Income Tax Rates Uk 2019 20

Income limit for personal allowance.

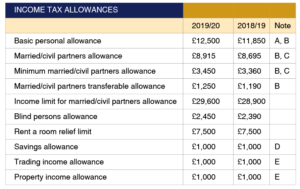

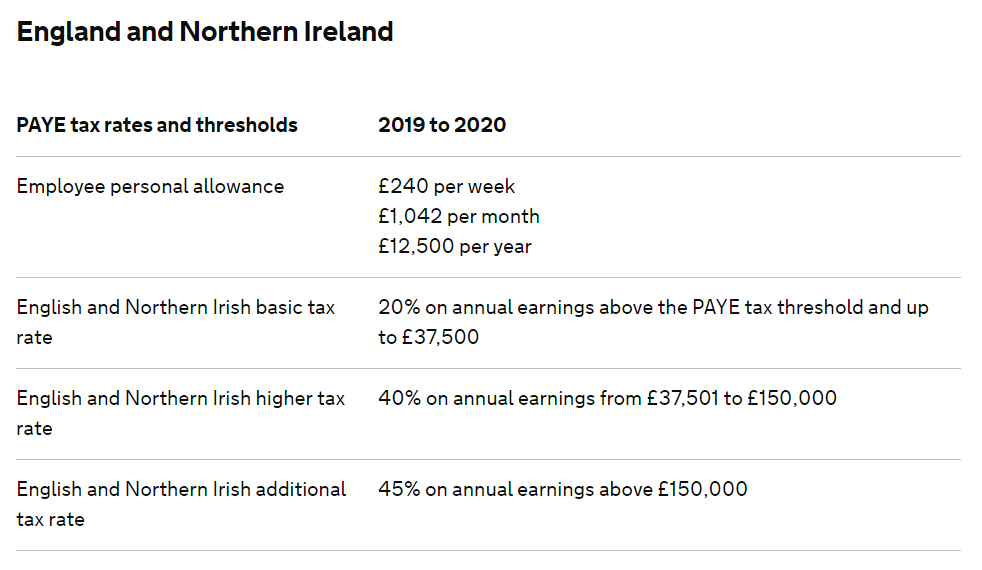

Income tax rates uk 2019 20. Income tax is devolved to wales from 6 april 2019. The personal allowance is a tax free amount which in the 2019 to 2020 tax year is a standard amount of. The allowance is tapered to 10 000 for those with an adjusted income of between 150 000 and 210 000. Depends on income tax band of other income.

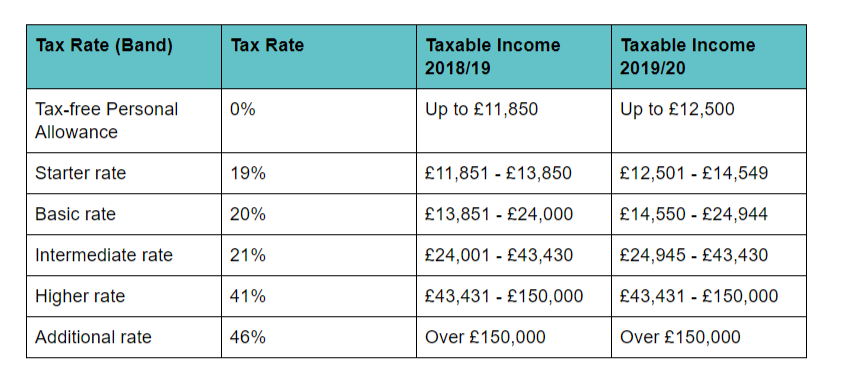

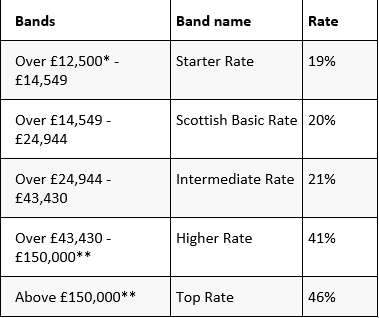

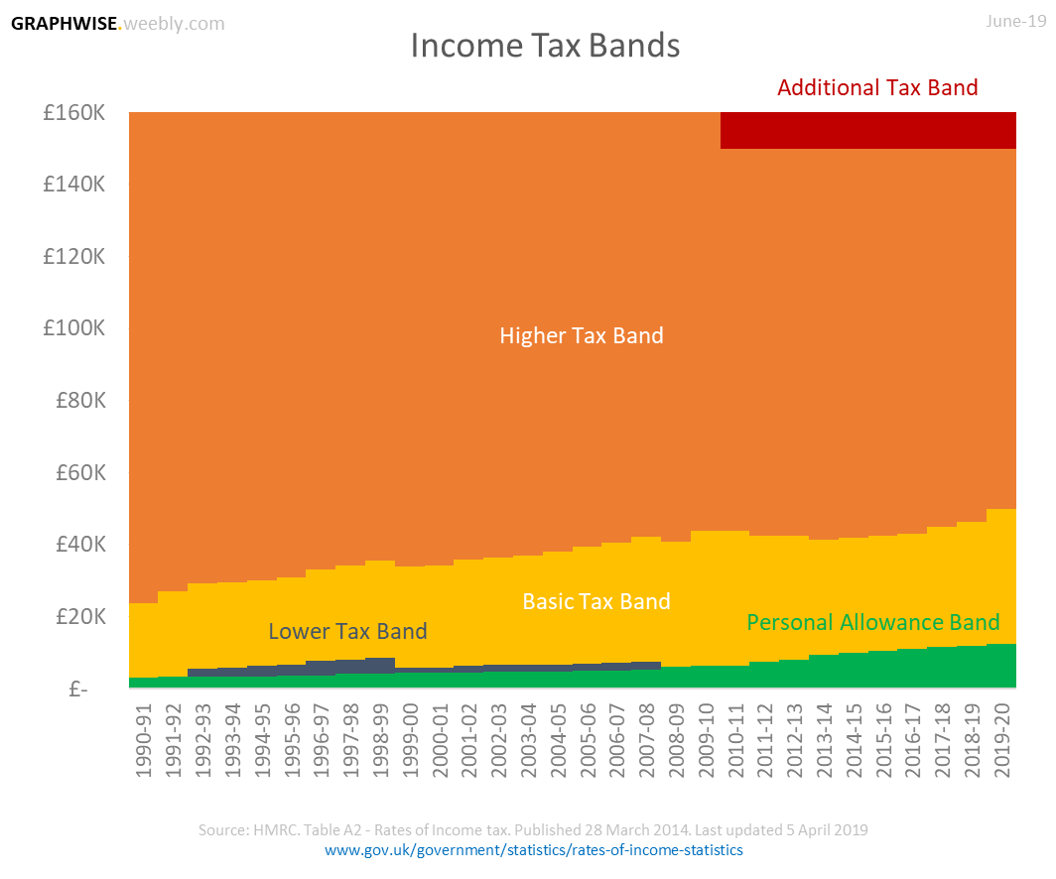

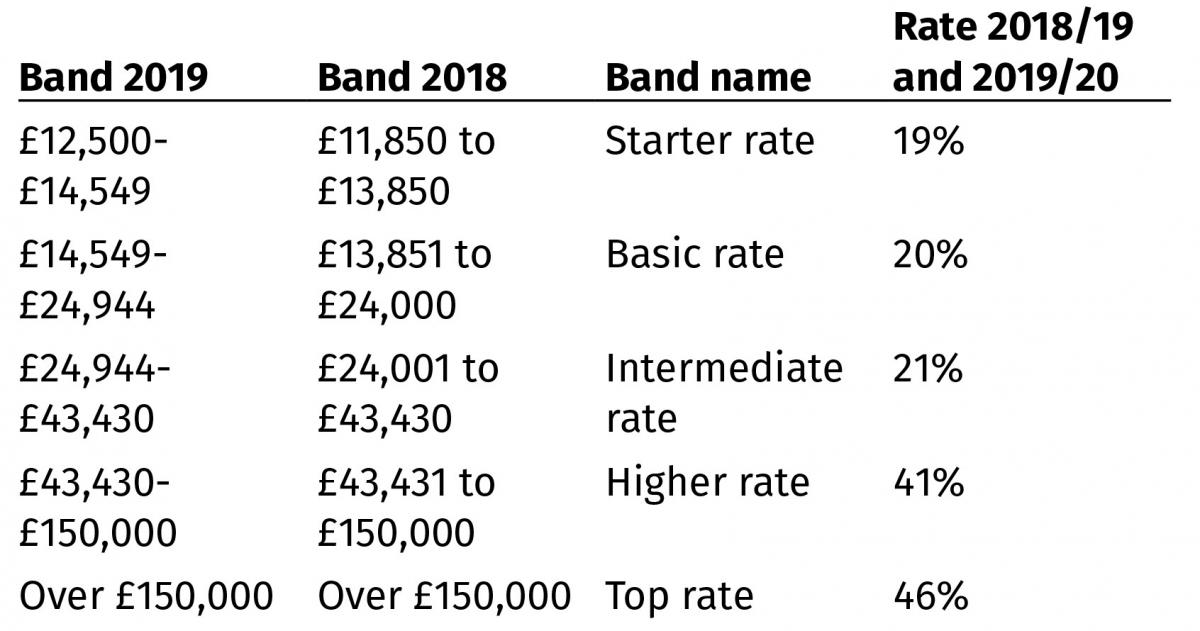

2019 20 band uk rate welsh rate overall rate 0 37 500 10 10 20 37 501 150 000 30 10 40 over 150 000 35 10 45 other allowances for specific types of income. Personal savings allowance at 0 tax on interest received. In the uk income tax applies at different rates to different portions of taxable income. Many of the rates and allowances shown in this card are subject to a range of exceptions and special rules that apply in different circumstances.

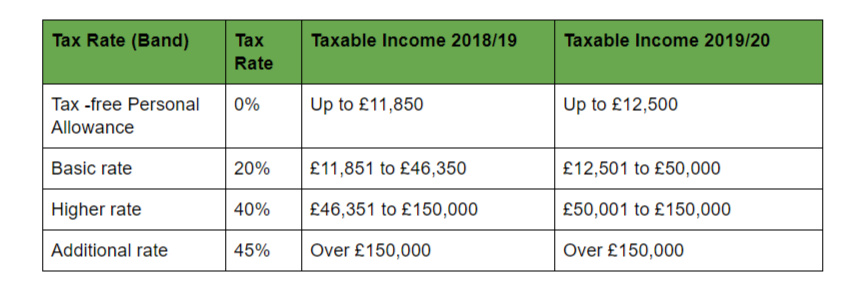

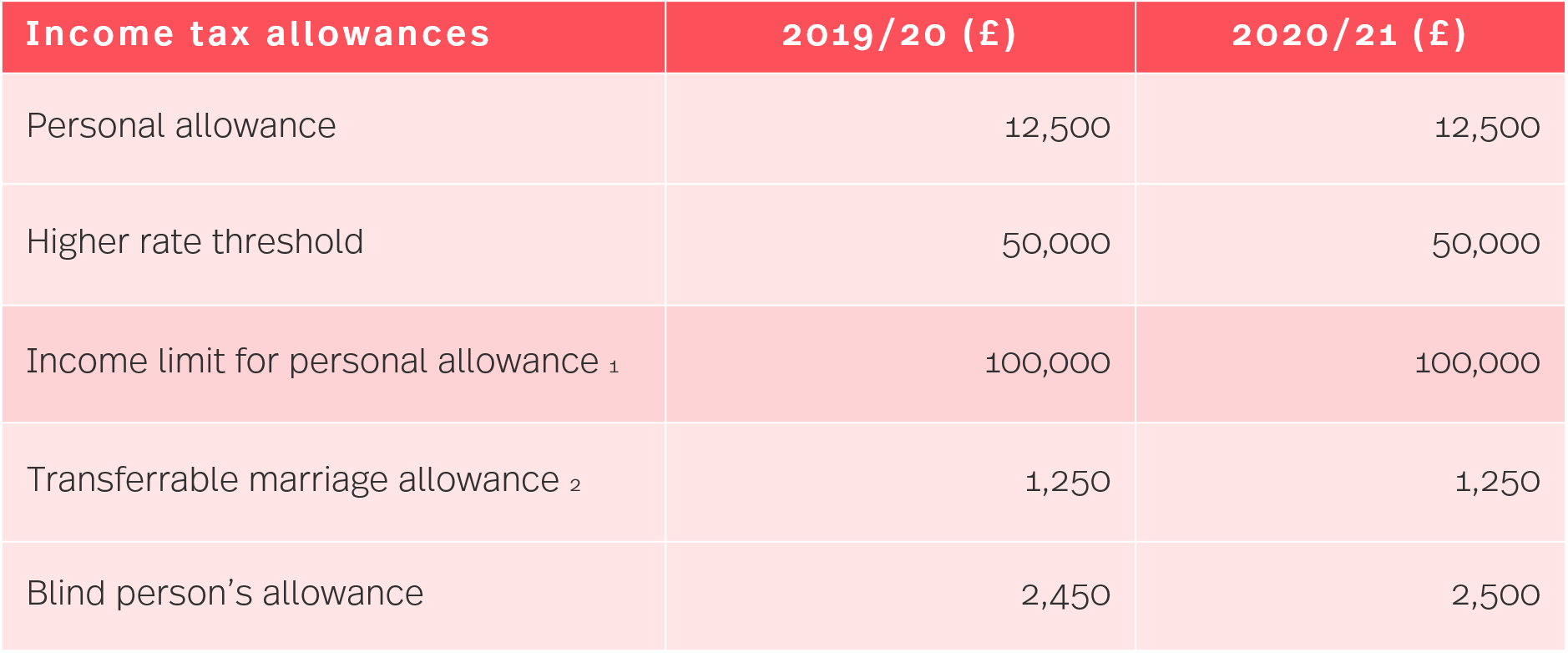

Increase to 12 500 and 50 000 in 2019 20 and 2020 21 and have been. If you need the tax rates for next year click the link to get the current 2020 21 uk income tax rates. Allowances 2020 to 2021 2019 to 2020 2018 to 2019 2017 to 2018. Savings rates starting rate at 0 on savings income up to.

We ll also explain how these changes will affect your tax bill. However welsh residents continue to pay the same overall tax rates as taxpayers resident in england and northern ireland. How are income tax rates changing in 2019 20. The details set out below should be taken only as a general guide.

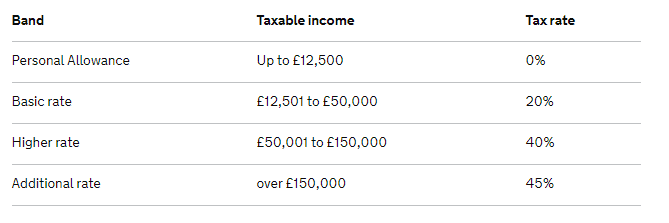

Reduced by 1 for every 1 of income above personal allowance 5 000. For the tax year 2019 20 this is 40 000. Band taxable income tax rate. Uk paye tax rates and allowances 2019 20 this article was published on 02 11 2018 this page contains all of the personal income tax changes which were announced at the october 29th 2018 budget.

These rates come into effect at the start of the new tax year on april 6th 2019. The figures for these measures are set out in table 2 1 of budget 2018 as personal allowance and higher rate threshold. Savings above the annual allowance will be subject to tax charges.