Fixed Income Yield Curve

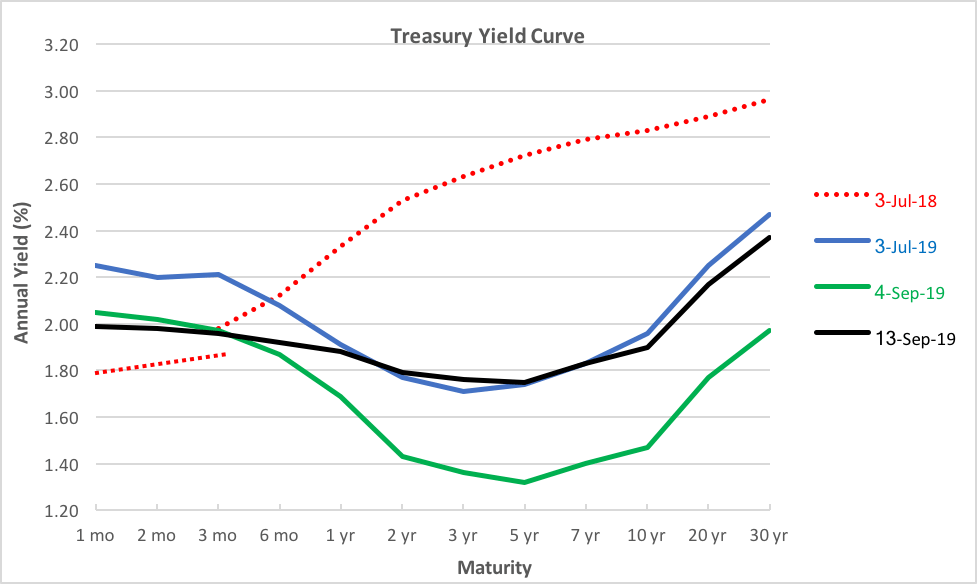

Global government bonds have performed strongly since the beginning of the year.

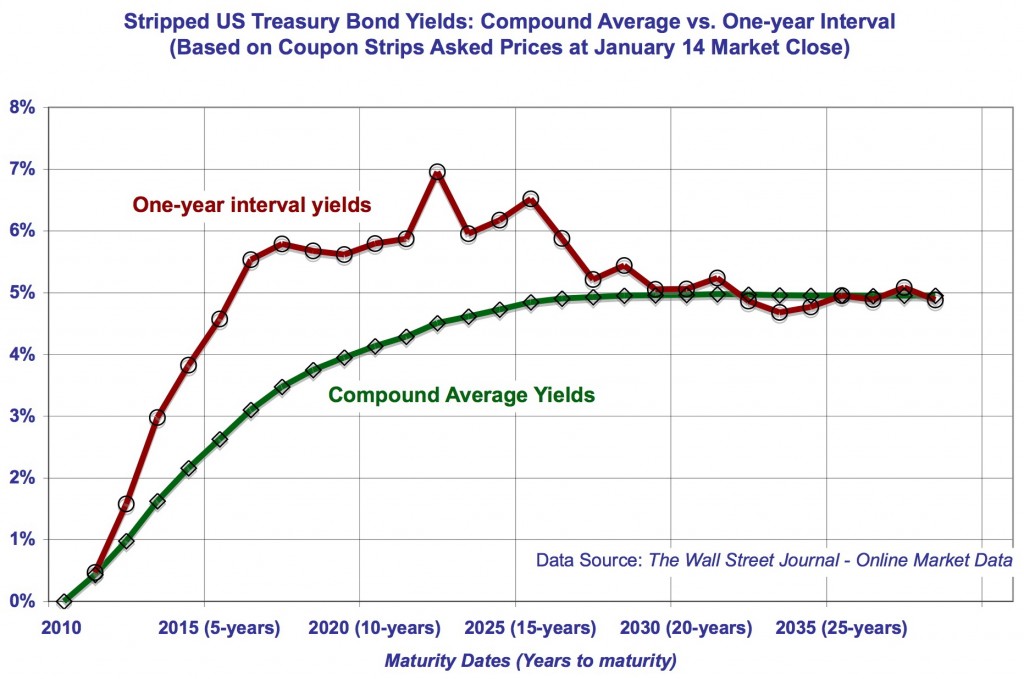

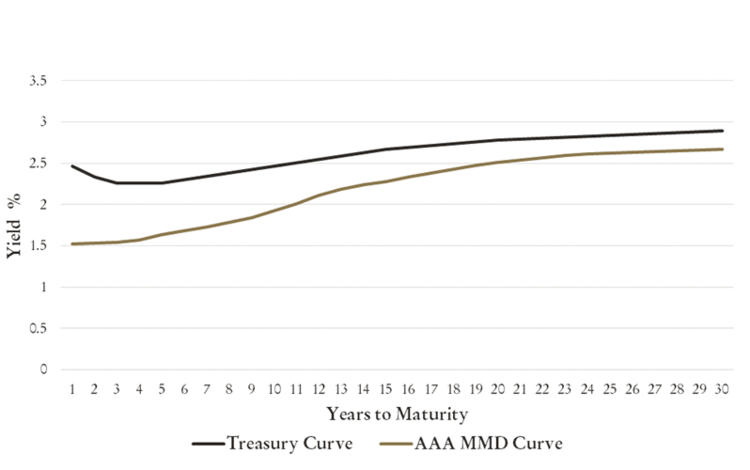

Fixed income yield curve. 15 433 financial markets fixed income yield curve macroeconomics and the yield curve the impact of monetary policy on the short end of the yield curve is direct. A relatively rare type of yield curve that results when the interest rates on medium term fixed income securities are higher than the rates of both long and short term. Fixed income attribution is the process of measuring returns generated by various sources of risk in a fixed income portfolio particularly when multiple sources of return are active at the same time. Further downgrades to global economic growth forecasts brexit uncertainty and concerns over a trade tariff escalation have lured investors to the safety of government bonds.

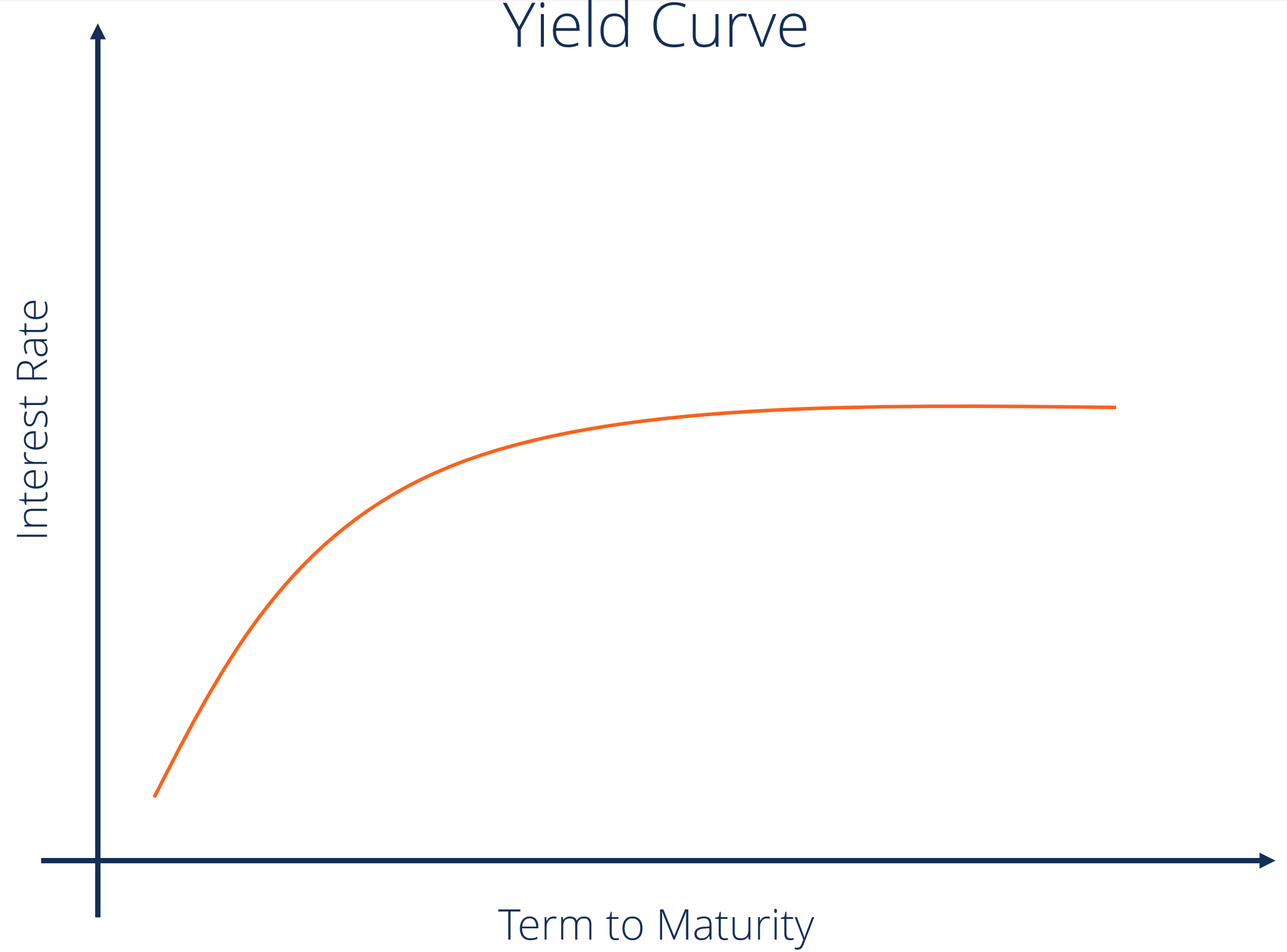

What is the yield curve telling us. It s a graphical representation of the yields available for bonds of equal credit quality and different maturity dates. The yield elbow is the peak of the yield curve signifying where the highest. For example the risks affecting the return of a bond portfolio include the overall level of the yield curve the slope of the yield curve and the credit spreads of the bonds in the portfolio.

Every six weeks the federal open market committee fomc meets to decide on the fed funds rate whether to cut keep or increase. The point on the yield curve indicating the year in which the economy s highest interest rates occur. The yield curve risk is the risk of experiencing an adverse shift in market interest rates associated with investing in a fixed income instrument. When market yields change this will impact the.

This site is a database of research articles presentations and applications software published by us during the period december 2000 december 2006. Fixed income securities have several unique attributes and factors that analyst may use the yield curve as a leading economic indicator economic indicators an economic indicator is a metric used to assess measure and. A yield curve is a way to measure bond investors feelings about risk and can have a tremendous impact on the returns you receive on your investments. A yield curve is a way to easily visualize this difference.

A fixed income fixed income trading fixed income trading involves investing in bonds or other debt security instruments.

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)