Income Tax Calculation Statement For The Financial Year 2020 21 Pdf

5 crores to rs.

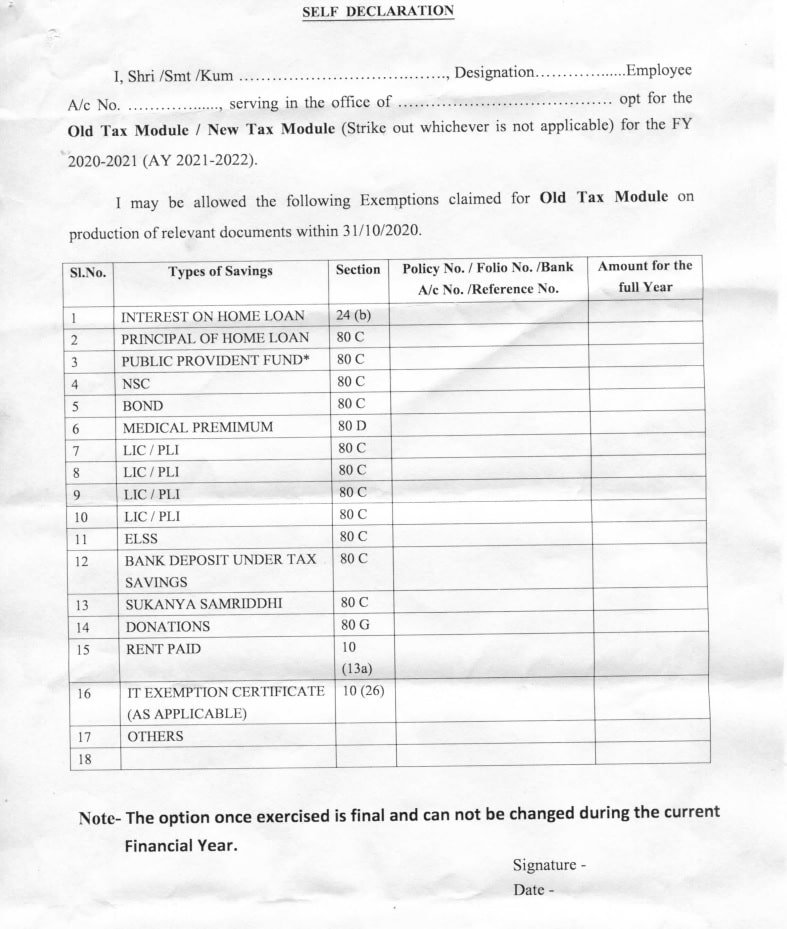

Income tax calculation statement for the financial year 2020 21 pdf. How to calculate income tax for assessment year 2020 21. The calculation of income tax that you are liable to pay under the new tax regime can be explained with an example. As per the finance no 2 act 2019 income tax is required to be deducted under section 192 of the act from income chargeable under the head salaries for the financial year 2019 20 i e. Format for financial year 2020 21 assessment year 2021 22.

Income tax slab rates 2020 21 pdf income tax slab rates 2020 income tax slab rates charts tables for fy 2020 21 ay 2020 21 income tax department official website. Download the malayalam menu based income tax estimator for ugc and kerala govt. Tax slab for the financial year 2019 20 the assessment year 2020 21 1 individual resident or non resident who is of the age of less than 60 years on the last day of the relevant previous year. Annual return of salaries under section 206 of the income tax act 1961 for the year ending 31st march form no 24 see section 192 and rule 37 annual return of salaries under section 206 of the income tax act 1961 for the year ending 31 st march iii the amount of tax shown in.

The tool is designed to prepare anticipatory income tax statements for the financial year 2019 20 ay 2020 21. 2 crores to rs. From the announcement of a full tax rebate on an annual income up to rs. 50 lakhs to rs.

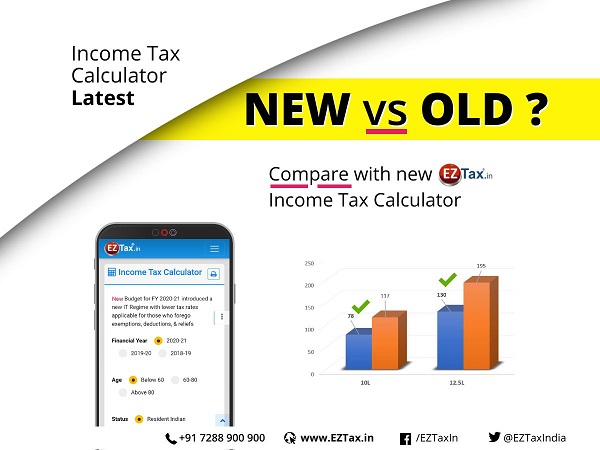

Suppose your total income in fy 2020 21 is rs 16 lakh. The finance minister has proposed to bring a new and simplified personal income tax regime wherein income tax rates will be significantly reduced for the individual taxpayers who forego certain deductions and exemptions however the same is options to individual. 1 crore to rs. Salary challenge entry facility and 10 e form preparation field is provided in the new version.

A comparative analysis of income tax calculation for fy 2020 21 ay 2021 22 under the existing tax slab and the new income tax slabs introduced in budget 2020 can be understood by comparing taxable income under both scenarios. Further during the year your employer has contributed rs 60 000 to your nps account which is eligible for deduction under section 80ccd 2. Assessment year 2020 21 at the following rates.