Va Residual Income Worksheet 2020

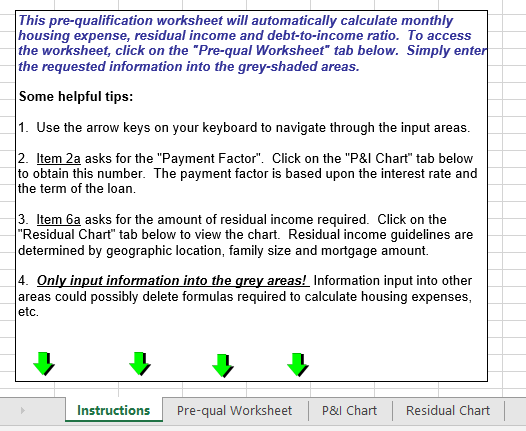

See part ii section 2 3 bi weekly.

Va residual income worksheet 2020. However lenders consider them together rather than in isolation. See part ii section 4 5 overtime bonuses. The method of calculation as well as the nature of limits of residual income and dti ratio may differ. Respondent burden this information is needed to help determine a veteran s qualifications for a va guaranteed loan.

Thus the residual income limits in the chart above are for borrowers whose dti is not above 41. Total net effective income less estimated monthly shelter expense line 21 federal income tax state income tax. This blog on va residual income requirements and guidelines was published on november 3rd 2020 va home loans is the best loan program for owner occupant home buyers. However when it comes to va loans many are not familiar with the va residual income chart guidelines va residual income is more important than a debt ratio because it shows how much income is remaining for basic living expenses.

Part m va residual income m 1 general information m 2 residual income calculation. Residual income is a calculation that estimates the net monthly income after subtracting out the federal state local taxes proposed mortgage payment and all other monthly obligations such as student loans car payments credit cards etc. Retirement or social security other specify total deductions guideline yes. See part ii section 3 4 semi monthly.

From the household paycheck s. At veterans united all borrowers with a dti ratio above 41 percent must have enough residual income to exceed their guideline by 20 percent. Veterans administration commonly referred to as the va is the federal agency governing va loans. Information is accurate as of the.

Income calculation worksheet part i income type section borrower co borrower 1 hourly. Va encourages lenders to put more weight on residual income than dti ratio and prospective borrowers with higher debt ratios will typically need to meet a higher standard for residual income. The va loan handbook states that a debt to income ratio of more than 41 requires close examination unless residual income exceeds the guidelines by at least 20 percent a high income compared to all your other regular expenses could push you over the top as far as qualification. Most people in the mortgage process hear the term debt to income ratio a lot and know its importance.

See part ii section 6. See part ii section 1a 1b 1c or 1d seasonal worker 2 weekly. See part ii section 5a or 5b 6 commissioned.