Income Tax Resident Meaning Kenya

You are considered a resident for tax purposes if you have resided in the country for 183 days or more out of the past fiscal year.

Income tax resident meaning kenya. Kenya s finance act 2016 introduced a provision for tax amnesty on foreign income with respect to any year of income ending on or before the 31 december 2016. Present in kenya for 183 days or more in that year of income or. Fees is deemed to constitute income accrued or derived in kenya. Tax residency is a basis for levying income tax in kenya.

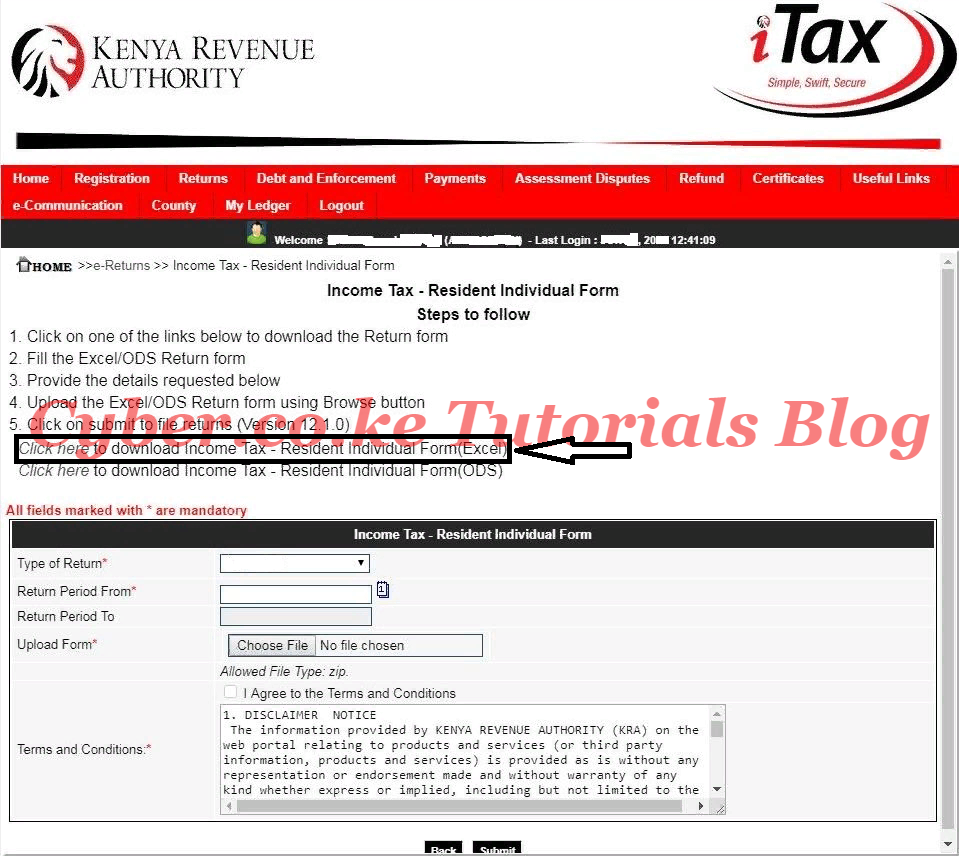

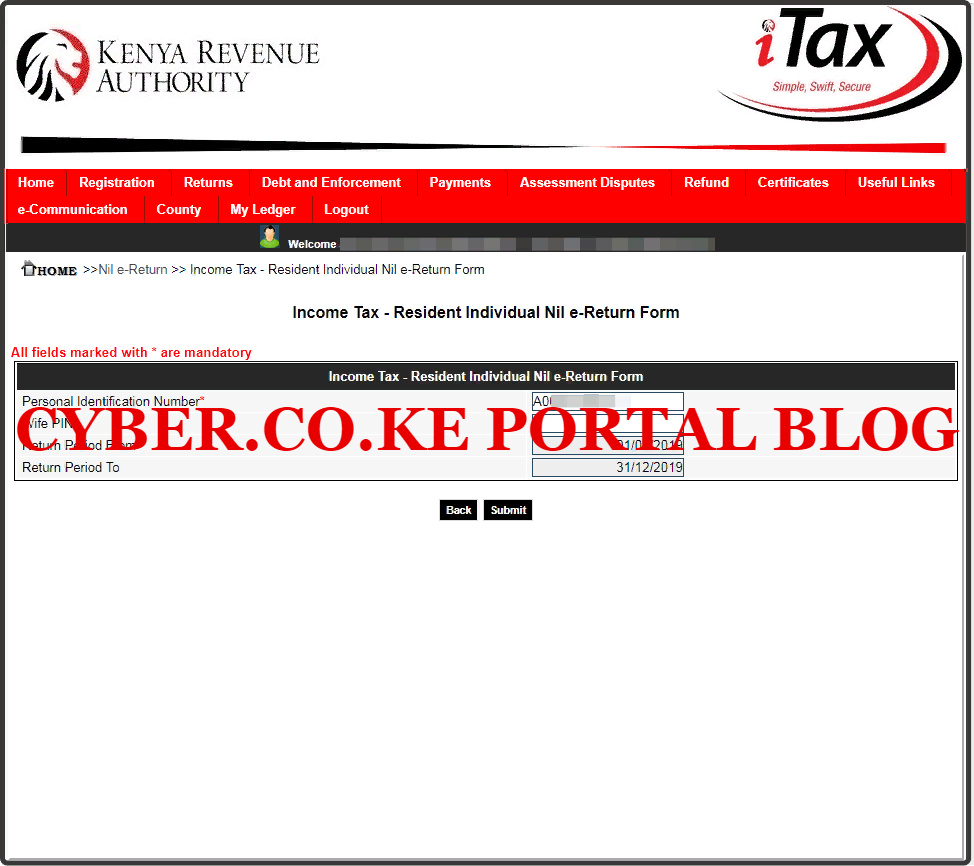

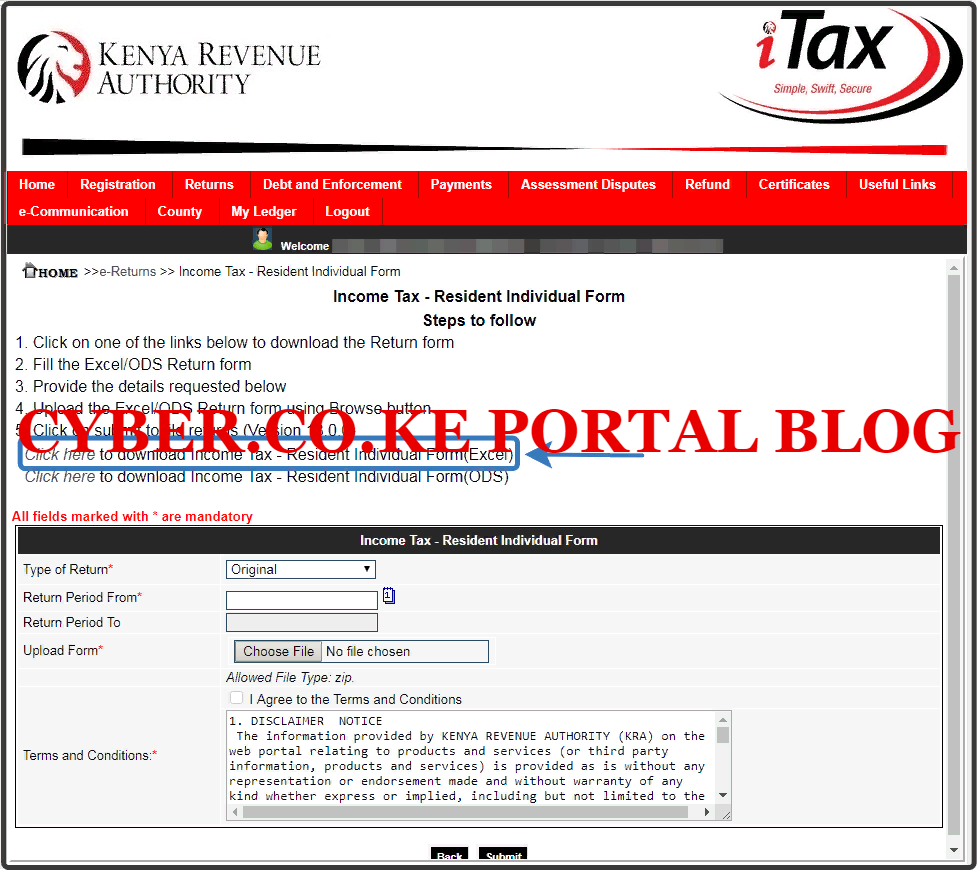

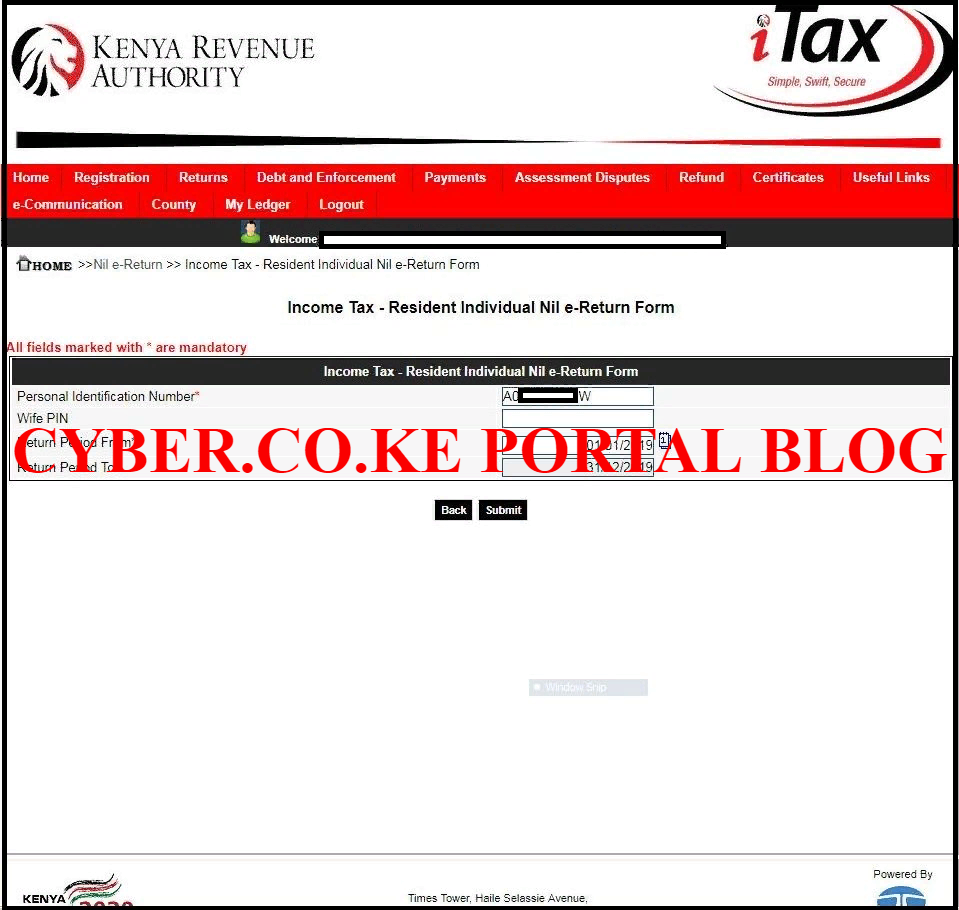

A person is considered to be tax resident in kenya if they. Personal income tax rates. The core purpose of this blog post is to let you understand the 4 tax obligations for individuals in kenya i e income tax resident income tax non resident income tax paye for employer only and value added tax. Tax in kenya is governed by the kenya revenue authority and all kenyan residents are required to pay tax on all income earned including bonuses overtime commissions etc.

These are subjected to withholding tax. In kenya determination of tax residency is guided by the income tax cap 470. Income tax is a tax charged for each year of income upon all the income of a person whether resident or non resident which is accrued in or was derived from kenya. 16 896 per annum kshs 1 408 per month.

Non resident employees are taxable only on their income earned from within kenya or derived from kenya. Tax residency means the country where a taxpayer has chosen to be the main taxpaying point. Residents are also taxed on any other income that has accrued in or is derived from kenya. Payments to non residents in kenya by a resident person or a person having a permanent establishment in kenya of the following management or professional fees royalties interest rent entertainment sports performance man.

Some jurisdictions also determine residency of an individual by reference to a variety of other factors such as the ownership of a home or availability of. Individual in this context refers to relating to one person a single human rather than to a large group. In kenya the statutory income tax rate for tax residents is thirty per cent. Any amount paid to non resident individuals in respect of any employment with or services rendered to an employer who is resident in kenya or to a permanent establishment in kenya is subject to income tax charged at the prevailing individual income tax rates.

Have a permanent home in kenya and were present in kenya for any period in a particular year of income under consideration or do not have a permanent home in kenya but were. The criteria for residence for tax purposes vary considerably from jurisdiction to jurisdiction and residence can be different for other non tax purposes. Income from a digital. Income tax is imposed on.

Income tax rates based on tax residency. Business income from any trade or profession. Taxation for non resident s employment income. Personal relief of kshs.