Ohio Nonresident Income Tax Filing Requirements

5747 05 a or b respectively that eliminates most or all ohio individual income tax.

Ohio nonresident income tax filing requirements. The filing requirement applies even if an individual is allowed a nonresident or resident credit under r c. Every full year resident part year resident and full year nonresident must file an ohio tax return if they have income from ohio sources. You do not have to pay taxes on the interest income to that state if you maintain a bank account in a state where you don t live and it earns interest. Ohio return on behalf of its nonresident owners.

You do not have to file an ohio income tax return if. 5747 01 i defines a resident of ohio for purposes of the ohio income. 8 is a pte subject to filing the ohio it 1140 if all nonresident individual investors file it 1040 individual income tax returns. A full year nonresident living in a indiana kentucky west virginia michigan or pennsylvania does not have to file if the nonresident s only ohio sourced income is wages.

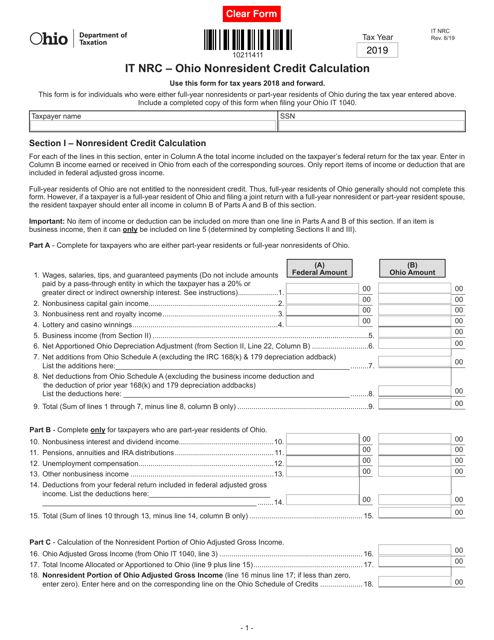

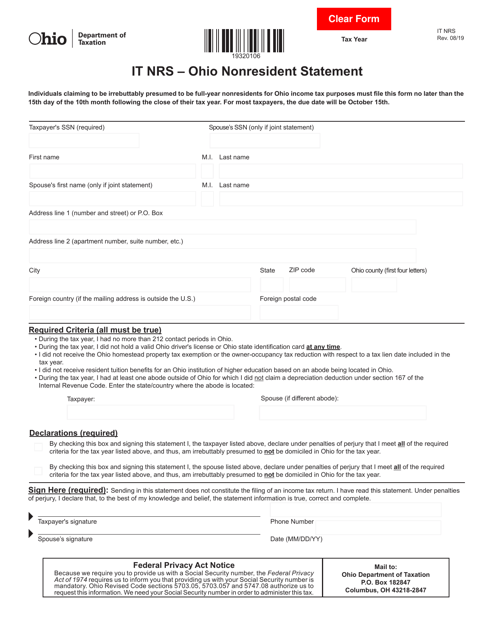

Nonresident taxpayers who are eligible to file form it nrs may now make their statement using the it 1040 in place of filing the it nrs. Examples of ohio sourced income include the following. Every ohio resident and every part year resident is subject to the ohio income tax. Nonresidents of ohio only.

Into calculating oh taxes. Carrying on a business trade profession or occupation in a state. Your ohio adjusted gross income line 3 is less than or equal to 0. Wages or other compensation earned in ohio see exception below.

You d have to file a non resident return if you worked as a consultant or contractor in another state. Who is a resident. I am resident of tx. For more information see pages 12 and 48 of the 2019 individual income tax instructions as well as the faq category income ohio residency and form it nrc.

When turbo tax premier fills out my oh state return it uses my federal joint filing status and all my income including my spouses who has no income from oh interest and dividends etc. Who must file an ohio income tax return. Thus an ohio resident pays ohio individual income tax on all of his or her compensation distributive share of income from pass through entities interest dividends capital gains rents royalties etc. Every nonresident having ohio sourced income must also file.

According to ohio instructions for form it 1040 every ohio resident and part year resident is subject to the ohio income tax.