Us Income Tax Calculator New York

The taxes that are taken into account in the calculation consist of your federal tax new york state tax social security and medicare costs that you will be paying when earning 175 000 00.

Us income tax calculator new york. To use our new york salary tax calculator all you have to do is enter the necessary details and click on the calculate button. Explore many more calculators on tax finance math fitness health and more. After a few seconds you will be provided with a full breakdown of the tax you are paying. Your household income location filing status and number of personal exemptions.

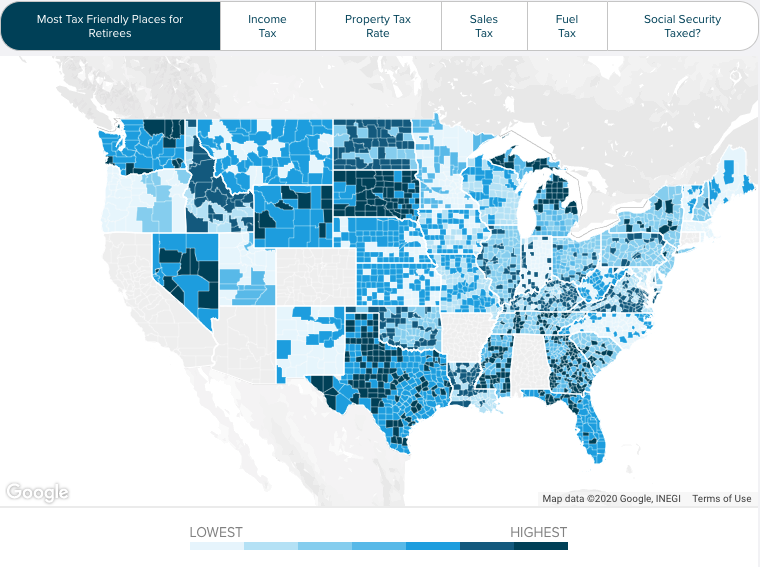

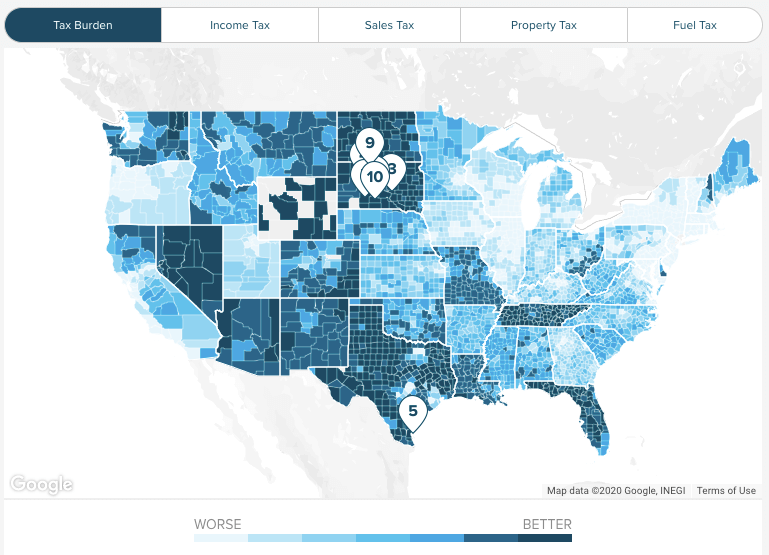

Our new york state tax calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 175 000 00 and go towards tax. Also we separately calculate the federal income taxes you will owe in the 2019 2020 filing season based on the trump tax plan. Our income tax calculator calculates your federal state and local taxes based on several key inputs. New york s income tax rates range from 4 to 8 82.

For heads of household the threshold is 1 616 450 and for married people filing jointly it is 2 155 350. Total tax paid net annual salary net monthly salary. Calculate your net income after taxes in new york. We also run some other websites that may be of interest.

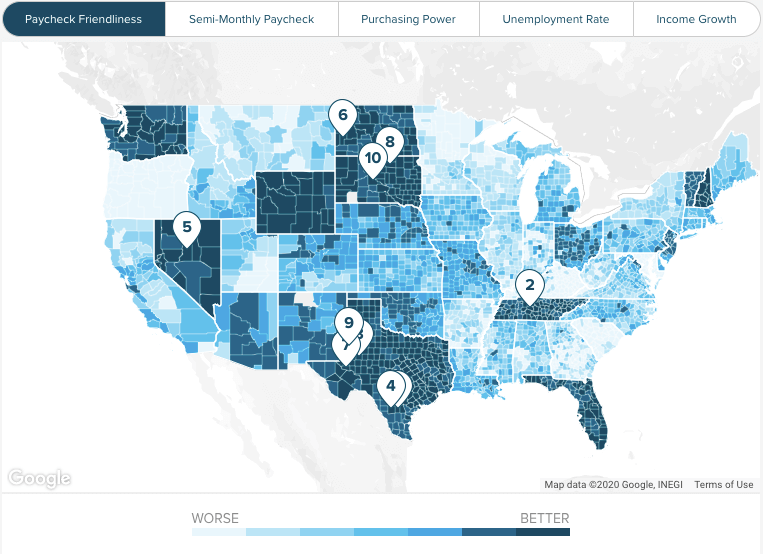

Incredibly a lot of people fail to allow for the income tax deductions when completing their annual tax return innew york the net effect for those individuals is a higher state income tax bill in new york and a higher federal tax bill. The tax calculator uses tax information from the tax year 2020 to show you take home pay. Total state income tax paid. If you make 55 000 a year living in the region of new york usa you will be taxed 12 144.

United states italy france spain united kingdom poland czech republic hungary. Taxable income in new york is calculated by subtracting your tax deductions from your gross income. Your average tax rate is 22 08 and your marginal tax rate is 35 98. You can calculate the new york state tax on your property by taking its taxable assessment or its assessed value minus any exemptions and multiplying it by the tax rate for school districts municipalities counties and special districts.

Free online income tax calculator to estimate u s federal tax refund or owed amount for both salary earners and independent contractors. That means that your net pay will be 42 856 per year or 3 571 per month. This marginal tax rate means that your immediate additional income will be taxed at this rate. The top tax rate is one of the highest in the country though only individual taxpayers whose taxable income exceeds 1 077 550 pay that rate.

See where that hard earned money goes with federal income tax social security and other deductions.