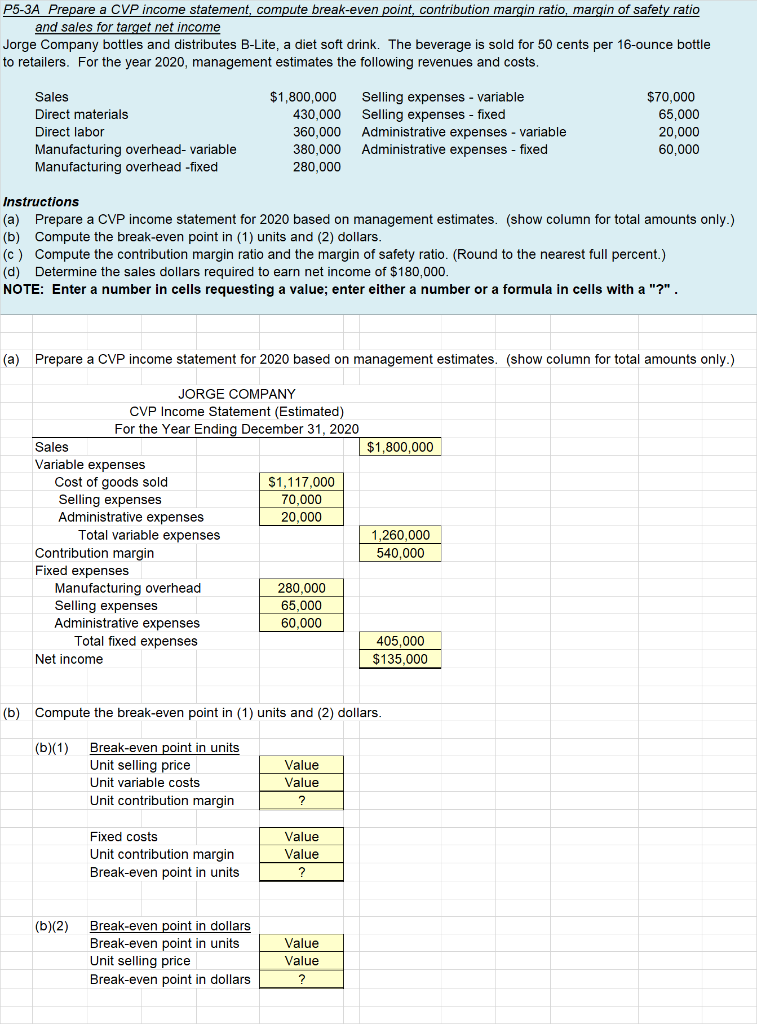

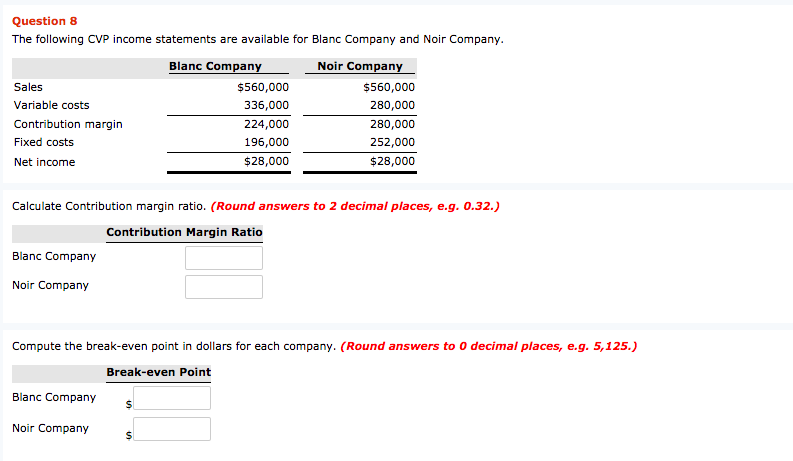

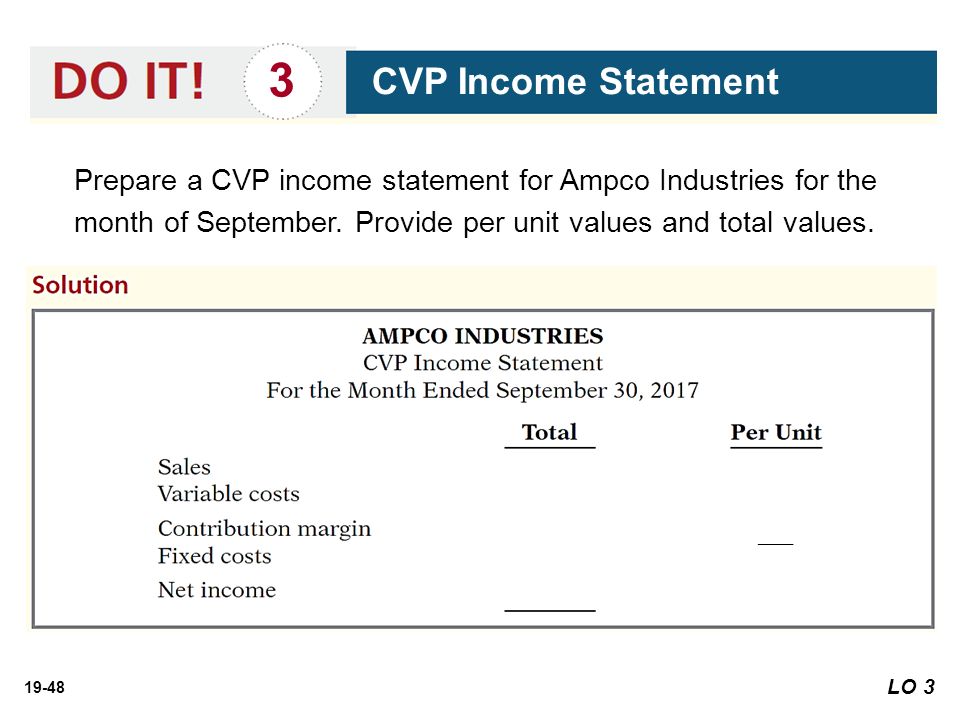

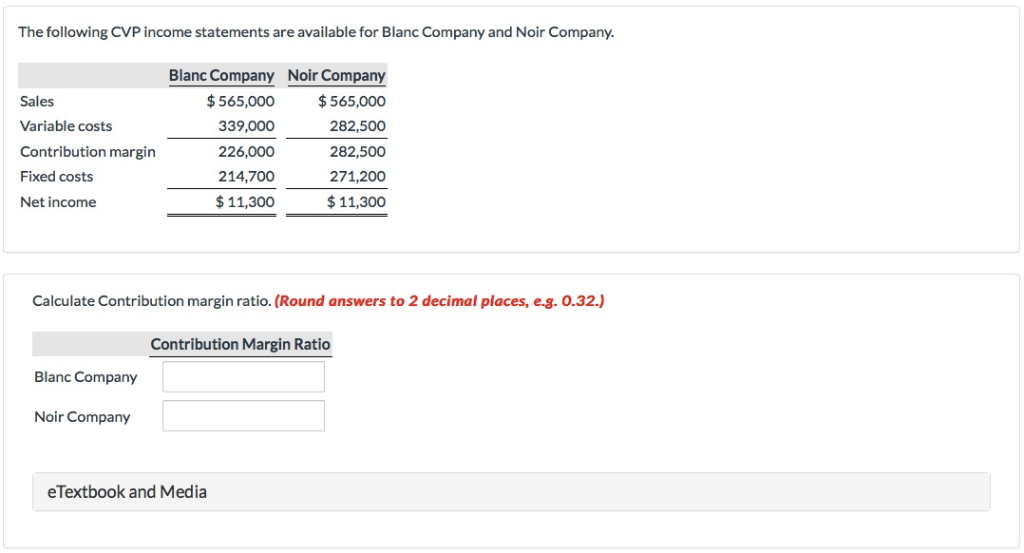

Prepare a cvp income statement compute break even point contribution margin ratio margin of safety ratio and sales for target net income. Cvp income statement format. Although 100 000 units are produced during year 2 only 80 000 are sold during the year. This statement tells you whether your efforts for the period have been profitable or not.

Prepare a contribution margin income statement assuming the company uses variable costing. It is a part of the contribution margin. The normal income statement has a gross margin whereas variable costing income statements have a contribution margin. In order to properly implement cvp analysis we must first take a look at the contribution margin format of the income statement.

Sales price sales volume variable cost fixed cost the graphs provide a helpful way to visualize. Variable costing income statement.