How To Produce An Income Statement From A Trial Balance

The income statement is a document presenting.

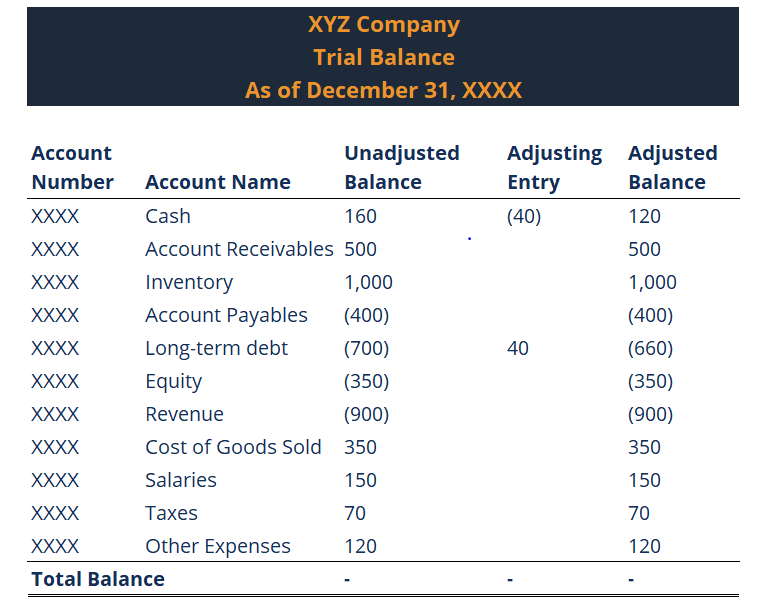

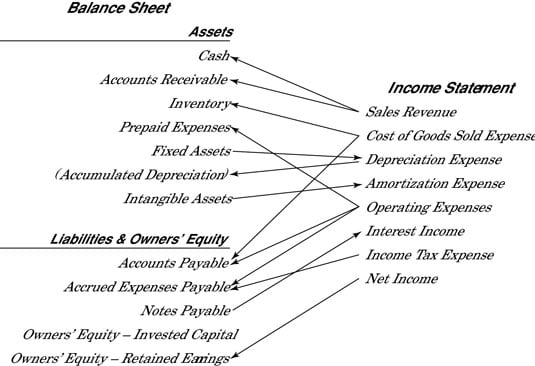

How to produce an income statement from a trial balance. Asset liability shareholders equity revenue and expenses are the different types of accounts. The income statement is prepared using the revenue and expense accounts from the trial balance. The five column sets are the trial balance adjustments adjusted trial balance income statement and the balance sheet. The income statement or profit and loss report is the easiest to understand it lists only the income and expense accounts and their balances.

Income accounts have a credit balance and expense accounts have a debit balance. Income statement and balance sheet overview. Other possible charges which do not correspond to the sales of the accounting cycle under study are. You are given the following additional information.

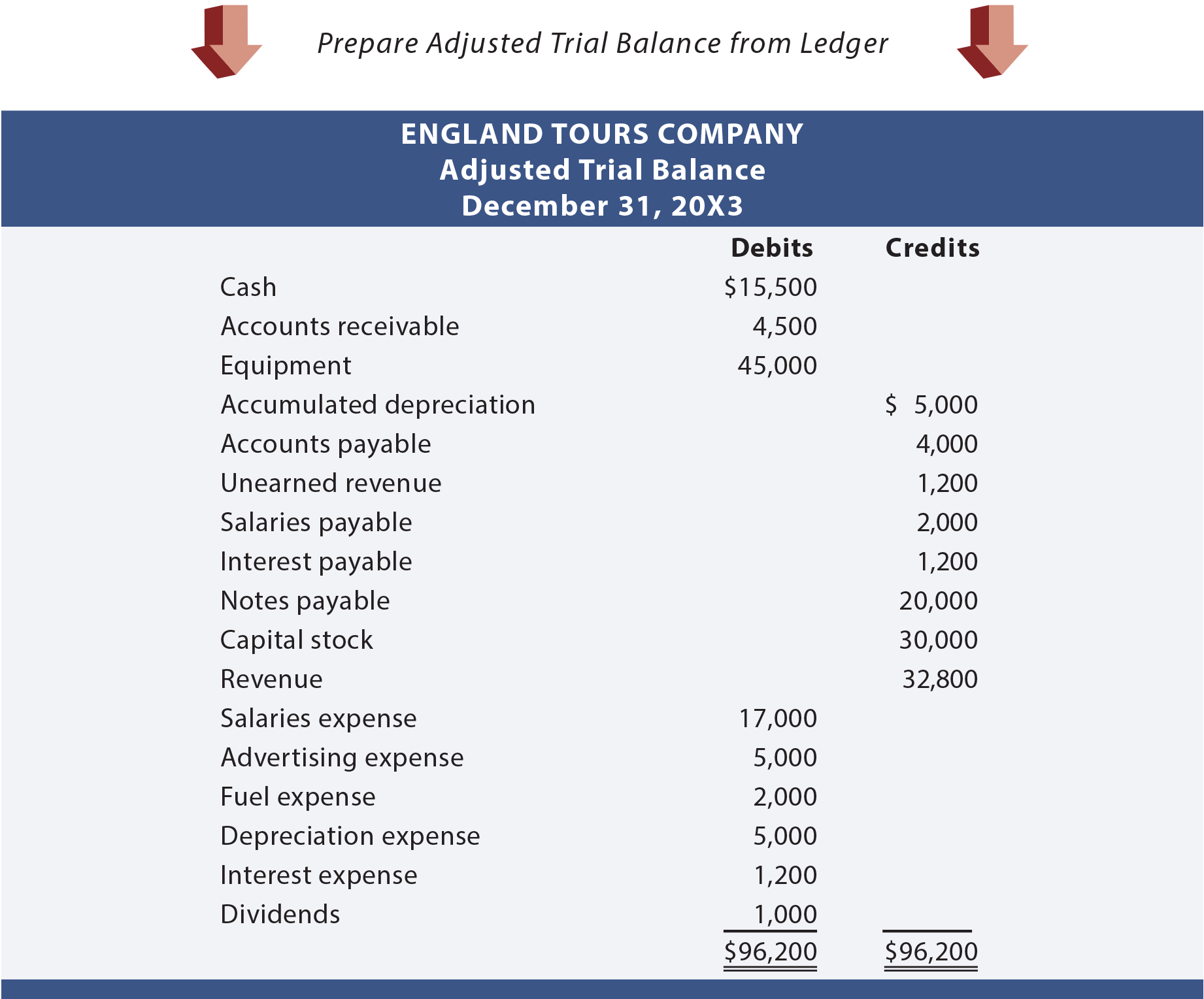

Prepare trial balance from ledger balances. Preparing a trial balance from ledger balances is the next step of posting and balancing ledger accounts the trial balance is a statement of debit and credit balances that are extracted from ledger accounts on a specific date. Step 7 prepare the income statement and statement of financial position. We will be using the adjusted trial balance from this lesson.

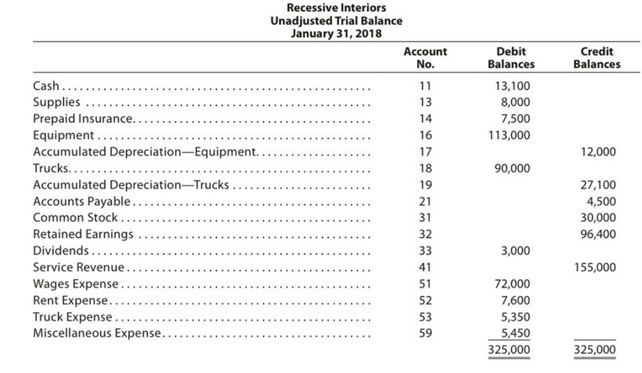

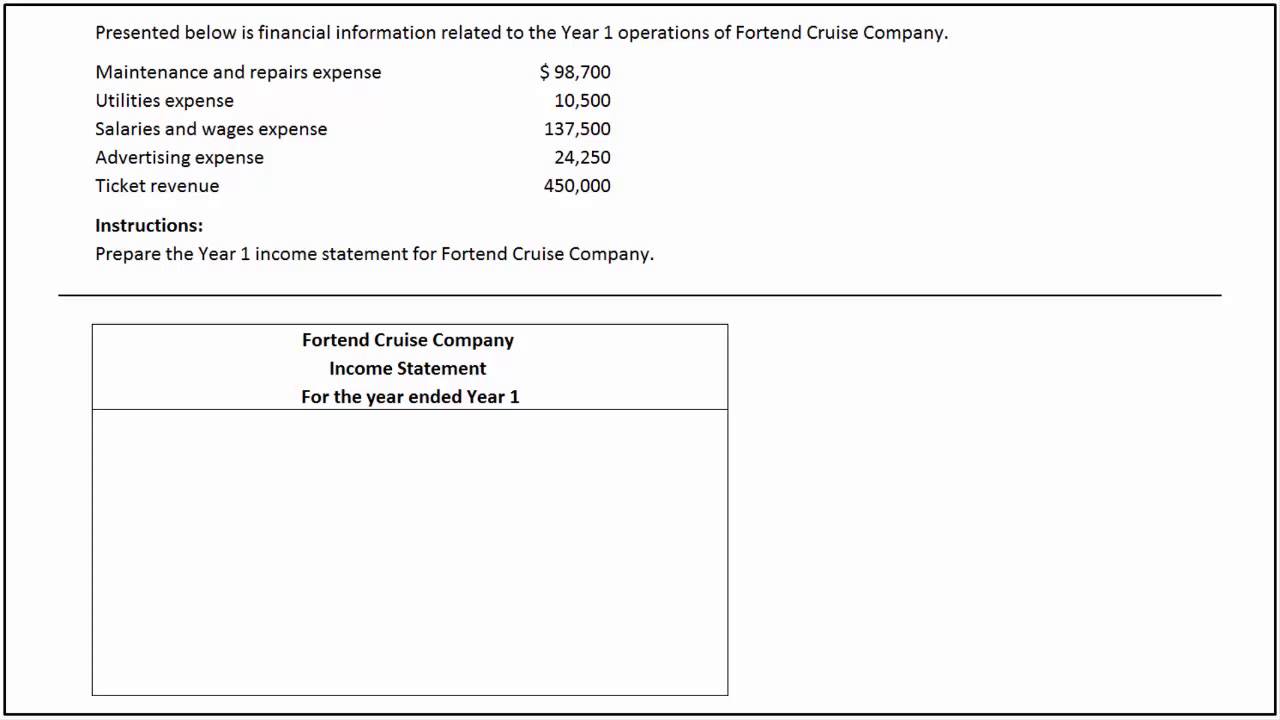

The income statement needs to be prepared before the balance sheet because the net. In this tutorial we will prepare an income statement of a sole proprietorship service type business using information from previous lessons. Identify the revenue and expense accounts on the unadjusted trial balance. The sales revenues turnover the costs chages consumptions matching the sales.

A trial balance is important because it acts as a summary of all of our accounts. After a company posts its day to day journal entries it can begin transferring that information to the trial balance columns of the 10 column worksheet. If an income statement is prepared before an entity s year end or before adjusting entries discussed in future lessons it is called an interim income statement. The trial balance is as the name suggests is a table where we lay out all our debit accounts and all our credit accounts to see if they balance or not.

Adjusted trial balance if you want you may take a look at how an income statement looks like here before we proceed. The income statement totals the debits and credits to determine net income before taxes the income statement can be run at any time during the fiscal year to show a company s profitability. Typically companies keep a chart of accounts which is a numbered list of accounts. Kevin suri carries on business as a retail trader.

Test your understanding 1. By looking at our trial balance we can immediately see our bank balance our loan balance our owner s. To prepare an income statement generate a trial balance report calculate your revenue determine the cost of goods sold calculate the gross margin include operating expenses calculate your income include income taxes calculate net income and lastly finalize your income statement with business details and the reporting period. 1 inventory at 31 december 20x5 was 25 680.

In other words we present in the is only the costs which were actually incurred to produce the sales.