Net Operating Income Yield Formula

Apple sheet pdf explanation.

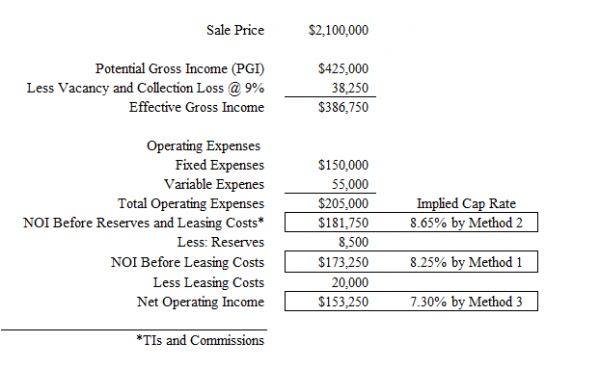

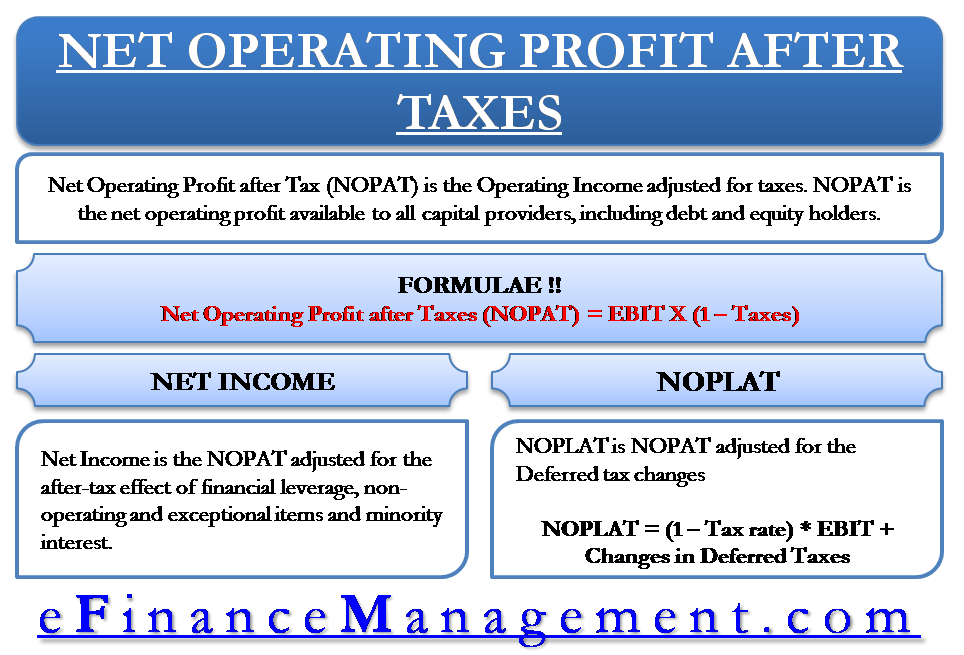

Net operating income yield formula. Stabilized noi pgi vlc oi oe where pgi is potential gross income vlc is vacancy and loss collection oi is other. The nopat formula is calculated by multiplying a company s operating income by 1 minus the corporate tax rate. Nopat operating profit x 1 tax rate if a detailed income statement isn t available and you can t figure out the operating in come of the company you can always calculate the net operating profit after tax equation using. An income of 27 360 minus costs of 23 521 equals 3 839 cash return over cash out and 3 839 divided by a cash investment of 60 000 equals a cash on cash rental yield of 6 4 percent.

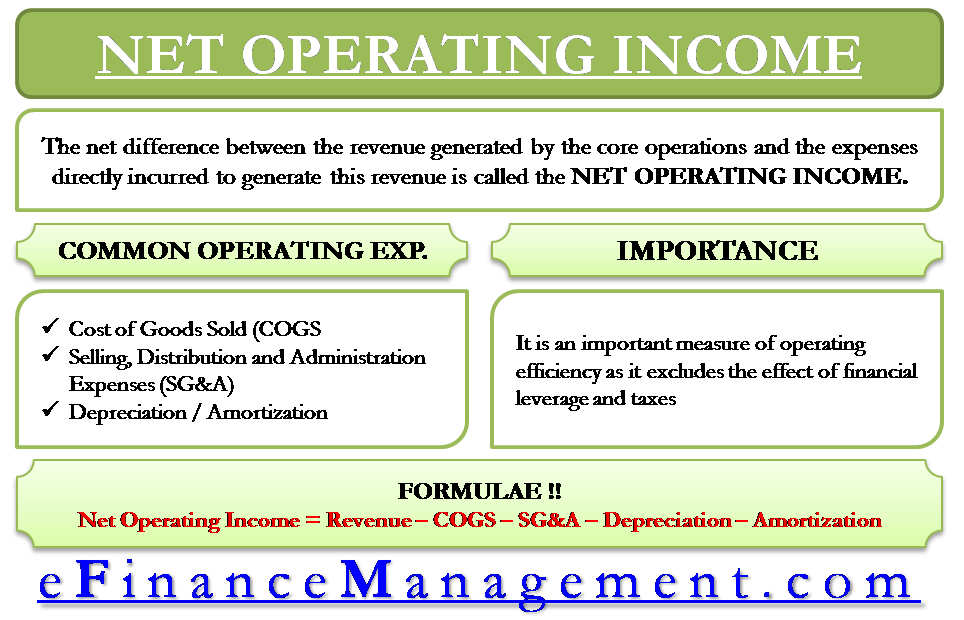

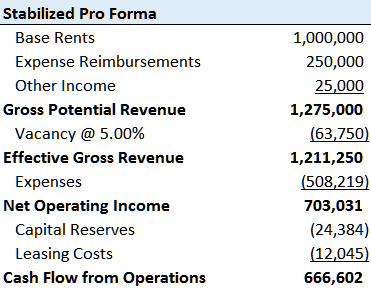

Firstly determine the total revenue of the company which is the first line item in the income statement otherwise the total revenue can also be computed by multiplying the total number of units sold during a specific period of time and the average selling price per unit. The operating expenses used in the noi metric can be manipulated if a. Net operating income measures an income producing property s profitability before adding in any costs from financing or taxes. In other words it measures the amount of cash flows that a property has after all necessary expenses have been paid.

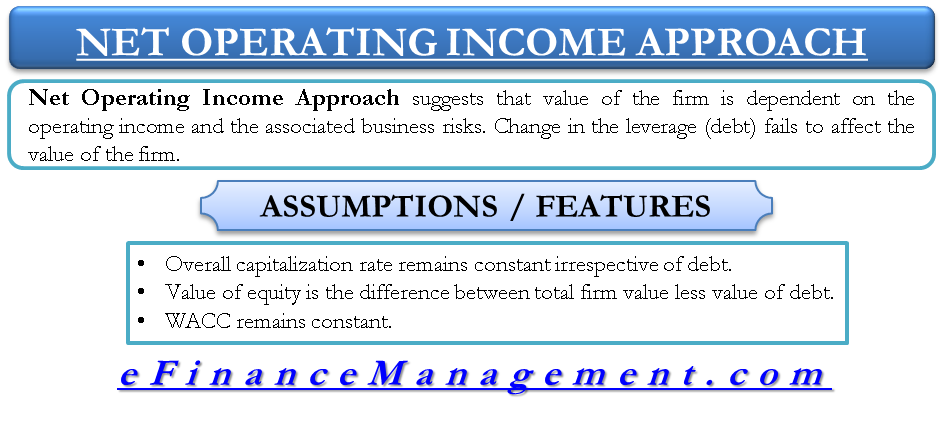

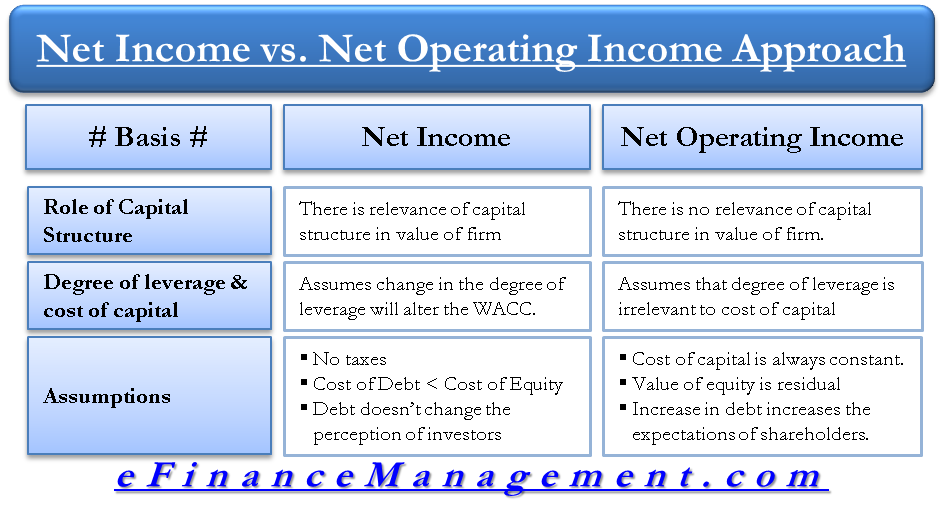

Net operating income or noi is a formula used to determine the potential income generated by a commercial property. Dividends per share stock price x 100 coupon bond price x 100 net rental income real estate value x 100 also called cap rate capitalization rate the capitalization rate cap rate is used in real estate refers to the rate of return on a property based on the net operating income of the property. The formula for arriving at stabilized net operating income noi is. It assumes that the benefit that a firm derives by infusion of debt is negated by the simultaneous increase in the required rate of return by the equity shareholders with an increase in debt the risk associated with the firm mainly.

Investors also use noi to determine the overall yield or return of an. In this example the costs include 5500 of ongoing costs and 6500 for one month unrented. Net yield weekly rental x 52 costs property value x 100. Net operating income approach to capital structure believes that the value of a firm is not affected by the change of debt component in the capital structure.

:max_bytes(150000):strip_icc()/market-value-69e5d658792841c3baabe0d0d23c2dcc.jpg)

.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/NetProfitMargin2-edf5ae45cbe048208913caa9d3b03110.png)