Income Tax Definition Us Government

Taxes have been called the building block of civilization.

Income tax definition us government. Like many nations the united states has a progressive tax system not a regressive one through which a higher percentage of tax revenues are collected from high income. Irc section 115 excludes from gross income any income derived from the exercise of or administration of any public function. To access any tax court case opinions issued after september 24 1995 visit the opinions search page of the united states tax court. It was not until the sixteenth amendment was ratified in 1913 that the federal government assessed taxes on income as a.

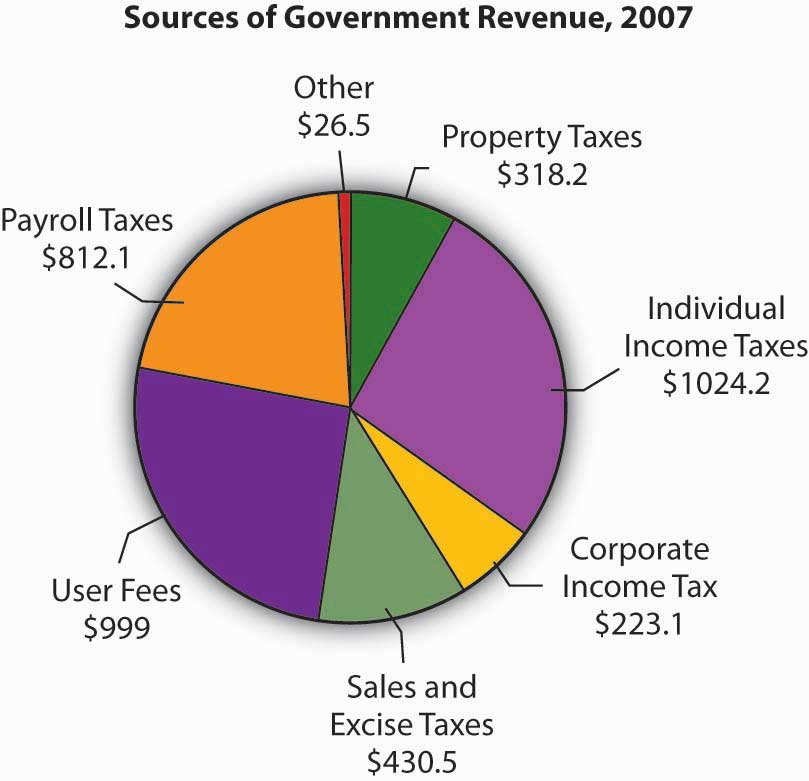

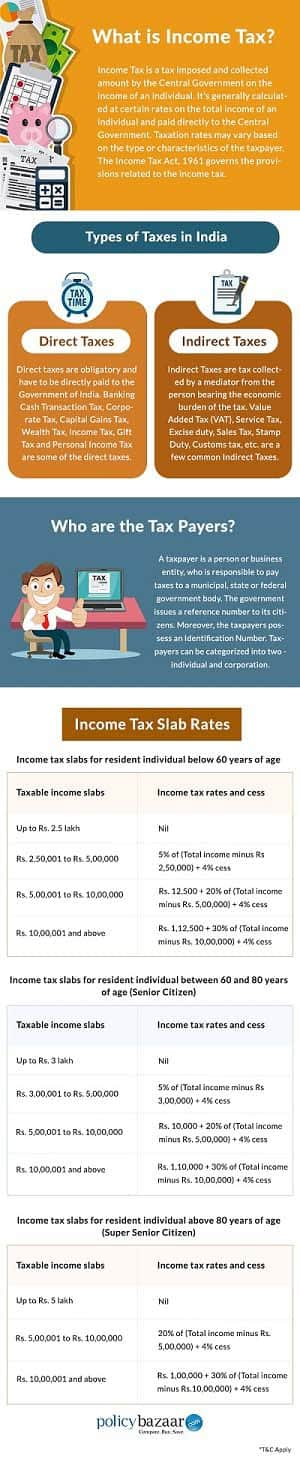

Income tax is used to fund public services pay government. In some states. An income tax of 3 was levied on high income earners during the civil war. Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction.

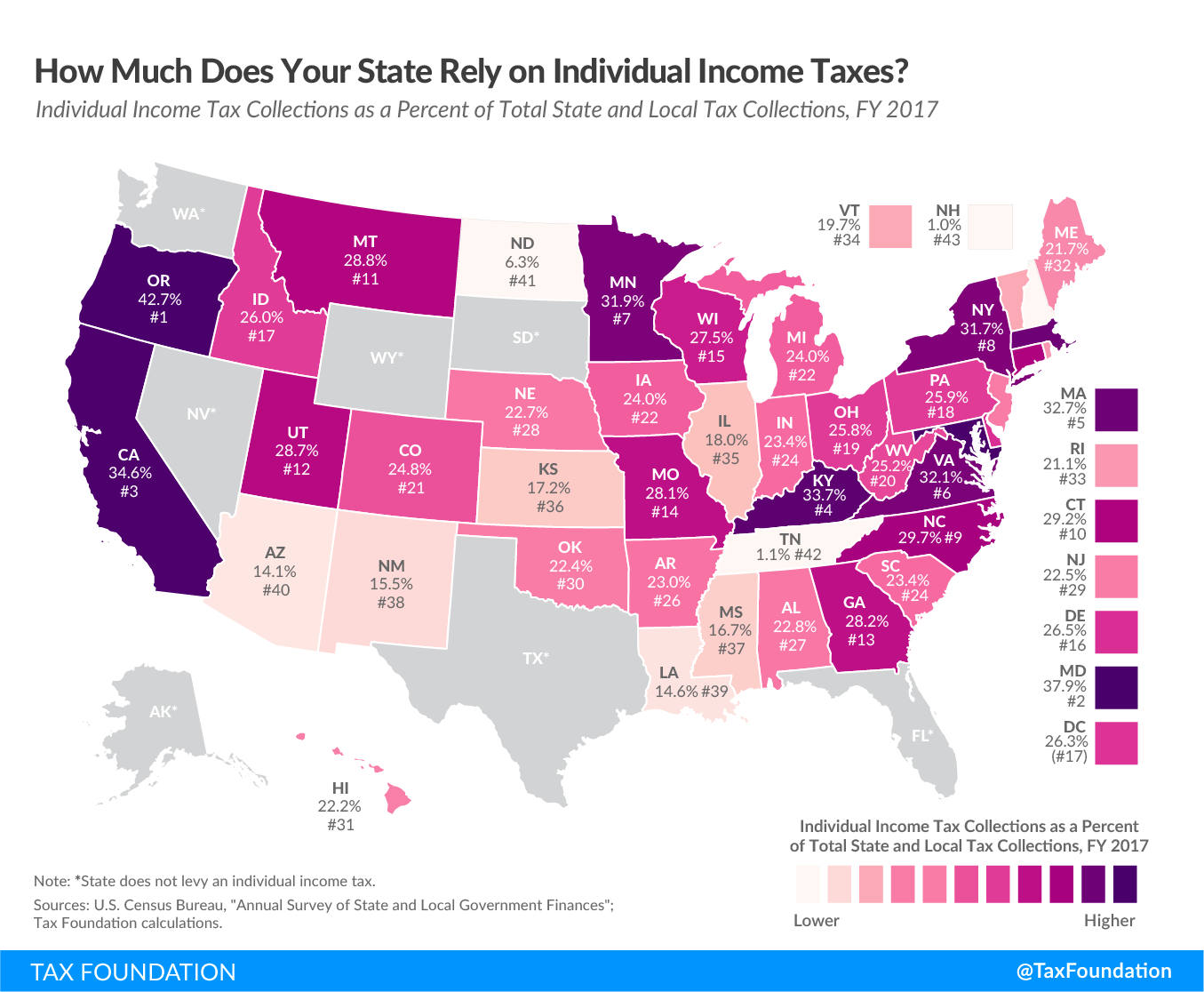

Income taxes in the united states are imposed by the federal most states and many local governments the income taxes are determined by applying a tax rate which may increase as income increases to taxable income which is the total income less allowable deductions individuals and corporations are directly taxable and estates and trusts may be taxable on undistributed income. There are different types of income tax including federal state and local income tax. The primary tax difference from other taxpayers is the general exemption from income tax. A charge imposed by government on the annual gains of a person corporation or other taxable unit derived through work business pursuits investments property dealings and other sources determined in accordance with the internal revenue code or state law.

Income taxes income taxes are a percentage of the money someone makes on their job. To access the applicable irc sections treasury regulations or other official tax guidance visit the tax code regulations and official guidance page. Taxes in the u s.

:max_bytes(150000):strip_icc()/1040-Page1-e7bbe01bc7824e54a552dfab83fff0b6.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png)

/ScreenShot2020-02-03at11.20.15AM-ed3d6962a8d74a509a58ce0cab7069bf.png)

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/Target1-de0fcdc67fc44470805a5ccdf3b105e0.png)