Usda Income Worksheet Attachment A

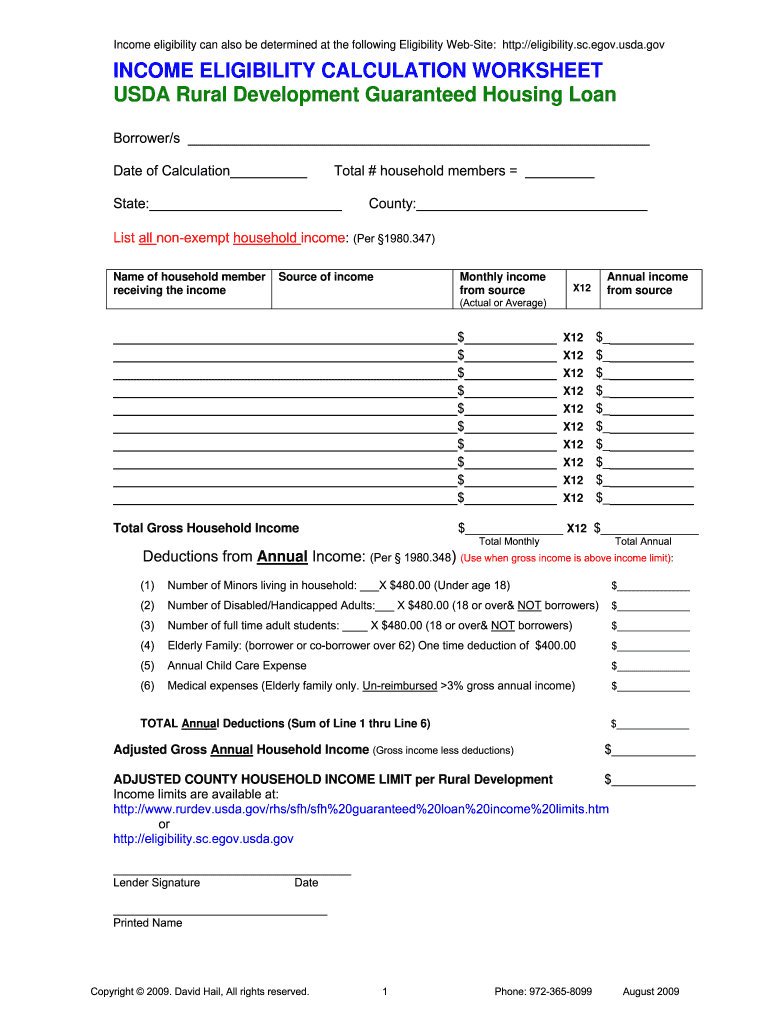

Completing the information below will ensure accurate information is provided to usda to determine borrower eligibility.

Usda income worksheet attachment a. Food yes no food stamps wic food bank cash contributions yes no in kind donations yes no other yes no shelter costs. A public website is available to assist in the calculation of annual and adjusted annual income online at. 0 0 0 0. Dependent deduction 480 for each child under age 18 or full time student attendi ng school or disabled family member over the age of 18 x 480 8.

Annual child care expenses reasonable expenses for children 12 and under. Attachment 9 c provides a case study to illustrate how to properly complete the income worksheet. This site is used to evaluate the likelihood that a potential applicant would be eligible for program assistance. Adjusted income calculation consider qualifying deductions as described in 1980 348 of rd instruction 1980 d 7.

Documentation required of a lender s permanent file by income type. In order to be eligible for many usda loans household income must meet certain guidelines. Attachment 9 c provides a case study to illustrate how to properly complete the income worksheet. E e amount.

Yes no cash contributions yes no. A public website is available to assist in the calculation of annual and adjusted annual income online at. Attachment 9 a of this chapter provides a sample worksheet to help lenders with these calculations and attachment 9 b of this chapter provides a case study illustrating the key principles outlined in this section. The low income limit is established at approximately 80 percent of the median income for the area adjusted for household size.

Welcome to the usda income and property eligibility site. Attachment 9 b of this chapter includes an income worksheet for lenders to document these calculations. A public website is available to assist in the calculation of. C payment source d exempt if no col.

Attachment 9 b of this chapter includes an income worksheet for lenders to document these calculations. A worksheet has been provided on page 2 to ensure all allowable deductions are applied prior to entering the information in the usda website at. And the moderate income limit is established by adding 5 500 to the low income limit for each household size. 1 5 year history mo2 flp guide 20 this worksheet does not have to be completed but the page 2 history comparison in the table f k worksheet will be unavailable.

Zero income verification checklist a expense b recurring expense. The borrower has the right to determine a minimum income level for households of.