Income Tax Rates Jordan

The income tax rates and personal allowances in jordan are updated annually with new tax tables published for resident and non resident taxpayers.

Income tax rates jordan. The following tax rates apply for resident and non resident. Below is a brief of the major amendments in the new income tax law. Amended income tax law no. 50 lakhs to rs.

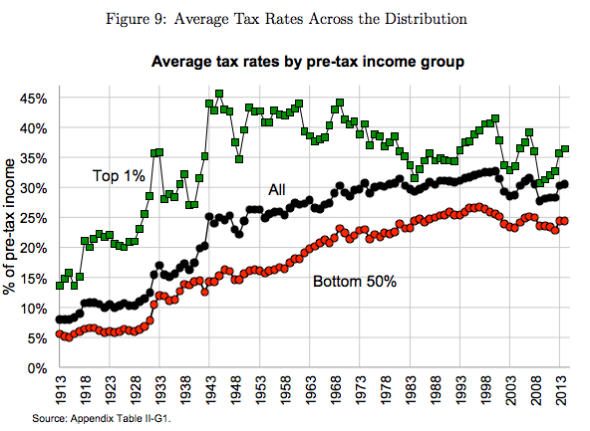

Personal income tax. 16 taxation in jordan. Taxable income jod pit rate the first 5 000. This page provides jordan personal income tax rate actual values historical data forecast chart statistics economic calendar and news.

Personal income tax rates. The personal income tax rate in jordan stands at 30 percent. Individuals whether resident or non resident in jordan are taxed based on income earned in the kingdom from all taxable activities including income from employment business either as sole proprietors or as partners rental income and directors fees. Company tax 20 21 with the national contribution tax tax rate for foreign companies resident corporations are subject to corporate income tax on their jordan source income unless an income is raised from sources that originate and relate to jordanian deposits and funds in which case this income would be taxed at rate of 10.

Personal income tax rate in jordan averaged 21 31 percent from 2004 until 2019 reaching an all time high of 30 percent in 2019 and a record low of 14 percent in 2011. Income tax highest marginal rate vat or gst or sales tax further reading. The tax tables below include the tax rates thresholds and allowances included in the jordan tax calculator 2020. Personal income tax pit rates are applied progressively as follows.

38 for the year 2018. Under the current jordanian investment law no. Surcharge is levied on the amount of income tax at following rates if total income of an assessee exceeds specified limits rate of surcharge assessment year 2021 22 assessment year 2020 21 range of income range of income rs. The jordan tax calculator is a diverse tool and we may refer to it as the jordan wage calculator salary calculator or jordan salary after tax calculator it is however the same calculator there are simply so many features and uses of the tool jordan income tax calculator there is another that we refer to the calculator functionally rather.

38 for the year 2018 which entered into force on january 1st 2019. Any income incurred in or from jordan for any person regardless of the place of payment shall be subject to tax in jordan. 20 0 25. 1 crore to rs.

30 of 2014 the investment law income generated by an entity registered in the development zones in respect of activities undertaken inside the development zone is subject to a unified tax rate of 5. 38 for the year 2018. Kpmg in jordan provides an update on the salient features of the amended income tax law no.