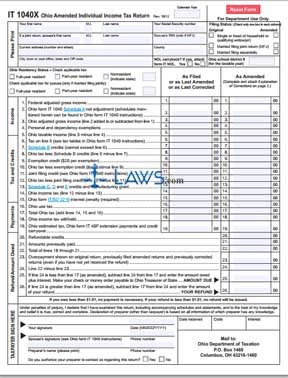

Ohio Income Tax Amended Return

Ohio amended individual income tax return it 1040x step 1.

Ohio income tax amended return. Hio department of taxation individual income tax return 19000102 use only black ink uppercase letters. 2019 ohio it 1040 individual income tax return this file includes the ohio it 1040 schedule a it bus schedule of credits schedule j it 40p it 40xp and it re. We last updated ohio form it 1040x in january 2020 from the ohio department of taxation. Ohio amended individual income tax return it 1040x step 2.

Include the ohio it re do not include a copy of the previously filed return. Additionally if the irs makes changes either based on an audit or an amended return that affect your ohio return s you are required to file an amended it 1040 and or sd 100. Complete a form it 1040 and check the space next to check here if this is an amended return include the ohio it re do not include a copy of the previously filed return to report that it s an amended return. Individual income tax instruction booklet individual tax instructions instructions only no returns hio 2019 instructions for filing original and amended.

This includes extension and estimated payments original and amended return payments billing and assessment payments. Allows you to electronically make ohio individual income and school district income tax payments. This form is for income earned in tax year 2019 with tax returns due in april 2020 we will update this page with a new version of the form for 2021 as soon as it is made available by the ohio government. You should file an amended it 1040 or sd 100 any time you need to report changes to your originally filed return s.

Oh tax amendment form it 1040 this form can be used to file an. Hio gov 2019 ohio it 1040 sd 100 instructions these instructions are for ohio s individual income and school district. Income tax return tax amendment change of address. Also you have the ability to view payments made within the past 61 months.

Individual income tax it 1040 school district income tax sd 100 hio department of taxation tax. It 40p tax year. 2019 revised on 10 19 income tax payment voucher. On the first line enter your first name middle initial last name and social security number.

Why has the ohio department of taxation combined the amended income tax return forms formerly it 1040x and sd 100x into the ohio it 1040 and sd 100 returns. A return can be filed jointly even if only one spouse has taxable income however each spouse must have resided in the same municipality for the entire year. This change will increase convenience for taxpayers filing an amended return. Check here if this is an amended return.

Enter the calendar year for which you are filing an amended return at the top of the first page.