Income Statement One Off Items

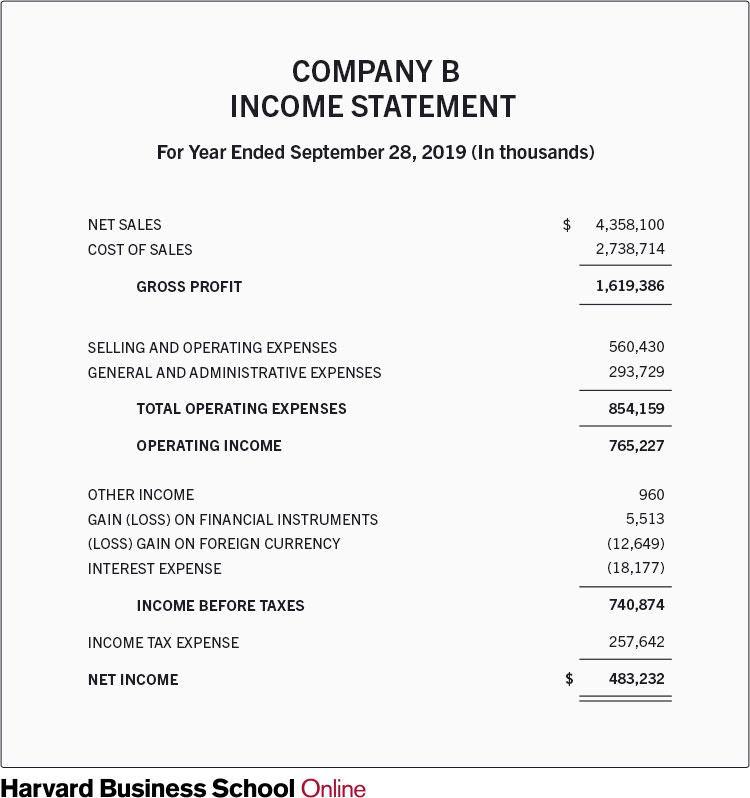

Below is a multiple step income statement containing discontinued.

Income statement one off items. Tax basis discontinued operations one off items extraordinary profit loss mldr net interest expense after tax interest expense interest income x 1 tax rate net operating profit after tax nopat net operating income net interest expense after tax operating working capital current assets cash and marketable securities current liabilities st debt and current. They are however included in net income before income taxes are calculated. A loss on discontinued operations would be reduced by the income tax savings associated with the loss see net of tax. 3 3 1 income statement items.

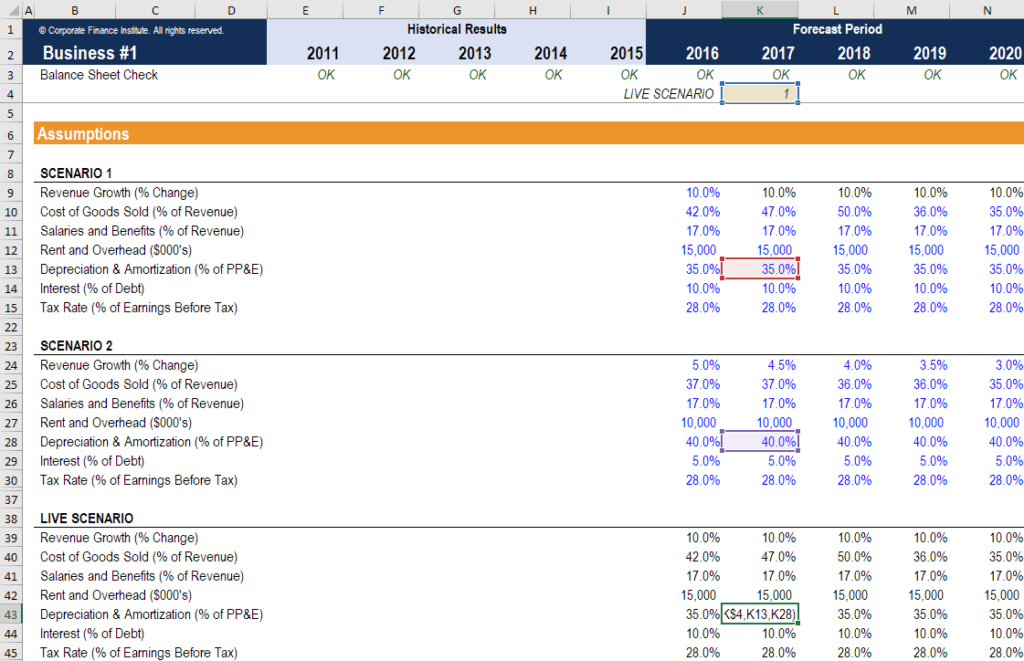

When building a three statement model 3 statement model a 3 statement model links the income statement balance sheet and cash flow statement into one dynamically connected financial model. The excerpt below shows how the one time expenses and revenues for the examples above appear on the income statement of a retail or wholesale company. A one time item is a gain loss or expense on the income statement that is nonrecurring in nature. Extraordinary events can include costs associated with a merger or the expense of implementing a new.

An extraordinary item is an event that materially affected a company s finances and needs to be thoroughly explained in the annual report or form 10 k filing. While the balance sheet constitutes a financial snapshot at a given point in time such as december 31 the income statement summarizes a financial movie of operational results over a period of time such as for the year ending december 31. Non recurring items are those set of entries that are found inthe income statement that is unusual and is not expected during the regular business operations. Note that even in a single step format shown above the amount of the discontinued operations is separated out and added to the end of the income statement.

A one time item is not considered part of a company s ongoing business operations. Projecting income statement line items. Examples of which include gains or loss from the sale of assets impairment costs restructuring costs losses in lawsuits inventory write off etc. Below the line refers to items in a profit and loss account profit and loss statement p l a profit and loss statement p l or income statement or statement of operations is a financial report that provides a summary of a that show no noticeable effect on a company s revenue sales revenue sales revenue is the income received by a company.

A non recurring event is a one time charge the company doesn t expect to encounter again.

:max_bytes(150000):strip_icc()/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)