Income Yield Vs Yield To Maturity

Read this article to get an in depth perspective on what yield to maturity is how its calculated and why its important.

Income yield vs yield to maturity. What is the yield to maturity ytm. A bond s yield to maturity isn t as simple as one might think. Yield to maturity is an important concept for all investors to know. Yield to maturity vs.

A more meaningful figure is the yield to maturity because it tells you the total return you will receive if you hold a bond until maturity. Yield to maturity or ytm is used to calculate an investment s usually a bond or other fixed income security yield based on its current market price. Expressed as an annual percentage the yield tells investors how much income they will. When investors consider buying bonds they need to look at two vital pieces of information.

The current yield would be 6 67 1 000 x 06 900. The yield to maturity ytm and the coupon rate. A precise calculation of ytm is rather. Risk and yield risk is an important component of the yield paid on an investment.

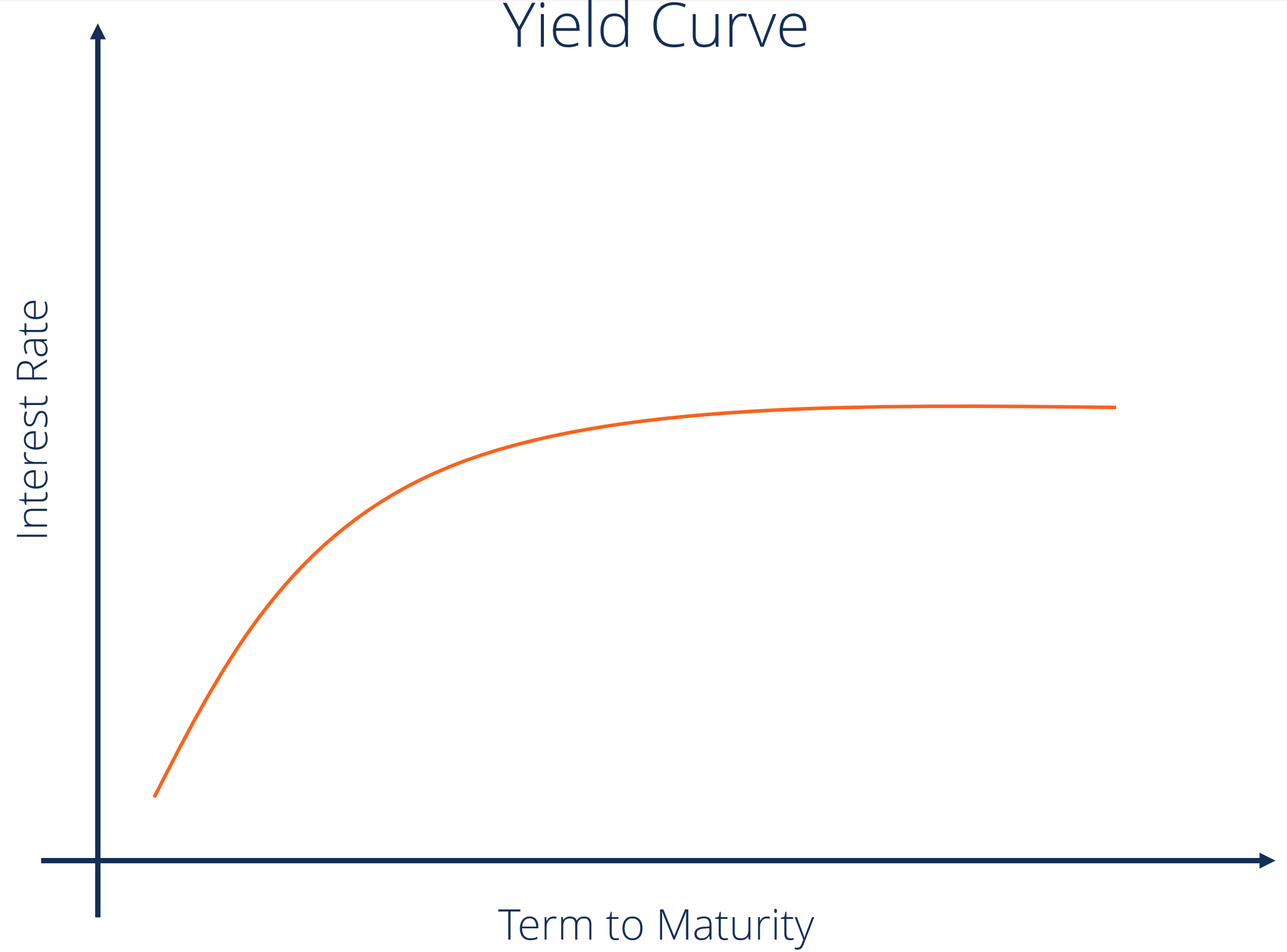

The yield to maturity is an estimate of what an investor will receive if the bond is held to its maturity date. It also enables you to compare bonds with different maturities and coupons. That reduces its overall yield to the. Yield to maturity ytm otherwise referred to as redemption or book yield yield yield is defined as an income only return on investment it excludes capital gains calculated by taking dividends coupons or net income and dividing them by the value of the investment.

While the current yield and yield to maturity ytm formulas both may be used to calculate the yield of a bond each method has a different application depending on an investor s specific goals. Current yield vs yield to maturity a bond is a form of a debt security that is traded in the market and has many characteristics maturities risk and return levels.

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

:max_bytes(150000):strip_icc()/UnderstandingTreasuryYieldAndInterestRates2-81d89039418c4d7cae30984087af4aff.png)

/Convexity22-0370dbde8e1c4a958bff8b670bf8bf5c.png)