Uk Income Tax Bands 2020 To 2021

The current tax year is from 6 april 2020 to 5 april 2021.

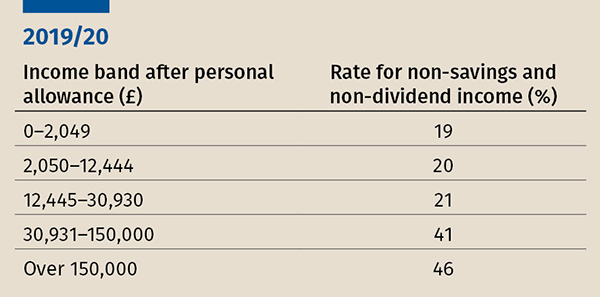

Uk income tax bands 2020 to 2021. The starting rate for savings is a. Here s what you need to know about the 2020 21 income tax rates and a rundown of how new budget measures will affect your. Find out more about income tax on our accounting glossary. For the 2020 21 tax year if you live in england wales or northern ireland there are three marginal income tax bands the 20 basic rate the 40 higher rate and the 45 additional rate also remember your personal allowance starts to shrink once earnings hit 100 000.

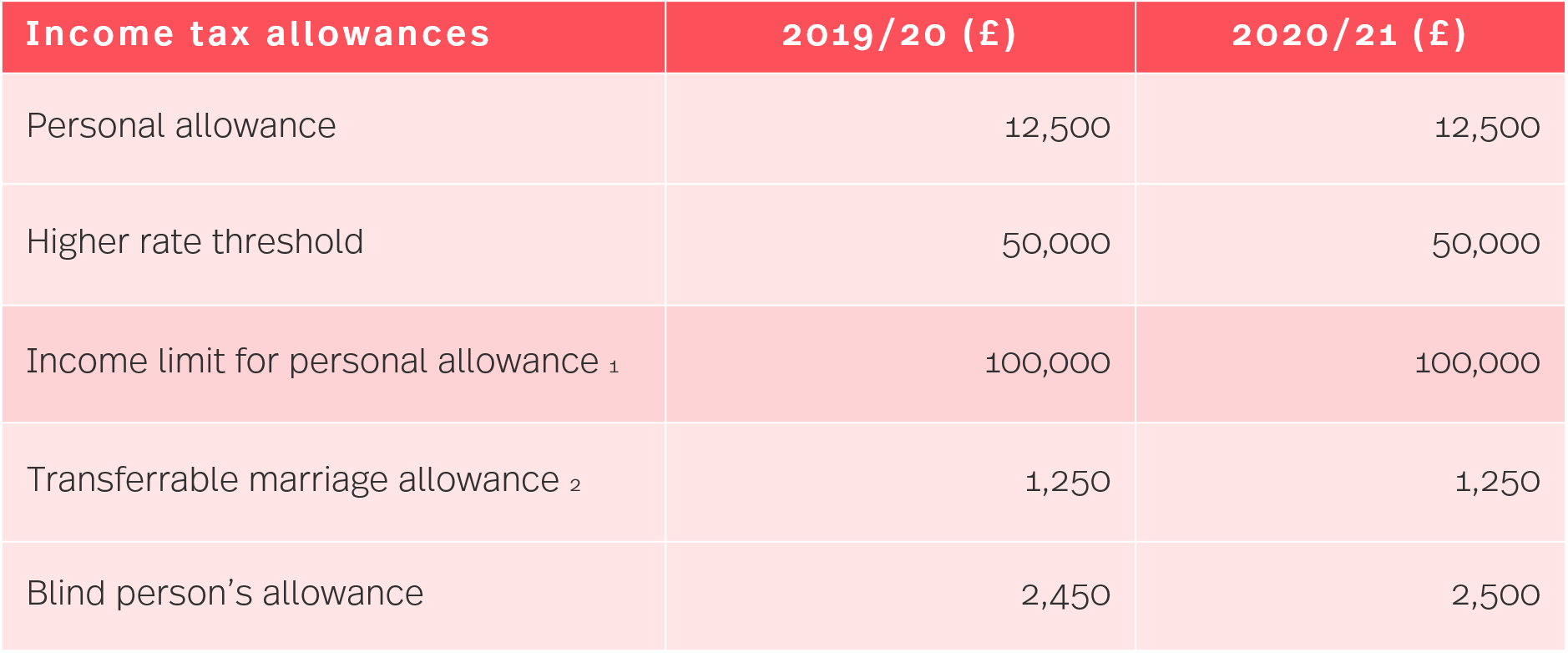

Allowances 2020 to 2021 2019 to 2020 2018 to 2019 2017 to 2018. How much of your income falls within each tax band. And while the income tax brackets and personal tax allowance won t be changing in 2020 21 chancellor rishi sunak s highly anticipated budget speech on 11 march had good news for both the employed and self employed. The new tax year in the uk starts on 6 april 2020.

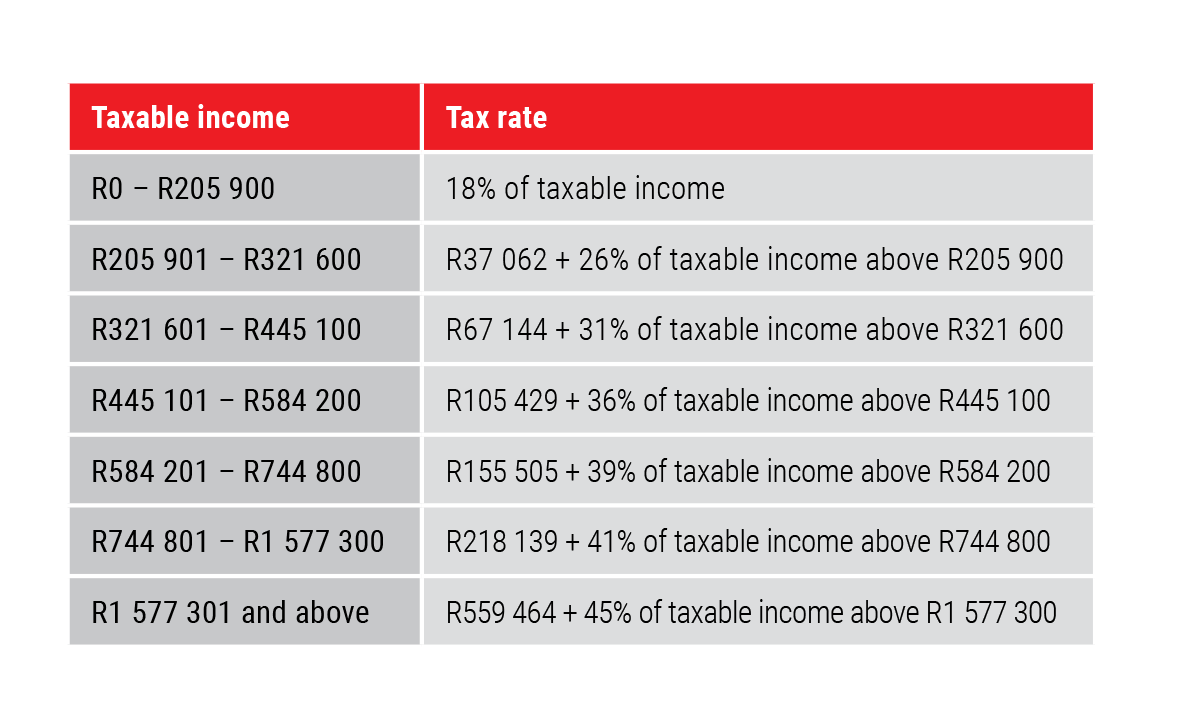

If you re in doubt as to the suitable course of action we recommend you seek tax advice. Income from dividends is taxed at a different rate. Rates allowances and duties have been updated for the tax year 2019 to 2020. Find out more about the scottish rate of income tax.

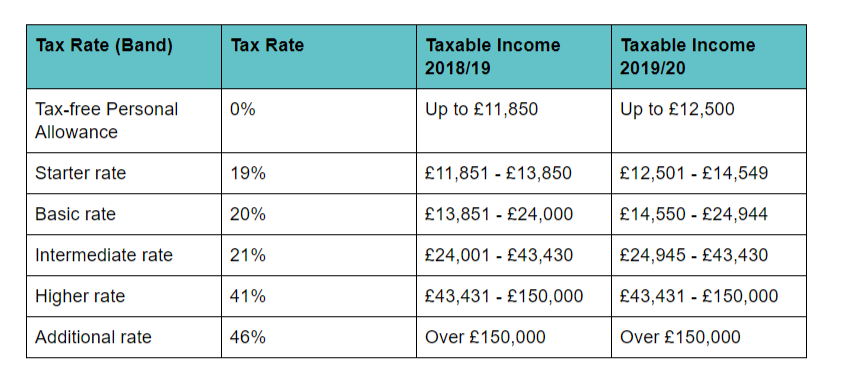

Code and design by ray arman. The standard personal. Taxpayers in scotland pay income tax in a different way to the rest of the uk. How martin works out his income tax as a sole trader.

2020 2021 tax rates and allowances. A quick guide to 2020 2021 tax rates bands and allowances. Unless otherwise stated these figures apply from 6 april 2020 to 5 april 2021. Income tax bands and percentages.

The scottish rate of income tax. 2020 2021 tax rates and allowances. Uktaxcalculators co uk free uk tax calculators for any income type. Some income is tax free.

Income tax rates of tax 2020 2021 starting rate of 0 on savings income up to 5 000 personal savings allowance basic rate 1 000 higher rate 500 basic rate of 20 0 to 37 500 higher rate of 40 37 501 to 150 000 additional rate o f 45 150 001 and over for other income less than 17 500 only. By using this site you agree we can set and use cookies. Income limit for personal allowance. Tax rates and allowances have been added for the tax year 2020 to 2021.