Income Statement Deduction From Revenue

An income statement also called a profit and loss statement or p l is a fundamental tool for understanding how the revenue and expenses of your business stack up.

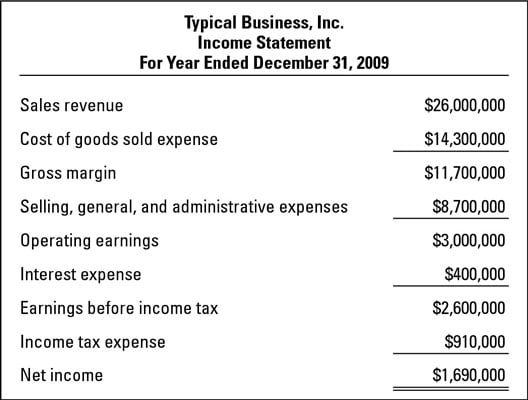

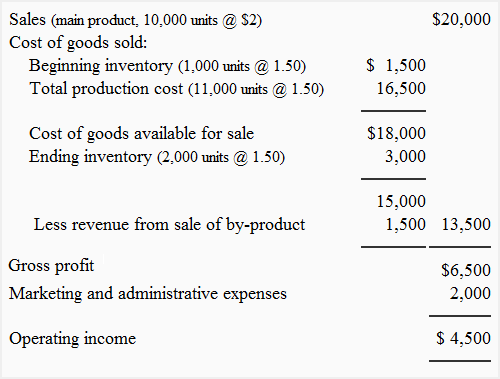

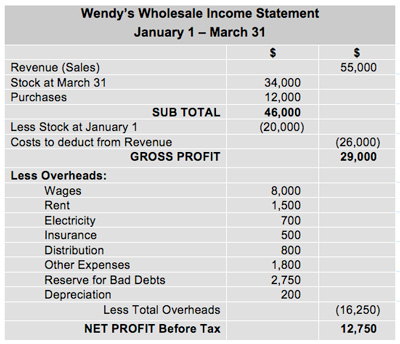

Income statement deduction from revenue. This example financial report is designed for you to read from the top line sales revenue and proceed down to the bottom line net income. Matching the proper amount of the costs of the goods sold with the sales revenues of the accounting period. A real example of an income statement. Sales revenue from selling goods to customers.

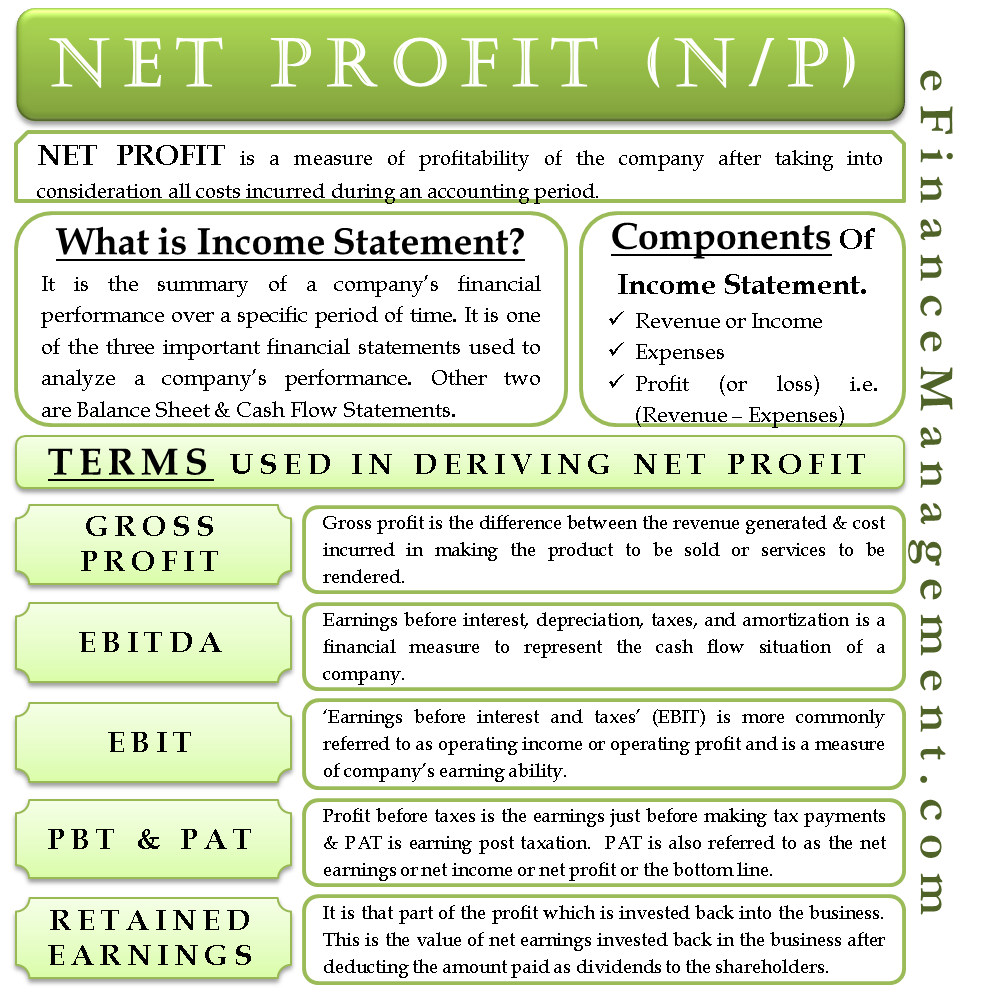

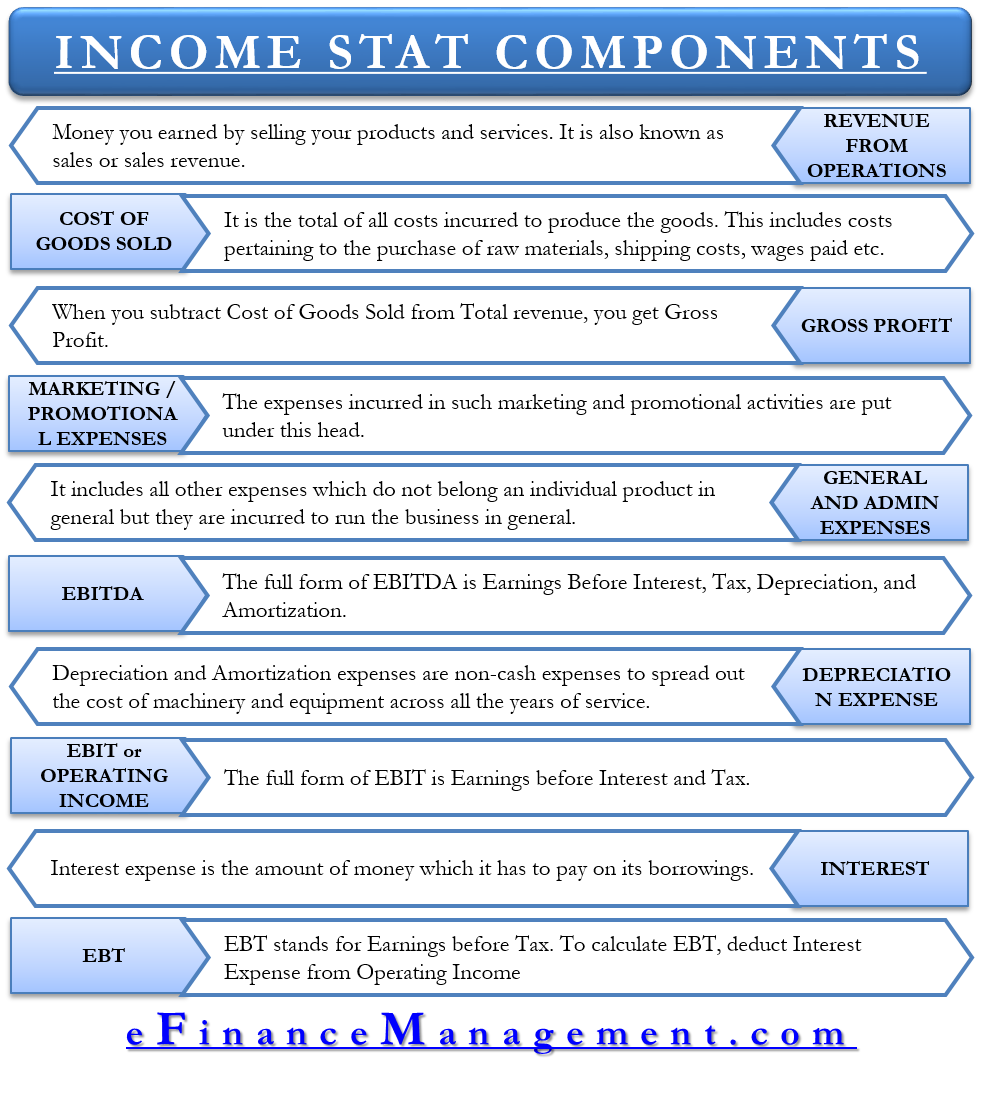

Simply put it tells anyone at a glance if your business is profitable or not. An income statement otherwise known as a profit and loss statement is a summary of a company s profit or loss during any one given period of time such as a month three months or one year. Identifies the business the financial statement title and the time period summarized by the statement. The most common income statement items include.

The income statement records all revenues for a business during this given period as well as the operating expenses for the business. It is shown in the income statement as a deduction to sales. An income statement is a standard financial document that summarizes a company s revenue and expenses for a specific period of time usually one quarter of a fiscal year as well as the entire fiscal year. 4 february 2013 page 4 of 23 e xpenses incurred on 5 1.

Sales discounts a contra revenue account that represents reduction in the amount paid by customers for early payment. Below is an example of amazon s consolidated statement of operations or income statement for the years ended december 31. Sales returns and allowances are posted in the income statement as deductions from revenue and are recorded as debit entries in the company s books. The income statement comes in two forms multi step and single step.

This is the amount that flows into retained earnings on the balance sheet after deductions for any dividends. Each step down the ladder in an income statement involves the deduction of an expense. Inland revenue board of malaysia date of issue deductions for promotion of exports public ruling no. A decrease in the amount of inventory will appear on the income statement as an addition to the cost of the purchases.

In an income statement sales is classified as a revenue account and is posted as a credit entry in a double entry bookkeeping system. It is the principal revenue account of merchandising and manufacturing companies. Here s how an income statement is usually.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/Apple10KIS-00e74dfe3f34479180ac7ede7b982292.jpg)

/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)