Income Tax Rebate Definition

Jeff s taxable income is 45 000 for the 2020 21 income year.

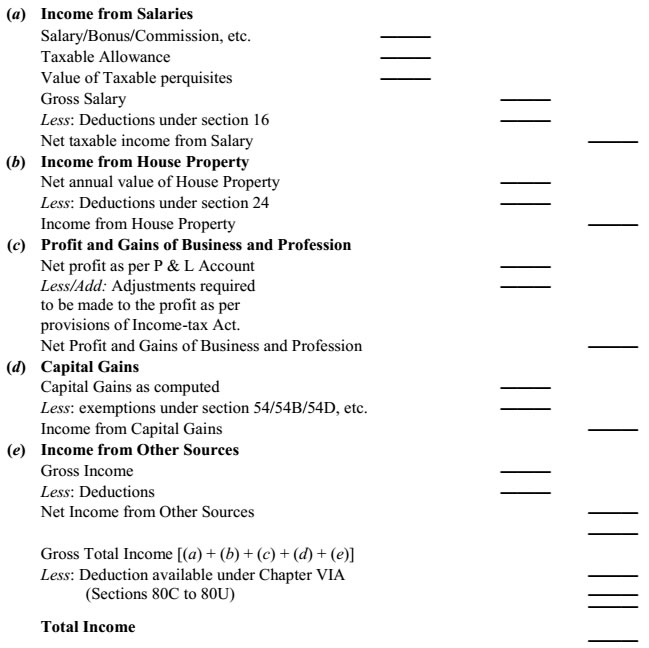

Income tax rebate definition. A tax rebate is basically a refund check issued from the government i e the irs to you the taxpayer. The government will sometimes issue tax rebates to stimulate the economy. Example income exceeds 37 500 but is not more than 48 000. In theory the tax rebate is a refund of taxes although as a practical matter many people who don t earn enough money to pay taxes still receive tax rebates.

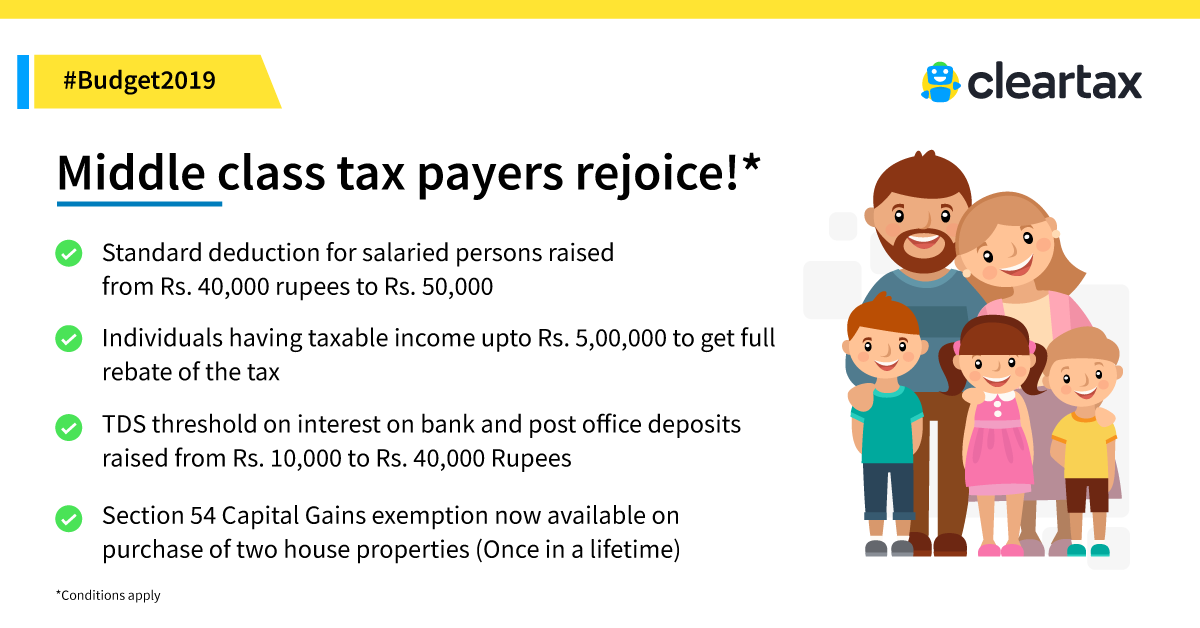

Prices are subject to change without notice. The rebate will not apply to income derived by a non resident company that is subject to final withholding tax. A tax refund or tax rebate is a refund on taxes when the tax liability is less than the taxes paid. Taxpayers can often get a tax refund on their income tax if the tax they owe is less than the sum of the total amount of the withholding taxes and estimated taxes that they paid plus the refundable tax credits that they claim.

Income tax rebates for resident individual with chargeable income less than rm35 000. Recently the irs has taken steps to reduce some of the confusion. The income tax treatment of rebates however has been a simmering dispute for more than 50 years leaving uncertainty for both payers and recipients as to characterization and timing. Fastest tax refund with e file and direct deposit.

Your rebate income is the total amount of your taxable income excluding any assessable first home super saver released amount plus the following amounts if they apply to you. Pay for turbotax out of your federal refund. Tax rebate year of assessment 2001 2008 year of assessment 2009 onwards rm rm a. A 40 refund processing service fee applies to this payment method.

Money paid back to a person or company when they have paid too much tax meaning pronunciation translations and examples. He is eligible for both the low income tax offset and the middle and low income tax offset. Companies need not factor in the corporate income tax rebate when filing the estimated chargeable income and the income tax return form c s c as iras will compute it and allow the rebate automatically.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)