Income Tax Rates Per Year

This is to maintain parity between the tax rates of non resident individuals and the top marginal tax rate of resident individuals.

Income tax rates per year. 10 12 22 24 32 35 and 37. Download toprate historical xlsx 12 15 kb. What this means for you this history is important because it shows that the tax law is always changing. Apart from tax 30 health and education cess is levied 4 of income tax.

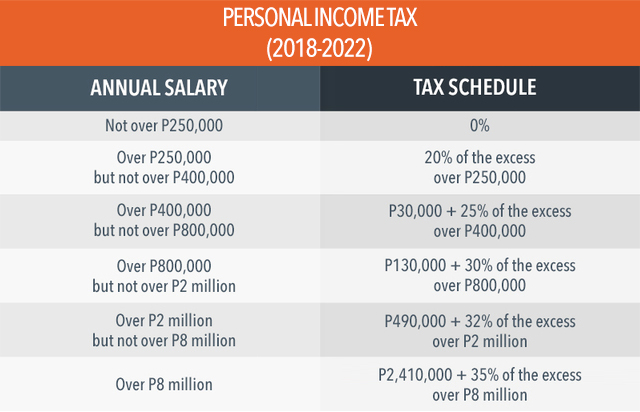

The highest income tax rate was lowered to 37 percent for tax years beginning in 2018. Surcharge surcharge is levied 12 on the amount of income tax where net income exceeds rs. Hindu undivided family including aop boi and artificial juridical person net income range. From ya 2017 the tax rates for non resident individuals except certain reduced final withholding tax rates has been raised from 20 to 22.

12 500 whichever is less. Average federal tax rates for all households by comprehensive household income quintile. There are seven federal tax brackets for the 2020 tax year. The additional 3 8 percent is still applicable making the maximum federal income tax rate 40 8 percent.

For the 2020 21 tax year if you live in england wales or northern ireland there are three marginal income tax bands the 20 basic rate the 40 higher rate and the 45 additional rate also remember your personal allowance starts to shrink once earnings hit 100 000. Your bracket depends on your taxable income and filing status. These are the rates for taxes due. Historical highest marginal personal income tax rates 1913 to 2020.

Effectively this filer is paying a tax rate of 17 2 13 774 80 000 172 which is less that the 22 tax bracket our taxpayer actually is in. Rate of income tax. The option to pay tax at lower rates shall be available only if the total income of assessee is computed without claiming specified exemptions or deductions. Effective tax rates don t factor in any deductions so if you wanted get closer to what percentage of your salary goes to uncle sam try using your adjusted gross income.

Normal tax rates applicable to a firm a firm is taxed at a flat rate of 30. Who is 80 years or more at any time during the previous year net income range. Taxes on director s fee consultation fees and all other income. Download toprate historical pdf 8 91 kb.

:max_bytes(150000):strip_icc()/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)

:max_bytes(150000):strip_icc()/UAETaxBrackets2-0db7d9918b414b2e978772ebeeb0f101.jpg)