Ohio Income Tax Capital Gains

Additional state capital gains tax information for ohio the combined rate accounts for federal state and local tax rate on capital gains income the 3 8 percent surtax on capital gains and the marginal effect of pease limitations which results in a tax rate increase of 1 18 percent.

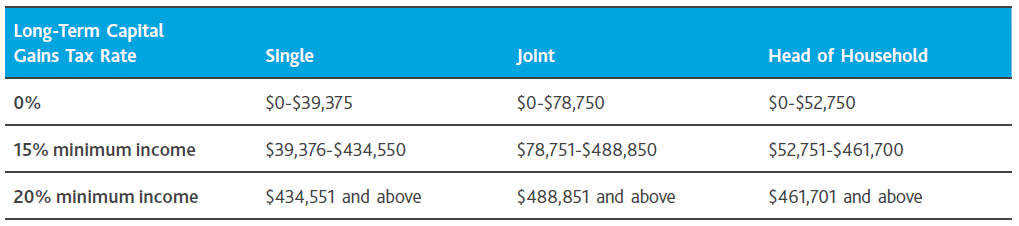

Ohio income tax capital gains. Long term capital gains tax is levied on profits from the sale of an asset held for more than a year. For 2019 a single filer pays 0 on long tern capital gains if that person s income is 39 375 or less. Business income is eligible for the business income deduction bid and the lower flat tax rate on business income. 181 17 2 476 of excess over 15 650.

The schedule d portion of a taxpayer s federal income tax return form 1040 contains information on the capital gains and losses claimed by the taxpayer which could include sales of stock and other business interests. 77 22 1 980 of excess over 10 400. Remember short term capital gains from. Additional state income tax information for ohio.

As for ohio the buckeye state has a tax rate of 29 4 percent which is above the national average of 28 2 percent. 311 16 2 969 of excess over 20 900. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. Long term capital gains tax rate is 0 15 or 20 depending on the individual s taxable income and filing status.

While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income. Specifically the issue before the ohio supreme court was whether ohio may constitutionally levy an income tax on the capital gain realized as a result of the sale of an interest in a pass through entity i e the sale of an intangible of a nonresident of ohio with a greater than 20 percent interest in the pass through entity doing business in ohio. The rate is 15 if the person s income falls under 434 550 and 20 if it is over that. Capital gains are taxable at both the federal and state levels.

The states with the highest top marginal capital gains tax rates. The short term capital gains tax rate equals the individual s ordinary income tax rate bracket. The capital gains tax calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. The table below summarizes uppermost capital gains tax rates for ohio and neighboring states in 2015.

928 71 3 465 of excess over 41 700.