The Income Statement Shows Revenues Coming Into The Organization

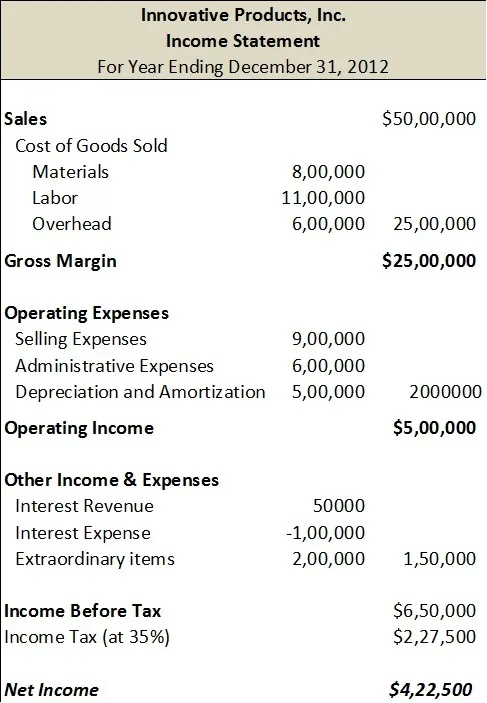

The purpose of the income statement is to show the reader how much profit or loss an organization generated during a reporting period this information is more valuable when income statements from several consecutive periods are grouped together so that trends in the different revenue and expense line items can be viewed.

The income statement shows revenues coming into the organization. The income statement offers effective tools to management for making decisions as to how revenues may be generated more and expenses may be reduced or controlled. The bottom line of an income statement shows the firms or net loss. In accounting we measure profitability for a period such as a month or year by comparing the revenues earned with the expenses incurred to produce these revenues. The company may receive revenues from sales of goods and services dividends and interest.

Also known as the profit and loss statement or the statement of revenue and expense the income statement primarily focuses on the company s revenues and expenses during a particular period. A negative income figure appears on a company s income statement also known as a profit and loss statement. The income statement is used to give a summary of the company s revenues and expenses over a specific period of time. The income statement is one of a company s core financial statements that shows their profit and loss over a period of time.

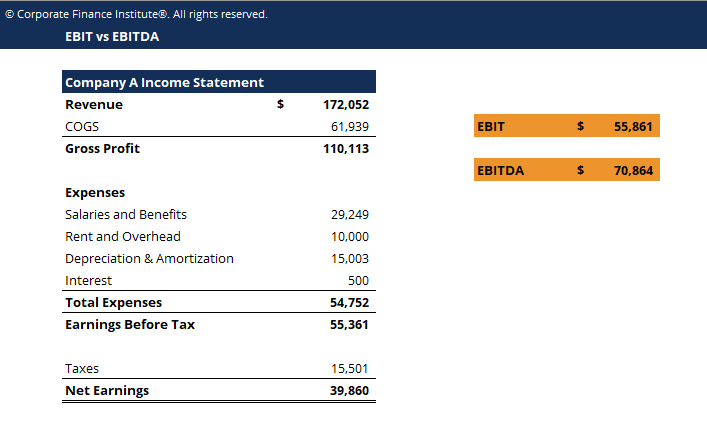

The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of three statements used in both corporate finance including financial modeling and accounting. The income statement comes in two forms multi step and single step. Effective decision making process entails drawing financial information from income statement. The income statement contains several subtotals that can assist in.

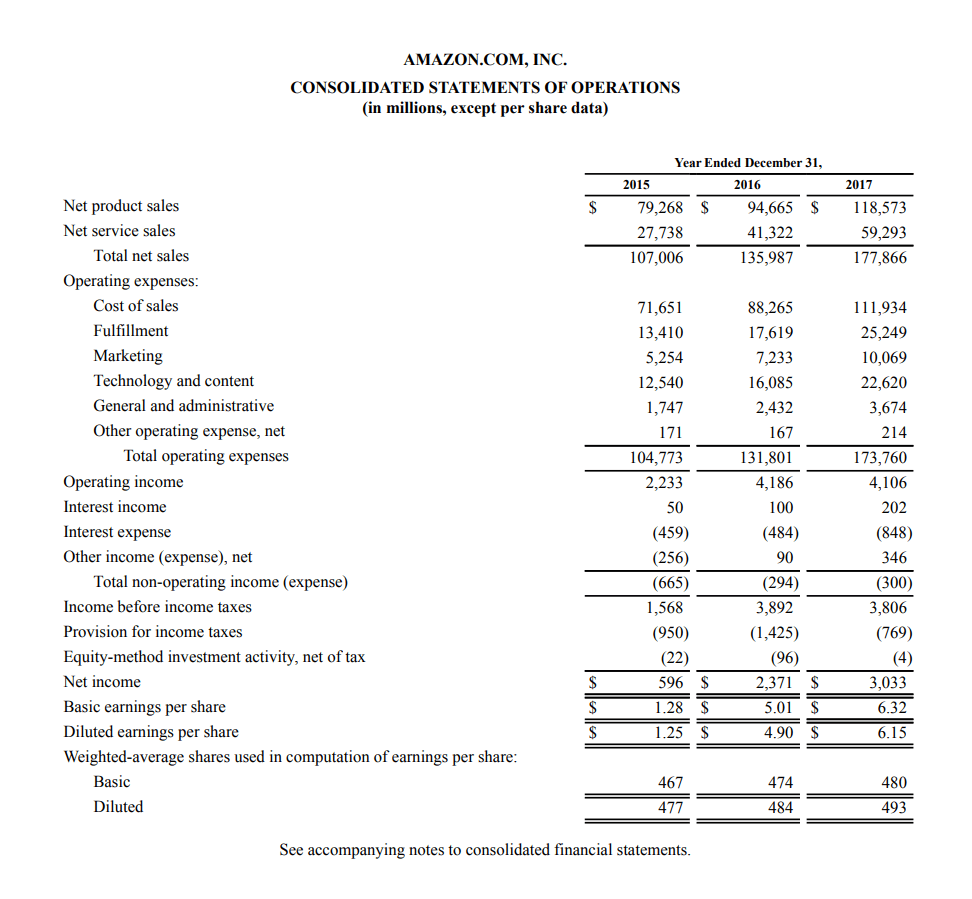

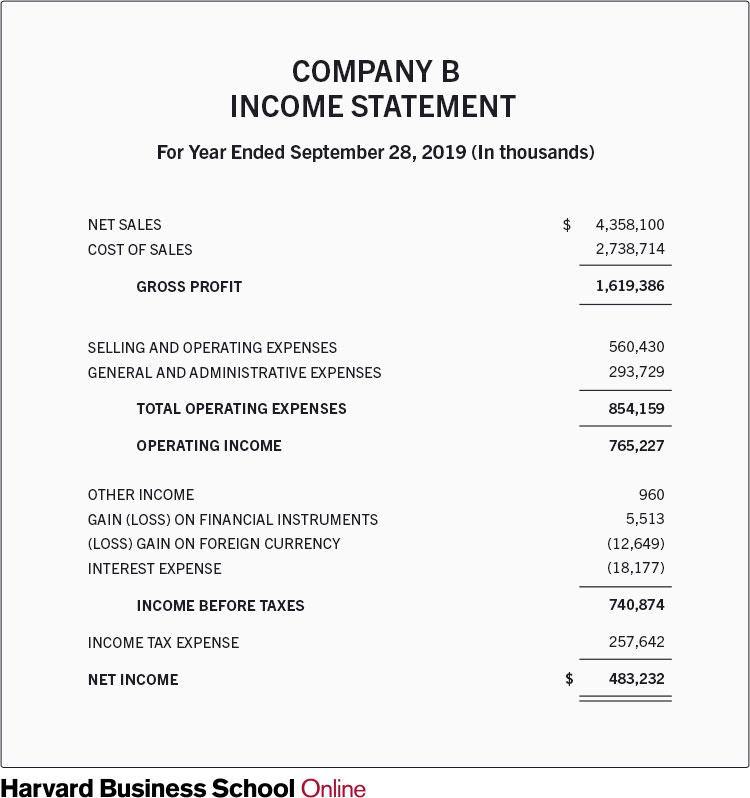

A total of 560 million in selling and operating expenses and 293 million in general and administrative expenses were subtracted from that. The income statement is one the major financial statements used to analyze a company. When the expenses exceed the revenues the company has a negative income. The income statement sometimes called an earnings statement or profit and loss statement reports the profitability of a business organization for a stated period of time.

The income statement summarizes a company s revenues and expenses over a period either quarterly or annually. This income statement shows that the company brought in a total of 4 358 billion through sales and it cost approximately 2 738 billion to achieve those sales for a gross profit of 1 619 billion. A provides a summary of cash coming into and money going out of a firms operations activities financing activities and investing activities. The income statement shows the company s revenues and expenses.

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)