Income Tax Rate Ohio 2019

In addition to the ohio corporate income tax ohio corporations must also pay the federal corporate income tax.

Income tax rate ohio 2019. Any income over 82 900 would be taxes at the rate of 3 802. The top ohio tax rate has decreased from 4 997 last year to 4 797 this year. These income tax brackets and rates apply to ohio taxable income earned january 1 2019 through december 31 2019. 2019 due date.

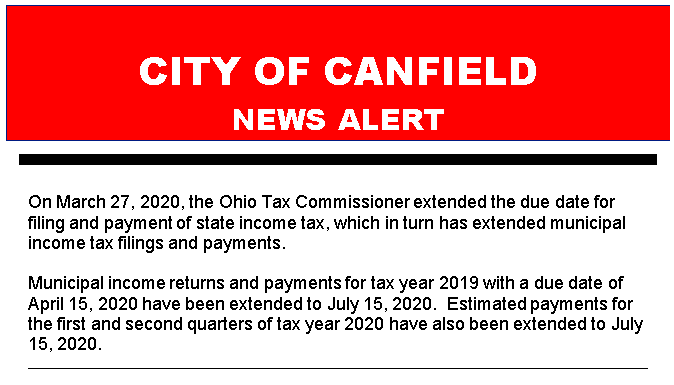

For the 2019 tax year which you file in early 2020 the top rate is 4 797. Ohio tax forms are sourced from the ohio income tax forms page and are updated on a yearly basis. The following are the ohio individual income tax tables for 2005 through 2020. 2020 coronavirus filing payment extension.

Please make sure. The ohio head of household filing status tax brackets are shown in the table below. Please note that as of 2016 taxable business income is taxed at a flat rate of 3. Additionally all ohio income tax rates have been reduced by 4.

There are 127 days left until taxes are due. Ohio income tax tables. Your ohio income is taxed at different rates within the given tax brackets below. Taxpayers with 22 150 or less of income are not subject to income tax for 2020.

Before the official 2020 ohio income tax rates are released provisional 2020 tax rates are based on ohio s 2019 income tax brackets. The 2020 state personal income tax brackets are updated from the ohio and tax foundation data. Starting in 2005 ohio s state income taxes saw a gradual decrease each year. Modified adjusted gross income.

For tax year 2019 ohio s individual income tax brackets have been modified so that individuals with ohio taxable nonbusiness income of 21 750 or less are not subject to income tax. Like the personal income tax the federal business tax is. Start filing your tax return now. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

Ohio 2019 income bracket rate and estimated taxes due. Ohio state income tax rate table for the 2019 2020 filing season has six income tax brackets with oh tax rates of 0 2 85 3 326 3 802 4 413 and 4 797 for single married filing jointly married filing separately and head of household statuses. Ohio head of household tax brackets. Ohio income tax rate 2019 2020.