How To Read A Pro Forma Income Statement

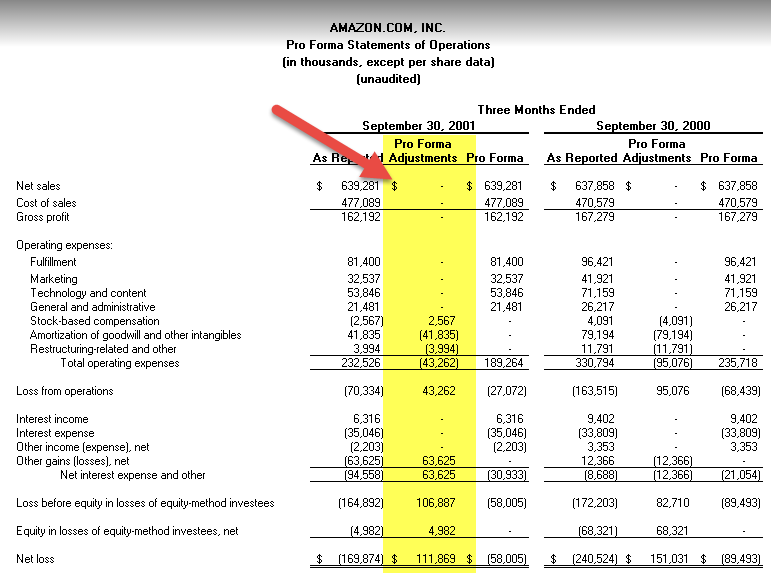

Pro forma earnings describe a financial statement that has hypothetical amounts or estimates built into the data to give a picture of a company s profits if certain nonrecurring items were.

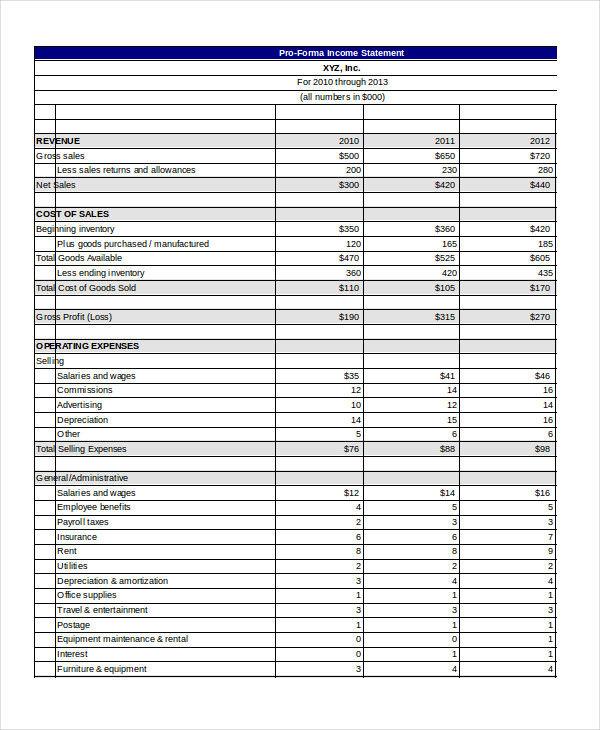

How to read a pro forma income statement. This portion of the pro forma statement will project your future net income sale of assets dividends issuance of stocks etc. Pro forma income statement also known as pro forma profit and loss means how the adjusted income statement will look like when certain assumptions like non recurring items restructuring costs etc were excluded or if a loss making unit is discontinued. A pro forma income statement basically looks similar to the conventional income statement. A pro forma financial statement can be a key tool to include in your arsenal to lower your risks plan for the future and help secure funding.

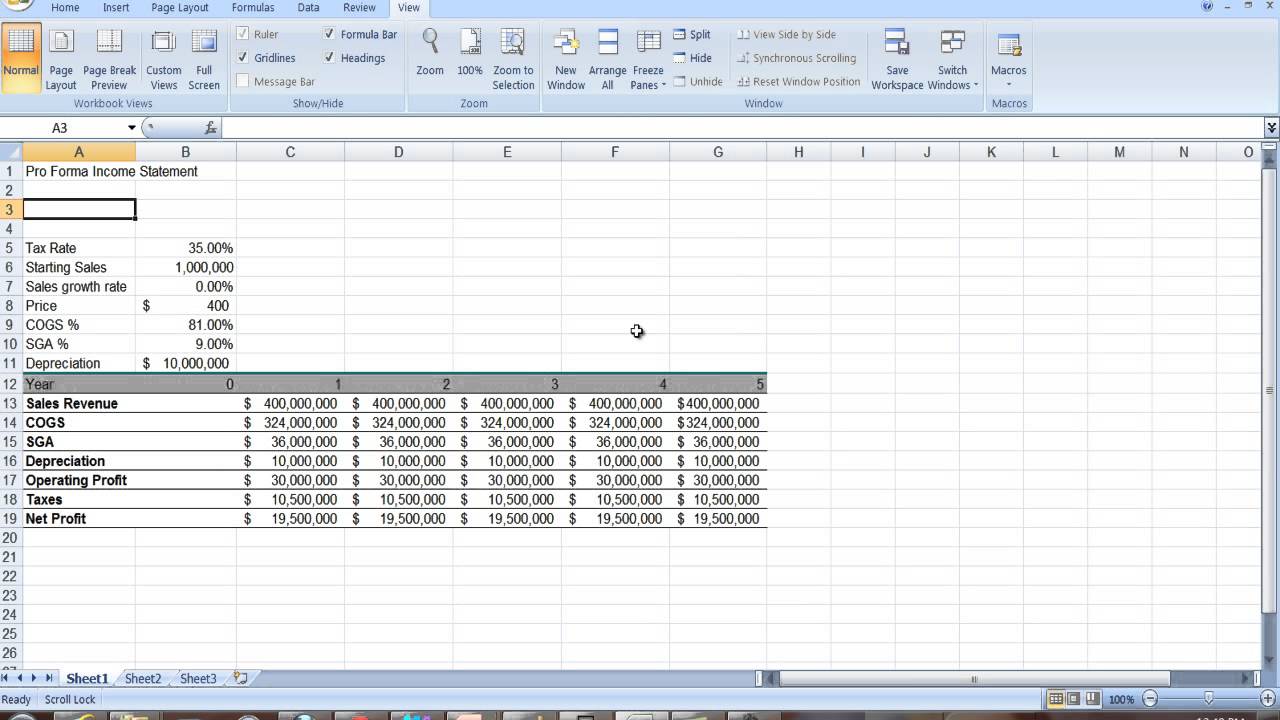

This chart of accounts will make up the pro forma statement for a 3 to 5 year period. For example if the business based its pro forma income statement on a 20 expected increase in its revenues then it is highly likely that the debtor balances of the business will also go up. It shows the possible income in the next. Pro forma income statement template microsoft excel.

If the projections predict a downturn in profitability then you can make operational changes such as increasing prices or decreasing costs before these projections become reality. For my purposes here a pro forma income statement is similar to a historical income statement except it projects the future rather than tracks the past. It details the amount of money made and spent within a certain period. Profit is the combination of all revenue and losses and is described as.

By the end of this article you ll know what a pro forma financial statement is used for how to. What is an income statement. Similarly the cost of goods sold will also increase in line with the increase in the revenues of the business thus resulting in higher creditor and. Create a pro forma income statement by using the calculated percentage change in sales.

A pro forma statement is a statement that presents the income of the entity in the estimated period and the expenditures to be made in a categorical manner and summarizes the result of such period activities as profit or loss. The only difference between pro forma income statement and income statement is the income statement is about past results whereas the pro forma income statement is a projection of the existing income statement. When used in the context of a business plan it represents financial forecasts based on. Work the arithmetic through to the bottom to complete a pro forma income statement.

Pro forma income statement template. This is the second section of your pro forma financial statement. Even if you re a new small business trying to get your company off the ground this technique can help and it s not as difficult as it sounds. A company s income statement is one of its most important financial documents.