Income Tax Withholding Louisiana

With rare exceptions if your small business has employees working in the united states you ll need a federal employer identification number ein.

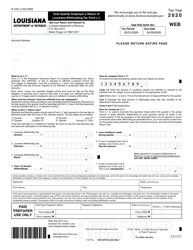

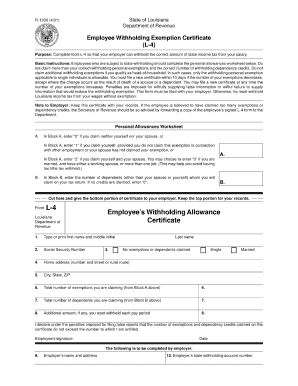

Income tax withholding louisiana. The amount of louisiana income tax to be withheld is based on the income tax withholding tables or formulas prescribed by louisiana administrative code 61 i 1501 and the withholding exemptions and dependent credits provided by the employee in the employee s withholding exemption certificate form r 1300 l 4. If the employee fails to provide a. What you need to know every employer that has resident or nonresident employees performing services except employees exempt from income tax withholding within louisiana is required to withhold louisiana income tax based on the employees withholding exemption certificate. When to obtain a tax identification number an employer who is opening a business with employees or who.

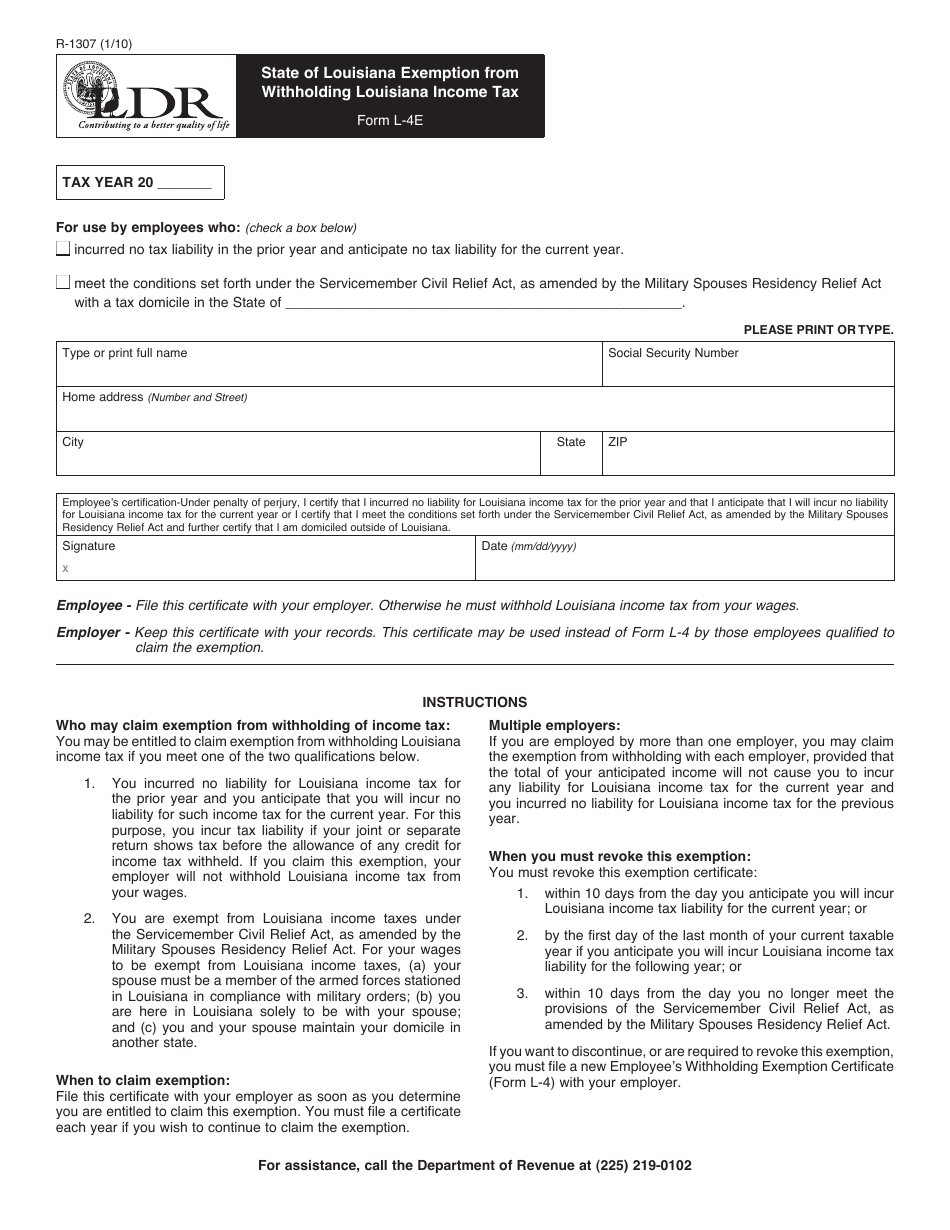

Exemption from withholding louisiana income tax l 4e r 1307 r 1307 1 10 state of louisiana exemption from withholding louisiana income tax form l 4e tax year 20 for use by employees who. The employer from withholding any louisiana income tax from the employee. If at any time the employee s status changes and is expected to incur an income tax liability the employee must file r 1300 l 4 with the employer. Here are the basic rules on louisiana state income tax withholding for employees.

You should obtain your ein as soon as possible and in any case before hiring your first employee. Check a box below incurred no tax liability in the prior year and anticipate no tax liability for the current year. 0 12 500 0 plus 2 10 0 12 500. Tax withholding table single personal exemption code s and 0 zero if the amount of taxable income is.

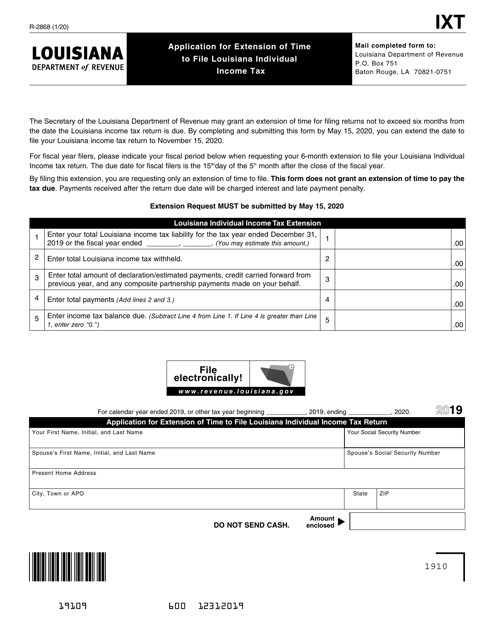

Line 1 3 enter the correct amount of louisiana income tax withheld or required to be withheld from the wages of your employees for the appropriate month. The amount of louisiana tax withholding should be. Line 4 add lines 1 2 and 3.

_20091209_Page_1.png)