Income Tax Rates For Trusts And Estates 2018

New tax brackets for trusts and estates.

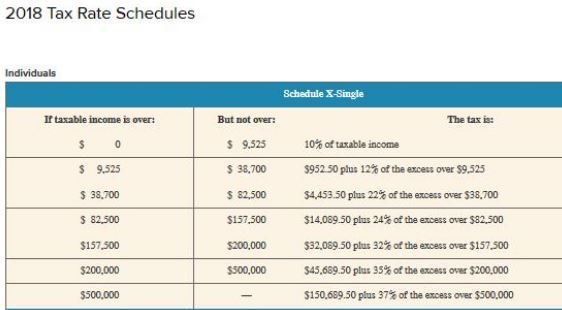

Income tax rates for trusts and estates 2018. Unless revised by future legislation the rates and brackets will revert back to 2017 levels after 2025. Income may become remittable if for example exchange controls are lifted. 2018 federal income tax rates. Estate and trusts not liable to pay tax at the trust rate tfn15.

For 2018 2019 taxable income attributable to net unearned income is taxed according to the brackets applicable for trusts and estates. Posted on january 6th 2018. Taxpayers can elect to apply the change to 2018 and 2019. Inflation adjustments will be made to these amounts for 2019 2025 based on chained cpi.

The tax rates which are shown below are to be used for taxable years beginning after december 31 2018 and through 2025. For 2020 this income is taxed at the parent s marginal tax rate. A comparison of. Treated as arising in the 2017 to 2018 tax year.

However new tax rates in place for 2018 will lower the tax rate on income over 12 500 to 37 down from 39 6 the year prior. Tax rates and income levels for trusts and estates remain virtually unchanged for irs filings for 2017. You shouldn t include this income in the trust and estate tax return. Rate reduction and thresholds.

Trust tax rates the united states tax rates and brackets for trusts and estates continue to change. These tax tables are designed for trusts and estates filing a 2018 income tax return. By joel roettger apr 17 2018 estate planning tax trusts. The law provides for tax years 2018 through 2025 a new table under sec.

1 j 2 e of ordinary income tax rates and thresholds for trusts and estates subject to adjustment for inflation for years after 2018 as shown in the chart below. A table showing the 2018 federal marginal income tax rates for estates and trusts under the tax cuts and jobs act. Below are the new tax brackets and tax rates for individuals estates and trusts for 2018 under the new tax reform that are reflected in the tax jobs and cuts act. The brackets 10 percent 24 percent 35 percent and 37 percent are still extremely compressed with the top rate applying at 12 500 of taxable income.