Interest Income Yield Formula

A financial solvency ratio that compares a financial institution s interest income to its earning assets.

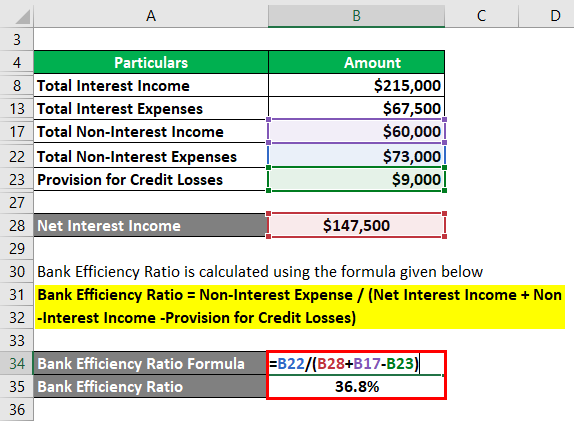

Interest income yield formula. Net interest income can be positive or negative and it is listed on the income statement. Both yield and interest rates are important terms for any investor to understand especially those investors with fixed income securities such as bonds or cds. Why does net interest income nii matter. The rate or yield that a bank earns and the rate or yield that a bank pays is often found in the bank s 10k statement typically in sections that breakdown the interest income and interest expense portion of the income statement.

In this example multiply 0 029629899 by 10 000 to find that when interest compounds daily you earn 292 63 in interest. Net interest income 1 000 000 975 000 25 000. The net interest income formula is used to calculate the amount of interest income that is left after covering interest expenses. Banks earn interest through loans mortgages and other similar interest earning products.

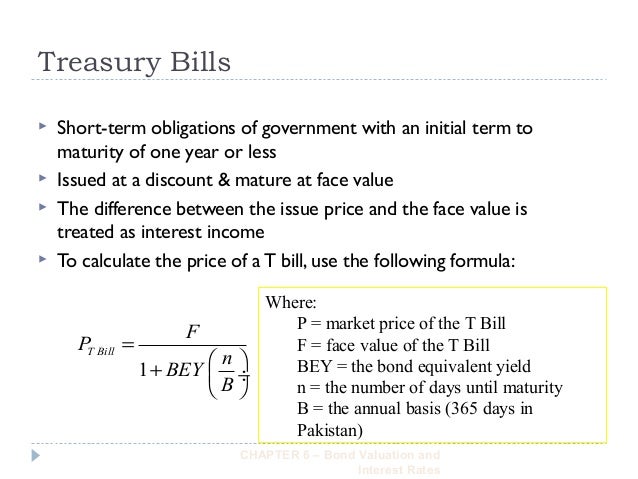

Successive quasi coupon dates determine the length of the standard coupon period for the fixed income security of interest and do not necessarily coincide with actual coupon payment dates. Yield on earning assets yea indicates how well assets are. The net interest spread formula is used to determine the difference between the rate a bank is earning versus the rate a bank is incurring. Yield on earning assets.

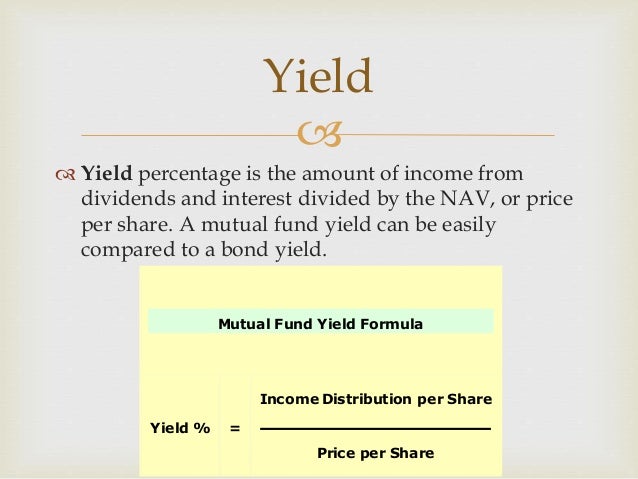

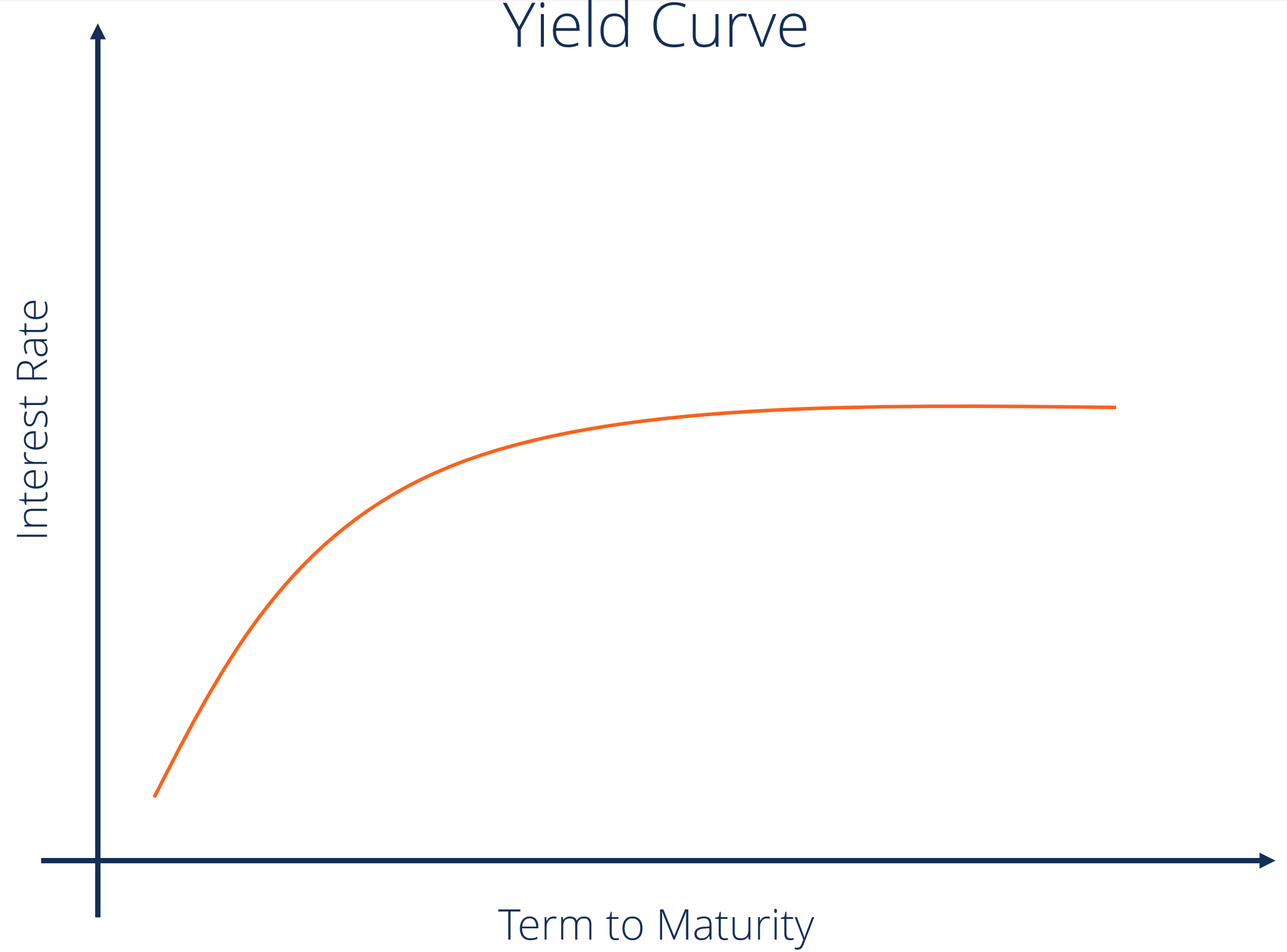

The total interest income total interest expense and net interest income can be found on a bank s income statement. In regard to banks net interest income should go up as the yield curve steepens long term rates rise faster than short term rates because the bank is able. Multiply the effective rate over the entire period by the amount invested to calculate the interest income. The percent yield formula is a way of calculating the annual income only return on an investment return on investment roi return on investment roi is a performance measure used to evaluate the returns of an investment or compare efficiency of different investments.

Interest income is money earned by an individual or company for lending their funds either by putting them into a deposit account in a bank or by purchasing certificates of deposits callable certificate of deposit a callable certificate of deposit is an fdic insured time deposit with a bank or other financial institutions. The toolbox includes price and yield functions that handle these odd first and or last periods.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

/16c2bc813fac68e26f0f7aea199a1cc9-dfac742897bb40eea19f17122bebf07e.jpg)

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

/dividendyield-5c67fc5946e0fb00011a0c31.jpg)