Annual Income Growth Calculator

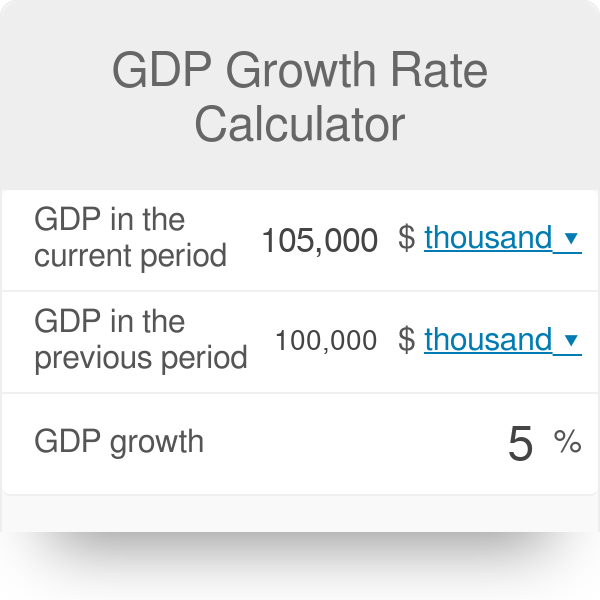

The percent growth rate calculator is used to calculate the annual percentage straight line growth rate.

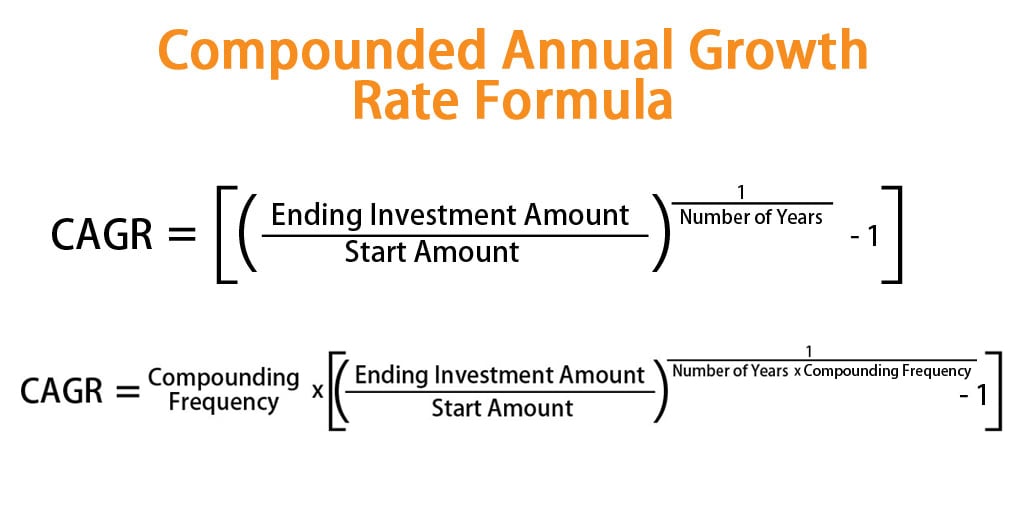

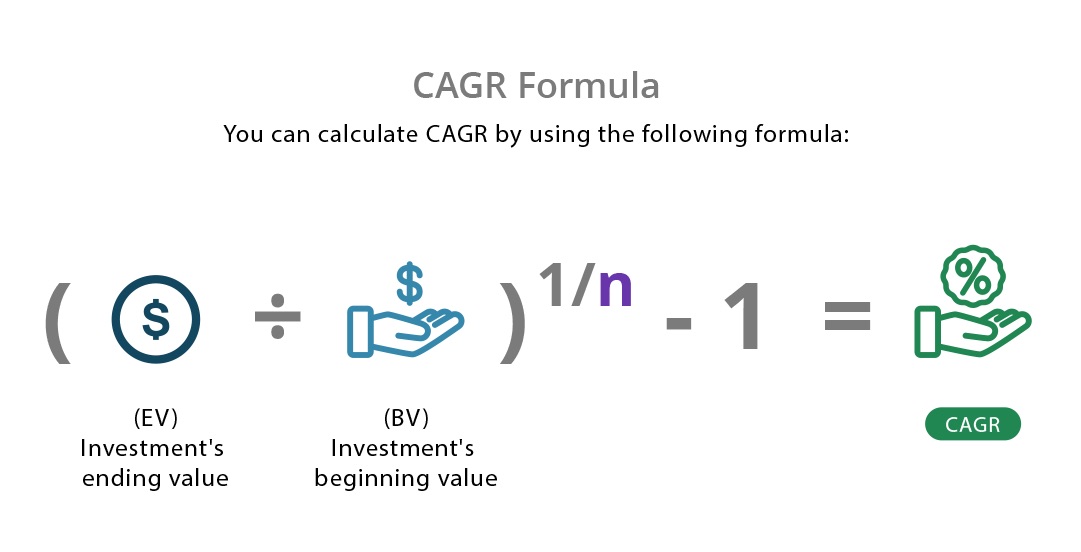

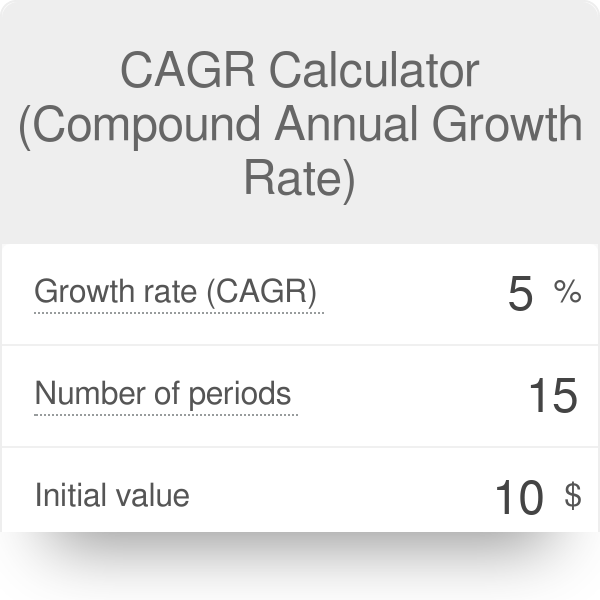

Annual income growth calculator. To get the cagr value for your investment enter the starting value or initial investment amount along with the expected ending value and the number of months or years for which you want to calulate the cagr. The compound annual growth rate calculator. On this page is a compound annual growth rate calculator also known as cagr it takes a final dollar amount as input along with a time frame and starting amount. It is very easy to use.

Check out the rest of the financial calculators on the site. We take 1 5 and raise it to. Directions the current salary is the sum of money you earn in one year. Cagr stands for compound annual growth rate and is a representational measure of growth of an investment.

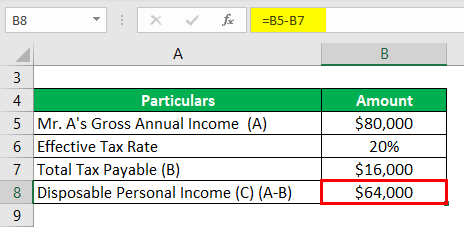

What growth rate do i need to meet my target income. Cagr calculator is free online tool to calculate compound annual growth rate for your investment over a time period. If you are gathering information to file taxes online keep in mind that it may be pre tax post tax or a future income. How to calculate the annual percentage growth rate with this tool.

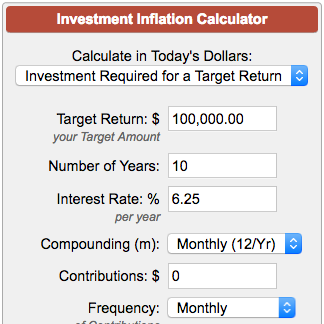

How to calculate investment. With all of those variables set you will press calculate and get a total amount of 151 205 80. This calculator is provided for informational purposes only. Calculate the annual rate of growth to calculate the annual rate of growth we now need to put our two previous answers together to get to a rate of growth.

The tool automatically calculates the average return per year or period as a geometric mean. To measure this real estate growth we calculated the number of new building permits per 1 000 homes. Type the numbers in the boxes and then click. To put it in simple terms cagr represents the growth interest rate that gets you from the present value to the future value in the specified time period taking into account for compounding.

Input past or present value number only present or future value number only and number of years number great than 0 only on the. We used real growth inflation adjusted in the local economy. An annuity running over 20 years with a starting principal of 250 000 00 and growth rate of 8 would pay approximately 2 091 10 per month. This means that with a 20 000 initial deposit a 2 interest rate and a 5 000 annual contribution you will have a savings fund of 151 000 after 20 years.

All charts and illustrations are used to illustrate the effects of growth of a hypothetical investment based on inputs provided by the user and are not intended to reflect future values of any fund or returns on investment in any fund.

:max_bytes(150000):strip_icc()/market-value-69e5d658792841c3baabe0d0d23c2dcc.jpg)