Income Tax Rate In Pakistan 2020 21

What is withholding tax important note.

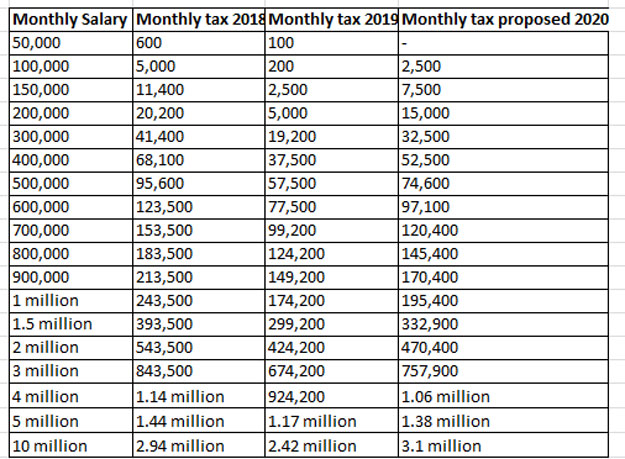

Income tax rate in pakistan 2020 21. Personal income tax rates the following tax rates apply where income of the individual from salary exceeds 75 of taxable income. In simple words if you are earning more than 600 000 rupees in a fiscal year starting from. When it announced the budget for fiscal year 2020 21 in june 2020 the pakistan tehreek i insaf led government had left income taxes unchanged from last year in a bid to avoid placing any. As per finance bill 2019 presented by government of pakistan in general assembly june 2019 following slabs and income tax rates will be applicable for salaried persons for the year 2019 2020 who meet the following income condition.

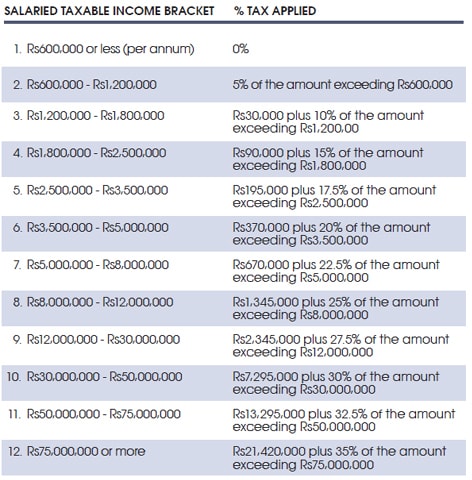

Calculate salary tax 2020 21 last updated. If the annual salary income exceeds pkr. In 2020 2021 the income tax payable on the amount that exceeds 600 000 rupees per year. Where the taxable salary income does not exceed rs.

Finally income tax slab rates for salaried class in pakistan 2020 21 has published in the month of june. Below you will find income tax calculator 2020 2021. 75 000 000 then the rate of income tax is pkr. Here are the income tax rates in pakistan for year 2022 21.

Updated up to june 30 2020. Please note as for these income tax rates in pakistan where a persons is not appearing in the active taxpayers list the rate of tax required to be deducted or collected as the case may be shall be increased by hundred percent of the rate specified to be deducted or collected. The income tax calculator 2020 2021 pakistan is designed to facilitate the taxpayer to understand the tax ratio. As per federal budget 2019 2020 presented by government of pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2019 2020.

Fbr income tax slabs for salaried persons 2020 21. A non resident individual is taxed only on pakistan source income including income received or deemed to be received in pakistan or deemed to accrue or arise in pakistan. If it will be collected then all of the poorer classes will be given relief and benefits. 50 000 000 but does not exceed pkr.

This income tax calculator pakistan helps you to calculate salary monthly yearly payable income tax according to tax slabs 2020 2021. 600 000 the rate of income tax is 0. Latest income tax slab rates in pakistan. Previously this salary slab was not included in the income tax deduction bracket.

This will help and let us to smoother up the flow of our money that also effects on the economy. Withholding tax rates applicable withholding tax rates.