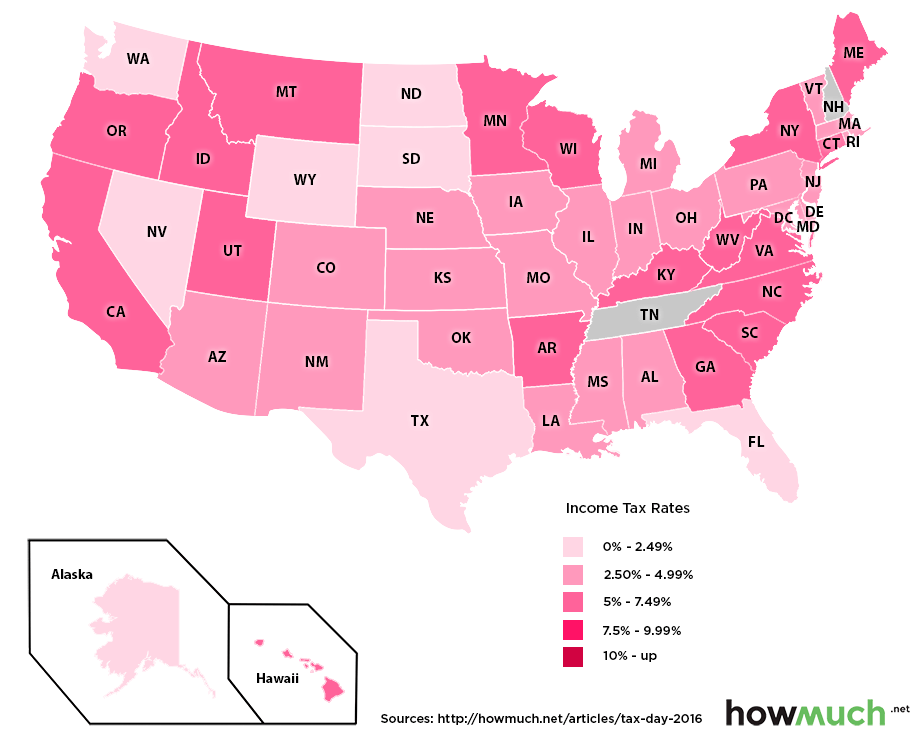

Income Tax Rates Across States

Read more personal finance coverage.

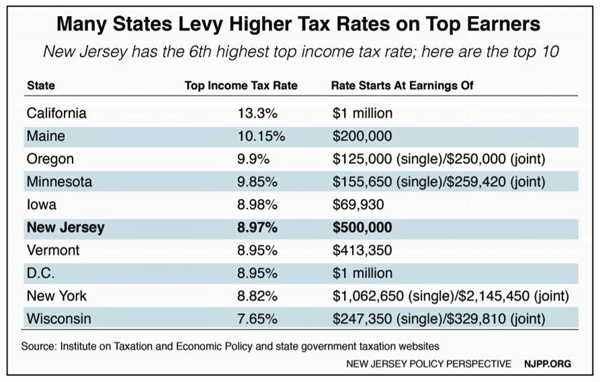

Income tax rates across states. 25 0 30 22 standard rate 11 lowest rate 0 extent taxation in uruguay uzbekistan. Federal income tax minimum bracket 10 maximum bracket 39 6. Colorado 4 63 individuals who are single can claim a standard deduction of 12 200 while those who are married can claim a standard deduction of 24 400. The top income tax rate in the country is 13 3 in california.

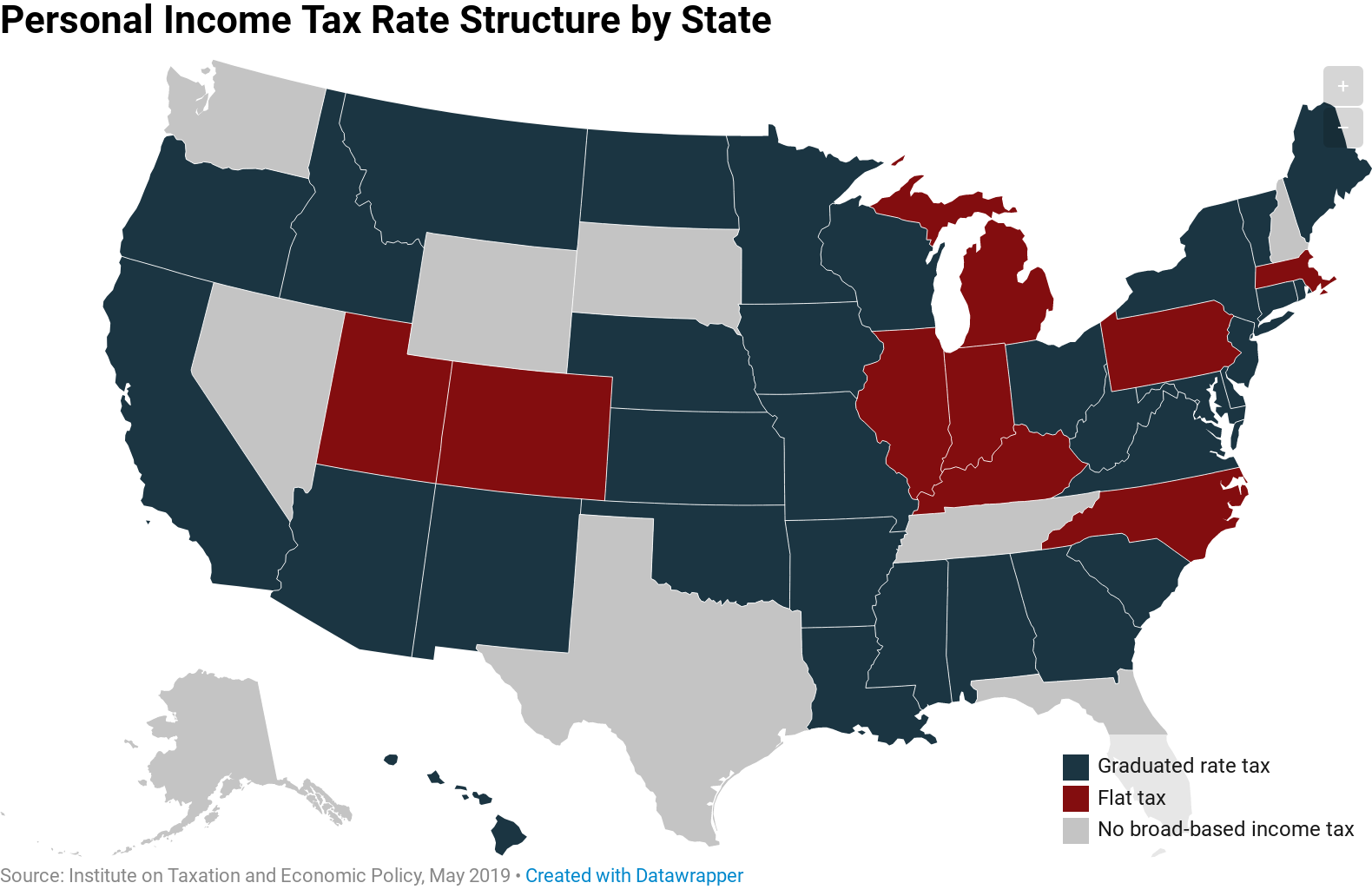

Most state governments in the united states collect a state income tax on all income earned within the state which is different from and must be filed separately from the federal income tax. 51 8 in san francisco california 37 federal tax 13 3 state tax 1 5 city tax 11 725 highest prevailing marginal state and local sales tax rate 0 lowest prevailing marginal rate taxation in the united states uruguay. As of february 2020 state individual income taxes for flat tax states include. This page lists state individual income tax rates for all fifty states including brackets for those filing both as an individual and jointly with a spouse.

Applicable in addition to all state taxes. California has the highest state income tax rate in the country at 13 3. For a visual comparison of state income taxes across the united states see our state. New hampshire and tennessee don t have a state income tax either but they do tax.

There are no personal exemptions. Seven us states have no income tax alaska florida nevada south dakota texas washington and wyoming. Most us states impose either a flat income tax or a progressive income tax. The following states have the highest and the lowest potential personal income tax rates as of jan.

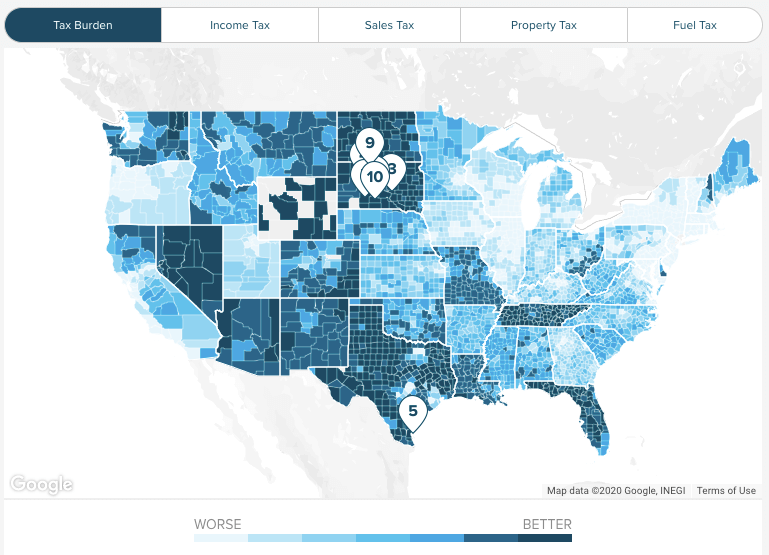

Us states have either a flat income tax a progressive tax or no income tax. State income taxes 2020. Overall state tax rates range from 0 to more than 13 as of 2020. California hawaii oregon minnesota and new jersey have some of the highest state income tax rates in the country and seven states have no tax on earned income at all.

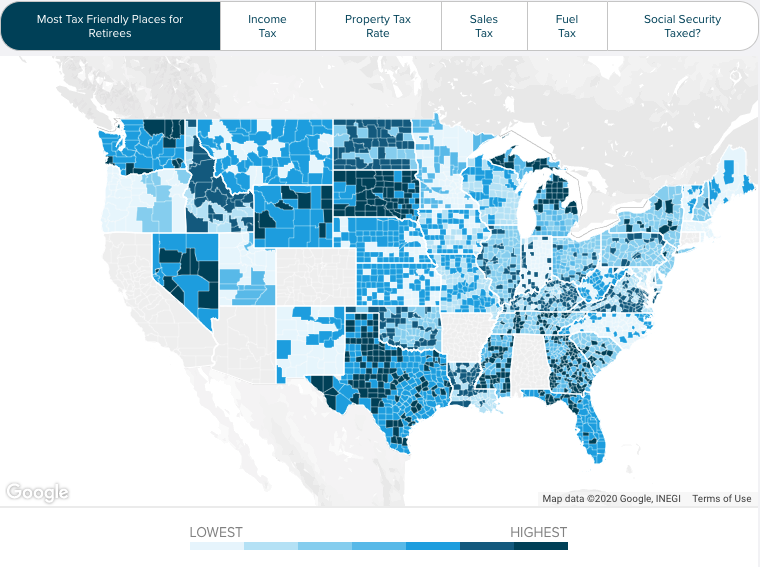

For people considering moving across state lines for work or after they retire significantly higher or lower personal income tax rates can be a deciding factor.