Insurance Income Statement Explained

:max_bytes(150000):strip_icc()/Apple10KIS-00e74dfe3f34479180ac7ede7b982292.jpg)

Turn to the insurance company s combined ratio to see how efficiently it handles its claims liability.

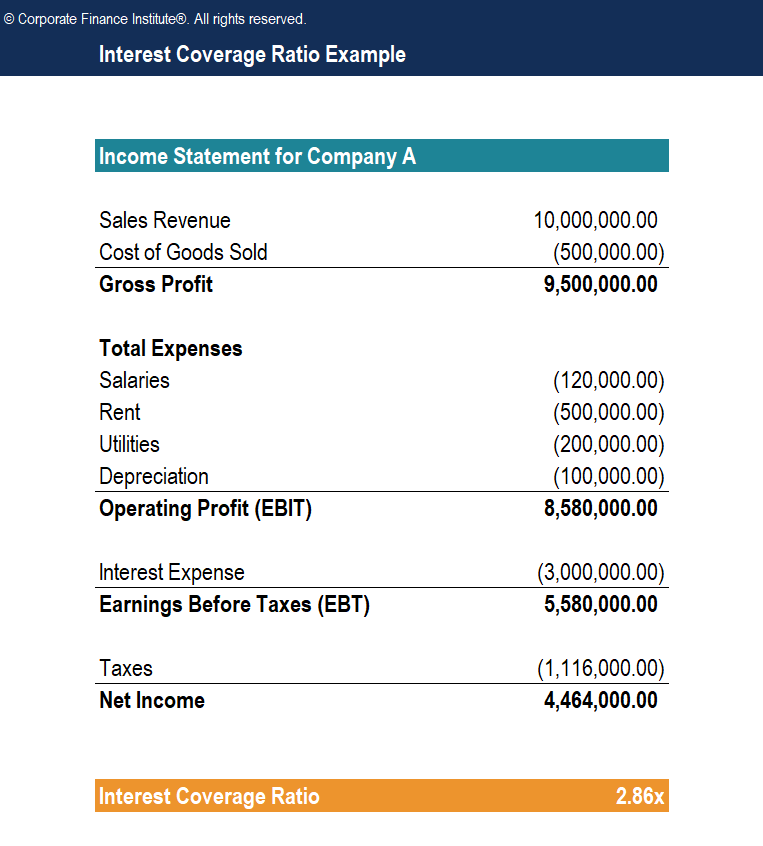

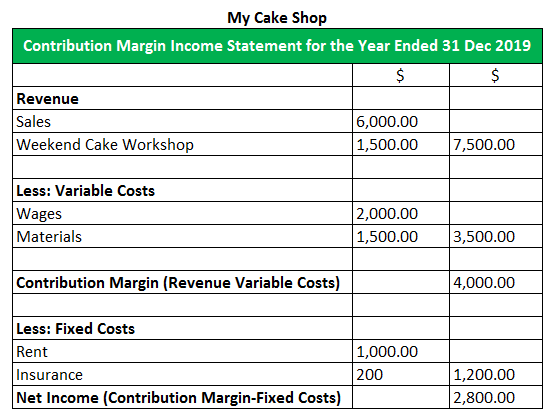

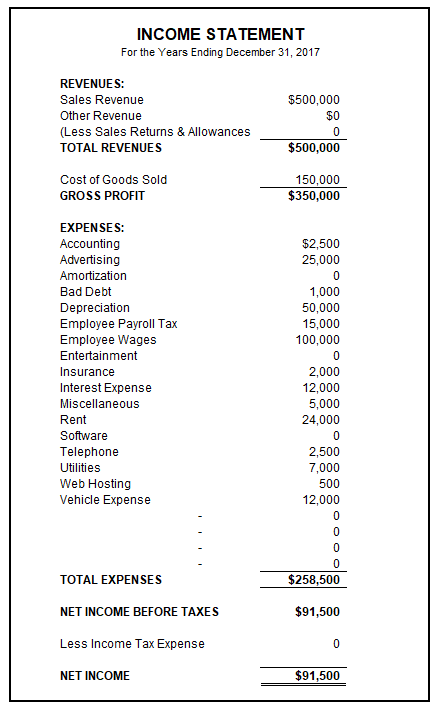

Insurance income statement explained. This example financial report is designed for you to read from the top line sales revenue and proceed down to the bottom line net income. Income statement j10 jun 2016 current xlsx 18 89 kb technical note on new insurance statistics feb 2018 pdf 120 82 kb summary background notes. Relating the business to the balance sheet and income statement. Income protection usually pays out until retirement death or your return to work although short term income protection policies which last for one or two years are also available at a.

Identifies the business the financial statement title and the time period summarized by the statement. Accounts receivable net written premiums and premiums earned accounts payable losses incurred loss expenses incurred other underwriting expenses incurred and aggregate write ins for. Each step down the ladder in an income statement involves the deduction of an expense. The income statement comes in two forms multi step and single step.

The income statement is one of a company s core financial statements that shows their profit and loss over a period of time. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of three statements used in both corporate finance including financial modeling and accounting. The national association of insurance commissioners explains that an insurer s combined ratio includes. Here s how an income statement is usually.

Understand the key financial items in insurance company financial statements and how the business model is reflected in the balance sheet. Formerly known as permanent health insurance income protection is an insurance policy that pays out if you re unable to work because of injury or illness. Understand the key components of an insurance company s income statement balance sheet and cashflow statement recognize the impact of differing accounting standards reserving policies and changes in external variables such as interest rates and asset prices on the financial statements. Key items of the balance sheet and income statement for life and non life insurers.

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)