On A Traditional Income Statement Cost Of Goods Sold Reports The Costs Attached

So for the parachute palace it s the profit phil generated after paying for the wholesale cost of the parachute he sold.

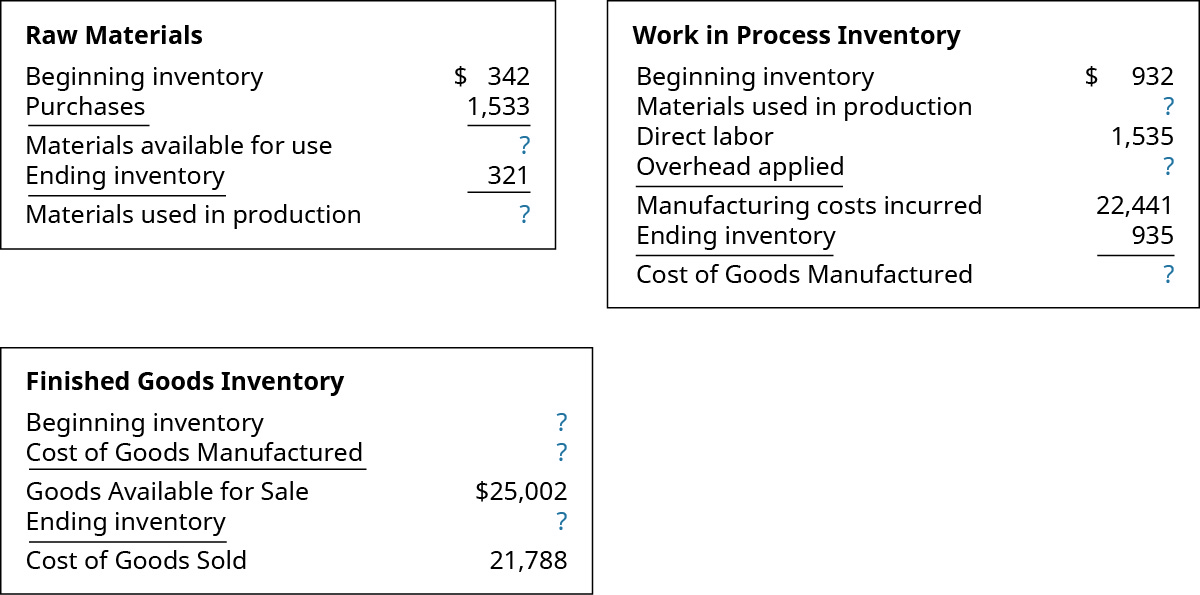

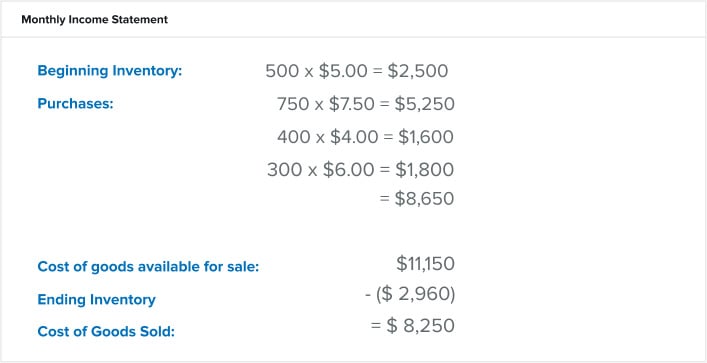

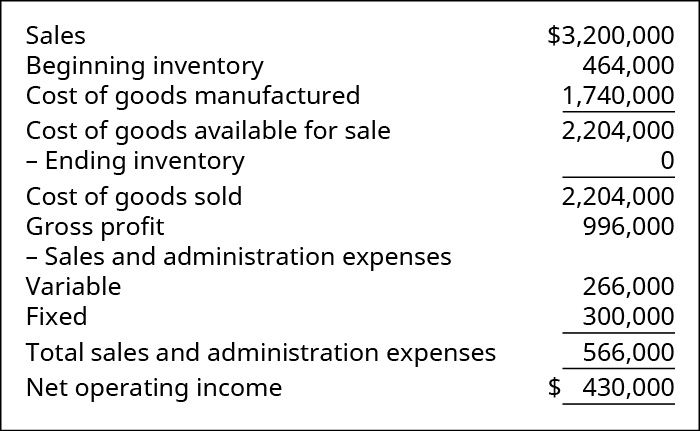

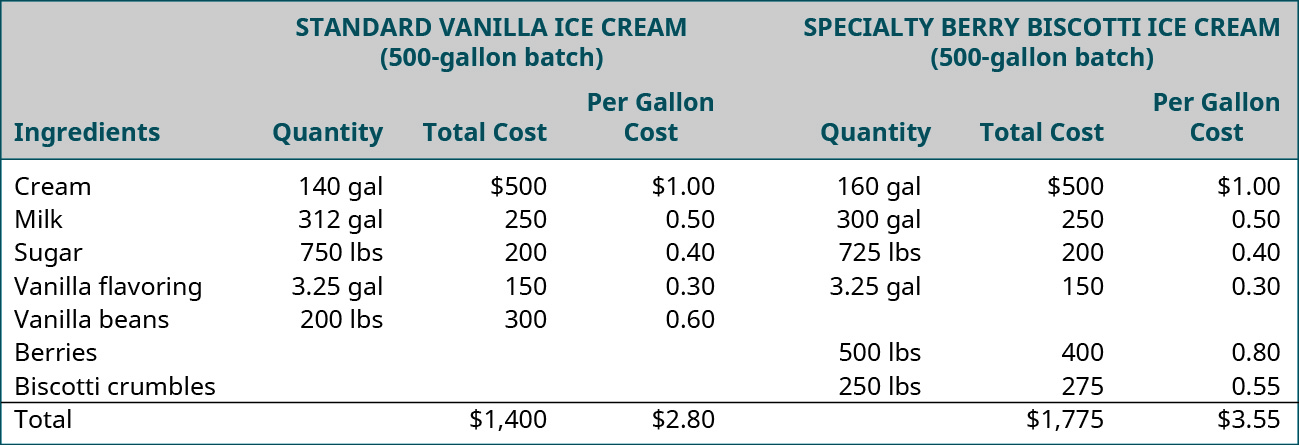

On a traditional income statement cost of goods sold reports the costs attached. Gross profit is the profit remaining after paying your direct product costs but before paying for your overhead and general expenses. Merchandising and manufacturing firms both prepare financial statement reports for creditors stockholders and others to show the financial condition of the firm and the firm s earnings performance over some specified intervals. In order to complete this statement correctly make sure you understand product and period costs. The basic format is to simply show the sales less the cost of goods sold equal gross profit.

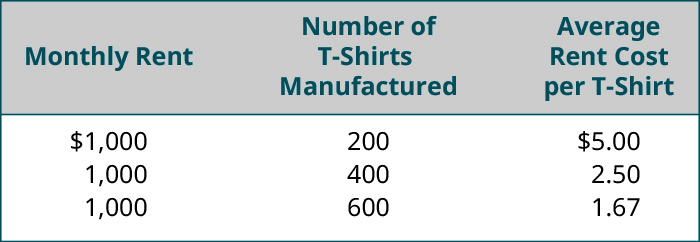

In a traditional format income statement for a merchandising company the cost of goods sold reports the product costs attached to the merchandise sold during the period. Cost of goods sold is an important figure for investors to consider because it has a direct impact on profits. True although the contribution format income statement is useful for external reporting purposes it has serious limitations when used for internal purposes because it does. Absorption costing statement assumes that fixed costs attach to products so all the production costs whether fixed or variable should become part of product cost.

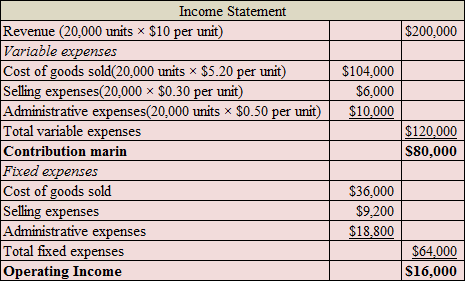

The gross profit equation is. Prepare income statement including a schedule of cost of goods sold. Marginal cost statement treats fixed and variable cost. Cost of goods sold is deducted from revenue to determine a company s gross profit.

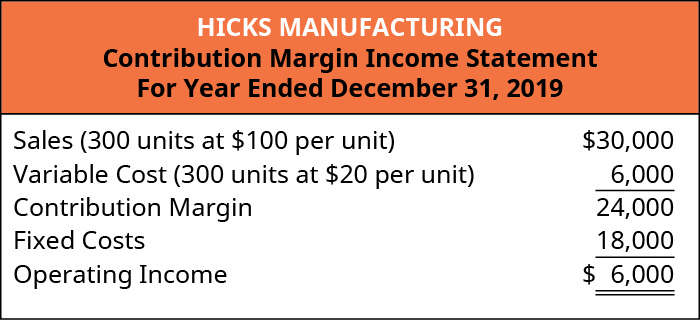

The contribution margin. Gross profit in turn is a measure of how efficient a company is at managing its operations. A cost of goods sold statement compiles the cost of goods sold for an accounting period in greater detail than is found on a typical income statement the cost of goods sold statement is not considered to be one of the main elements of the financial statements and so is rarely found in practice if presented at all it appears in the disclosures that accompany the financial statements. The format for the traditional income statement.

This income statement looks at costs by dividing costs into product and period costs. Gross profit revenue cost of goods sold other direct expenses. 234 on a traditional income statement sales revenue less cost of goods sold equals 235 for external reporting purposes u s. For a manufacturer cost of sales is the expense incurred for labor raw materials and manufacturing overhead used in the.

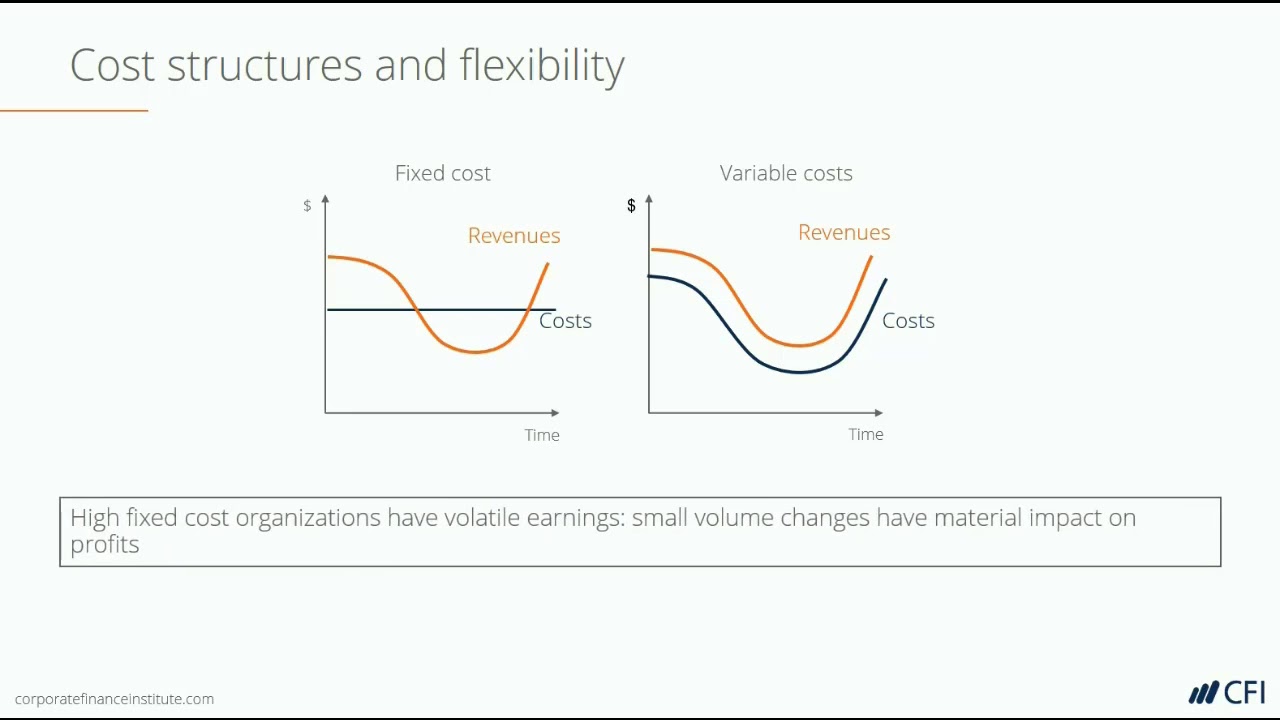

A traditional income statement uses absorption or full costing where both variable and fixed manufacturing costs are included when calculating the cost of goods sold. Marginal cost statement offers an alternative layout to the traditional income statement prepared under absorption costing.

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)