Income Tax Rate 2020 Sri Lanka

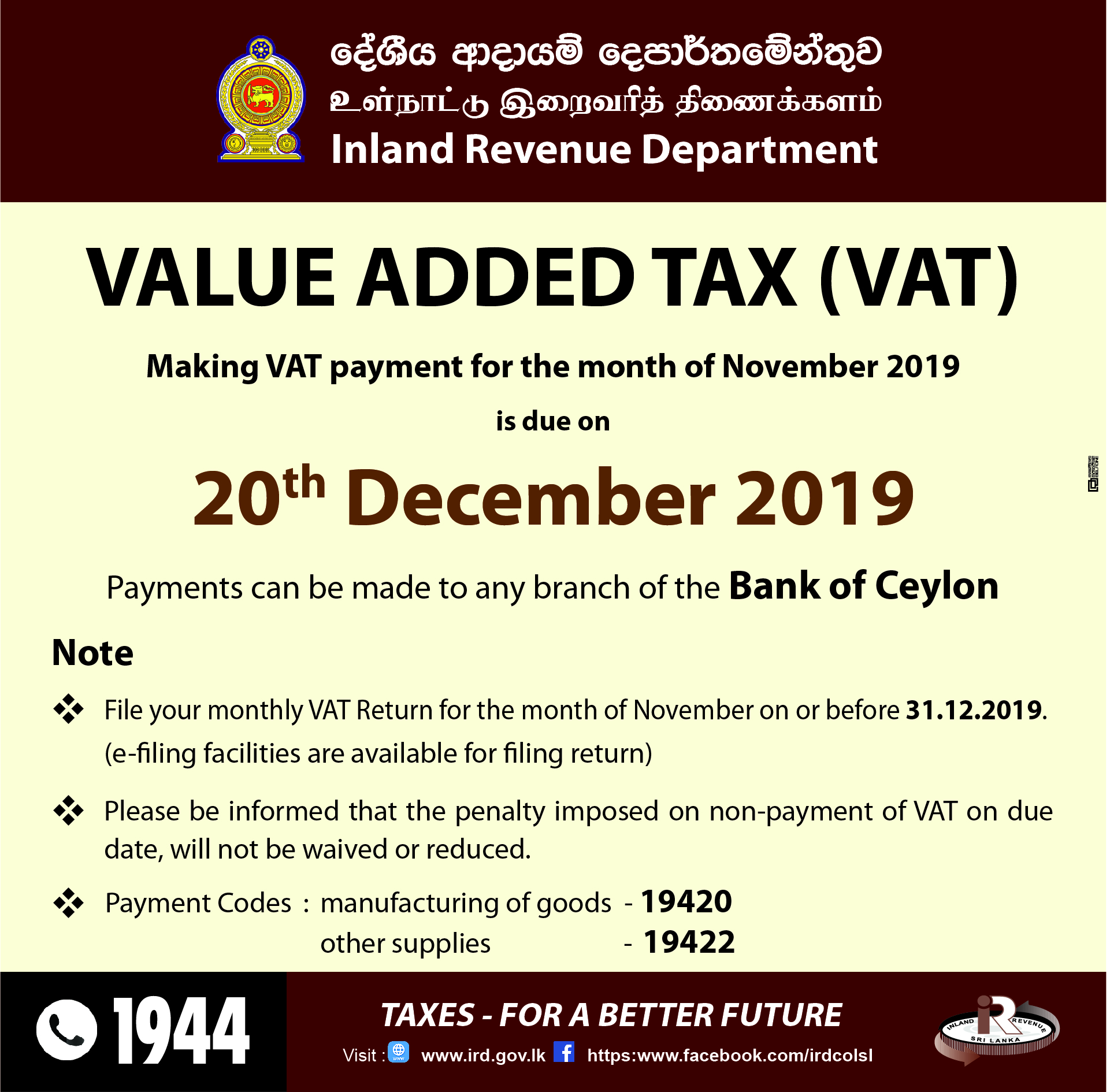

Paye wht on interest dividends rent and service payments to residents is abolished with effect from 1 january 2020.

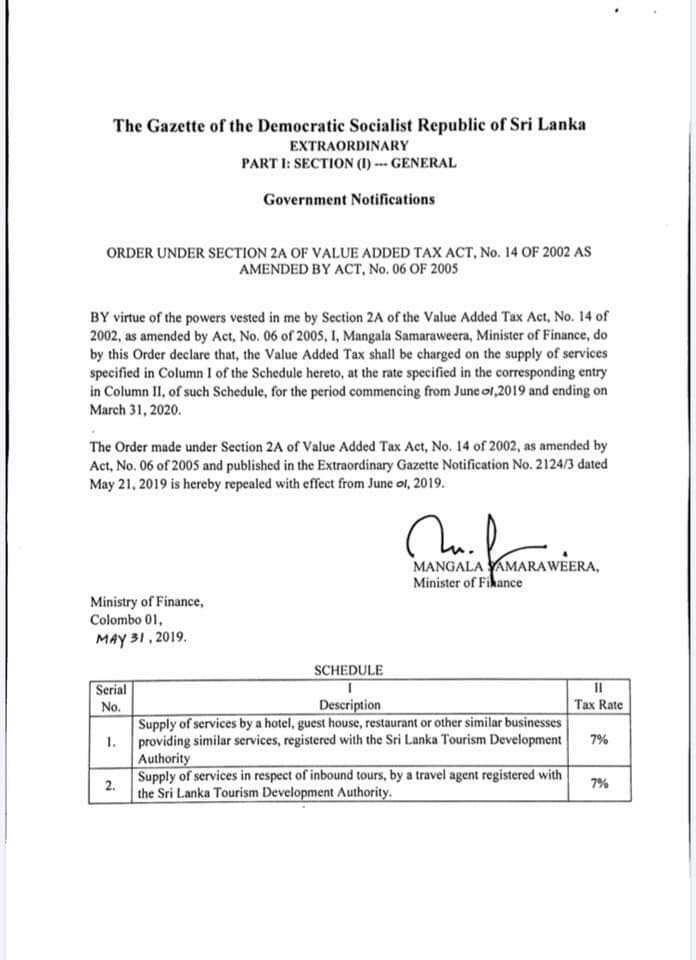

Income tax rate 2020 sri lanka. Government of sri lanka will be considered as a tax deductible expenditure. Following this change you may now be required to file income tax return. Tax relief measures covid 19 the department of inland revenue in april 2020 issued a release reflecting tax amendments to the new inland revenue act 24 of 2017. Personal income tax rate in sri lanka averaged 26 81 percent from 2004 until 2019 reaching an all time high of 35 percent in 2007 and a record low of 15 percent in 2016.

The contributions are to be made to a special account opened in the bank of ceylon. The personal income tax rate in sri lanka stands at 24 percent. Data published yearly by revenue department. Tax relief measures covid 19 sri lanka.

The maximum rate was 35 and minimum was 15. Personal income tax rate in sri lanka remained unchanged at 24 in 2019. 01 january 2020 income tax rates on taxable income of a company 24 on gains and profits from following specific businesses1 14 i. Small and medium.

Click and know the answers to the frequently asked questions and better understand the change in the regulation. Tax rates for resident and non resident individuals personal relief for residents non resident citizens of sri lanka is rs. 500 000 not available for gains from the realization of investment asset.