Capital Receipt Vs Revenue Receipt Income Tax

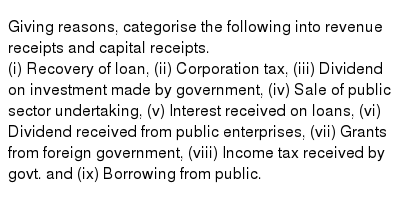

The capital receipt is received in exchange for the source of income.

Capital receipt vs revenue receipt income tax. Capital receipts appears on the liabilities side of the balance sheet whereas revenue receipts appears on the credit side of the profit and loss account as income for the financial year. It is important to correctly differentiate between the two. Capital and revenue receipts. The former would be a capital receipt whereas the latter would be a revenue receipt.

But this general rule is subject to certain exceptions. Unlike revenue received which is a substitution of income. When the business receives money it is again of two sorts. It my be a long term receipt a contribution by the owner either to start the business off or to increase the funds available to it.

Capital receipt leads to a reduction in the asset of the government. Let us take a brief look. Let us learn more about them. On appeal the tribunal accepted the order passed by the cit.

Revenue receipts are the regular sources of revenue of the government but the capital receipts are irregular sources of revenue. The primary difference between capital receipts vs revenue receipts is that capital receipts are the receipts of non recurring nature which either creates the liability of the company or reduces the company s assets whereas revenue receipts are the receipts of recurring nature and are reported in the statement of income of the company. Any amount received as compensation on surrendering a right or termination of any lease is capital receipt where as any amount received for loss of future income is a revenue receipt. He held that the income from such was different from the income earned by the periodical cutting of live bamboos.

Capital receipt and revenue receipt both are the very important components of accounting. Whereas when the assets of government are not reduced we get revenue receipts. Classification of these transactions reflects in the final statements of the company. Determining capital or revenue nature is undoubtedly very important in the field of accounting.

It is capital receipt but if he receives it as advance royalty for 5 years it is revenue receipt. Compensation received on termination of lease or surrender of a right. Before excavating any deeper first and the most important thing is to know the basic meaning of revenue nature and capital. Any amount received as compensation on surrendering a right is capital receipt whereas any amount received for loss of future income is a revenue receipt.

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)