Nj Income Tax Worksheet G

Also list income of any dependent who did not file a new jersey tax return.

Nj income tax worksheet g. Enter line 16b tax exempt interest of your 2019 nj 1040. The current tax year is 2019 and most states will release updated tax forms between january and april of 2020. Git 4 filing status for information on the exceptions and special circumstances. Your new jersey tax return.

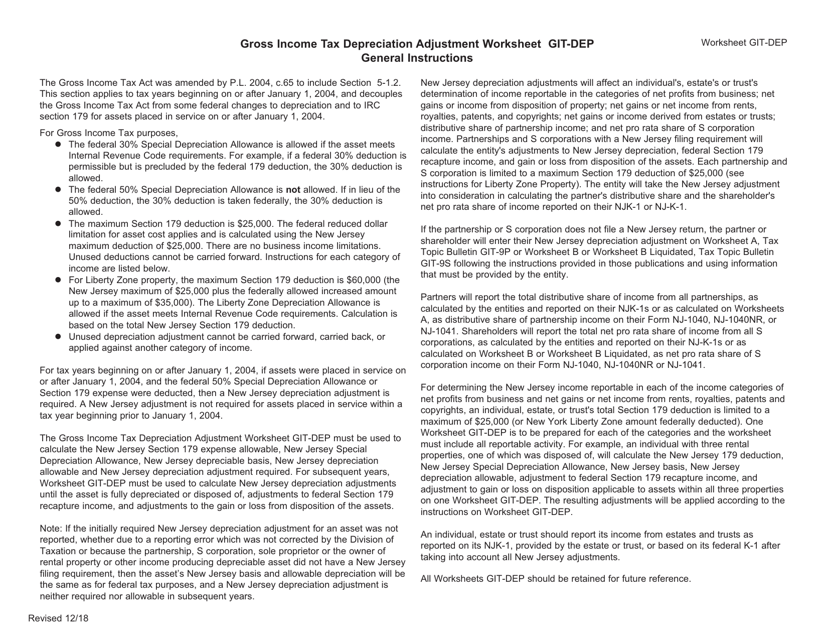

Nj 1040 new jersey resident income tax return nj 1040 new jersey resident income tax return nj 1040 1040 tgi git created date. A new jersey adjustment is not required for assets placed in service within a tax year beginning prior to january 1 2004. New jersey has a state income tax that ranges between 1 4 and 10 75 which is administered by the new jersey division of revenue taxformfinder provides printable pdf copies of 96 current new jersey income tax forms. The gross income tax depreciation adjustment worksheet git dep must be used to calculate the new jersey section 179 expense allowable new jersey special depreciation allowance new jersey depreciable basis new jersey.

Then complete schedule a and worksheet j. Gross income tax depreciation adjustment worksheet. Employee s certificate of non residence in new jersey. If you are in need of a skilled tax preparer or bookkeeper in burbank or glendale team up with moore paquette tax group.

With more than 70 years of experience our team is the one to trust. Lines 1 and 2 of worksheet g. See the instructions for schedule a on page 40 if you will receive a greater benefit by taking the deduction enter on line 38 the amount of the property tax deduction from worksheet g or schedule a and make no entry on line 49. Worksheet g 1 continued 2016 form nj.

First time new jersey filers are eligible to use this service as well. A new jersey resident must report all taxable income received whether from new jersey. Nj 1040 new jersey resident income tax return author. Nj 1040 new jersey resident income tax return keywords.

If you lived in more than one new jersey residence during the year you must determine the total amount of property taxes and or 18 percent of rent to use when calculating the property tax deduction or credit by completing worksheet g in the new jersey resident income tax return instruction booklet form nj 1040. For new jersey purposes your gross income includes income received in the form of money goods property benefits and services. Sheltered workshop tax credit. Complimentary forms worksheets.

New jersey gross income tax film and digital media tax credit.