Corporate Income Tax Rate 2020 Uk

This page provides united kingdom corporate tax rate actual values historical data forecast chart statistics economic calendar and news.

Corporate income tax rate 2020 uk. Main rate companies with profits over 300 000. And it is due to fall to 17 from april 2020 as part of a package of tax reforms designed to enhance uk competitiveness. The content is current on 1 january 2020 with exceptions noted. European oecd countries like most regions around the world have experienced a decline in corporate income tax rates over the last decades.

Corporate tax rates 2020. This maintains the rate at 19 rather than reducing it to 17 from 1 april 2020. The headline rate was 28 as recently as 2010 but is now 19. The content is straightforward.

The corporate tax rate in the united kingdom stands at 19 percent. This maintains the rate at 19 rather than reducing it to 17 from 1 april 2020. Keep up to date on significant tax developments around the globe with ey s global tax alert library here. The new tax year in the uk starts on 6 april 2020.

Corporate tax rates 2020 includes information on statutory national and local corporate income tax rates applicable to companies and branches as well as any applicable branch tax imposed in addition to the corporate income tax e g branch profits tax or branch remittance tax. Corporate tax rate in the united kingdom averaged 30 98 percent from 1981 until 2020 reaching an all time high of 52 percent in 1982 and a record low of 19 percent in 2017. And while the income tax brackets and personal tax allowance won t be changing in 2020 21 chancellor rishi sunak s highly anticipated budget speech on 11 march had good news for both the employed and self employed. United kingdom highlights 2020 page 2 of 12 basis a uk resident company is subject to corporate income tax corporation tax on worldwide profits and gains see taxable income below with credit granted for overseas taxes paid.

This measure sets the corporation tax main rate at 19 for the financial year beginning 1 april 2020. However banks have since 2016 paid an 8 surcharge on top of the headline rate of corporation tax. 4 1 what is the headline rate of tax on corporate profits. Small profits rate companies with profits under 300 000 20.

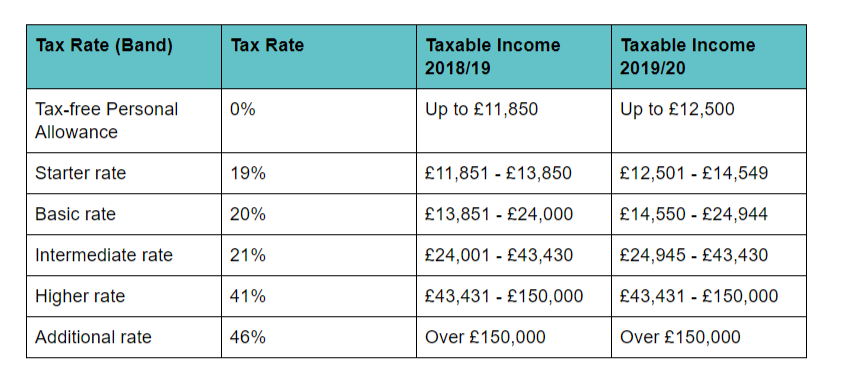

In 2000 the average corporate tax rate was 31 6 percent and has decreased consistently to its current level of 21 9 percent. Here s what you need to know about the 2020 21 income tax rates and a rundown of how new budget measures will affect your.