Federal Income Tax Withholding Tables For Employers 2020

These tables and the employer instructions on how to figure employee withholding are now included in pub.

Federal income tax withholding tables for employers 2020. From 2020 and beyond the internal revenue service will not release federal withholding tables publication 15. Federal employee withholding tables 2020 it is important to recognize how employment tax rates are measured and restored each year if you are a company. The income tax withholding assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees wages. Categories federal withholding tables tags federal income tax withholding tables for employers 2020 leave a comment 2020 federal withholding tables for employers october 17 2020 october 12 2020 by bismillah.

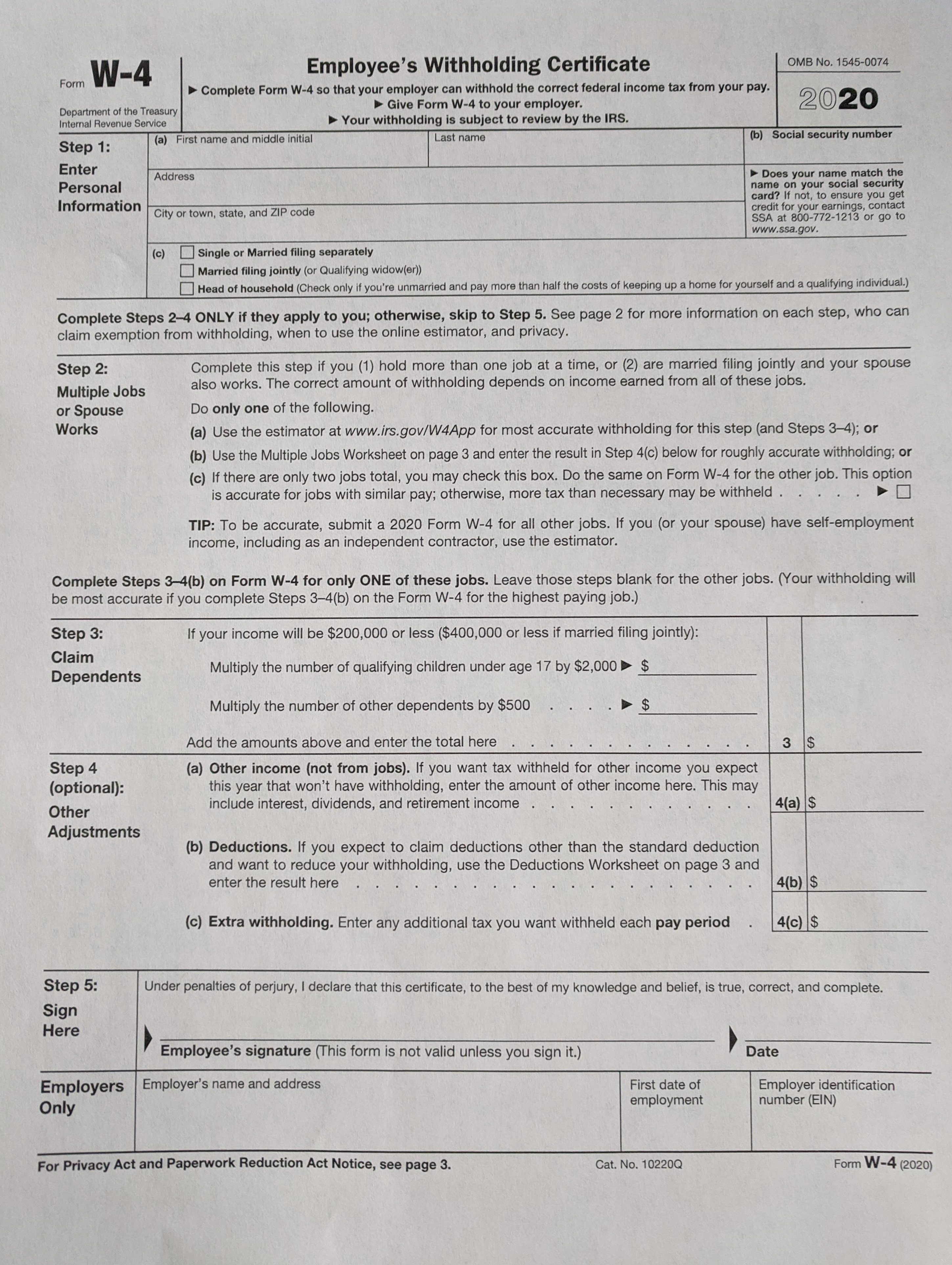

The tax cuts and jobs act of 2017 brought changes in tax rates and brackets an increase in the standard deduction the elimination of personal exemptions and a new w 4 form. For those of you that haven t recognized enough with the means withholding taxes are done on this year of 2020 you might discover it from federal tax. The internal revenue service released the federal withholding tables to help employers figure out how much tax to withhold from the employer s paycheck. You may also use the income tax withholding assistant for employers at irs gov itwa to help you figure federal income tax withholding.

Publication 15 t is a supplement document for publication 15 of guide for employer s tax and agricultural employer s tax. The quantity of federal withholding tax is changed each year based on the usa tax code and has actually been so given that the 1980s. You might check the withholding tax in 2020 on the following tables. It will help you as you transition to the new form w 4 for 2020.

2020 income tax withholding tables. Federal tax withholding tables 2020 employer federal tax withholding tables 2020. The irs publication 15 includes the tax withholding tables. Redesigned form w 4 for 2020.

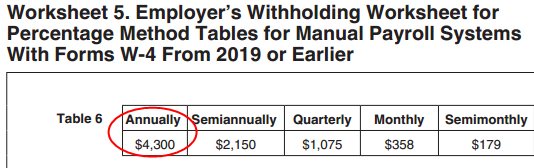

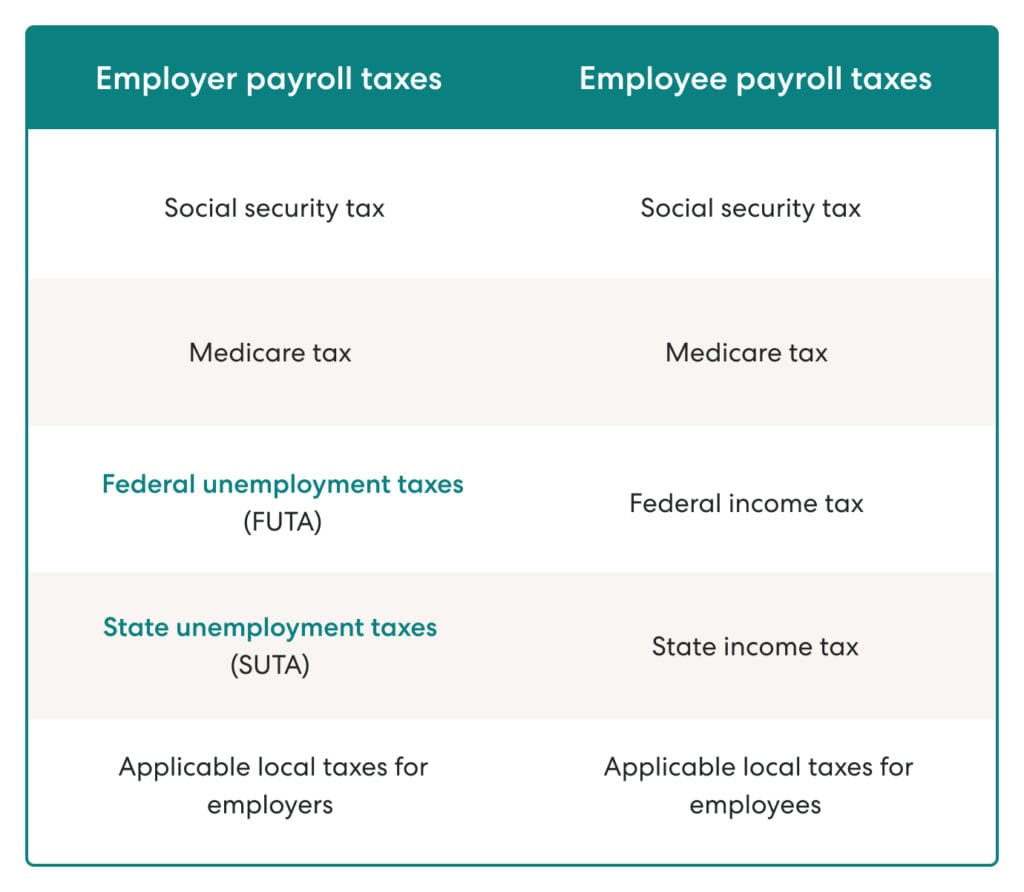

The rates affect how much employee salaries or wages that you need to withhold. If the nonresident alien employee has submitted a form w 4 for 2020 or later or was first paid wages in 2020 or later add the amount shown in table 2 to their wages for calculating federal income tax withholding. 15 t federal income tax withholding methods. The rates impact just how much staff member incomes or wages that you require to keep.

For those of you that haven t been familiar sufficient with the way withholding taxes are done on this year of 2020 you may discover it from federal.