Zakat Fitrah Income Tax

Zakat fitrah zakat in income tax filing how we disburse 8 groups of beneficiaries asnaf assistance for the poor needy religious programmes madrasah asatizah development islamic youth education faqs payment.

Zakat fitrah income tax. There are two types of tax rebate applicable for year of assessment 2019. Value added tax or vat is an indirect tax imposed on all goods and services that are bought and sold by businesses with a few exceptions. Referred to as the had kifayah minimum needs for an individual or family it again varies from state to state as it is determined by each state s islamic religious council. Zakat as an income expense zakat contributions are not eligible for 2 5 times tax deduction.

Zakat fitrah paid don t miss out on maximising your income tax refund 2020 now that you know about all the income tax reliefs rebates and deductions that are available for malaysia personal income tax 2020. Just like you have tax reliefs and rebates when paying income tax the zakat system also has its own reliefs that allow the payer to make deductions from the amount they have to pay. Calculate zakat fitrah 8 asnaf 4 projects assistance for the poor needy religious programmes madrasah asatizah development islamic youth education faqs zakat in income tax filing payment zakat modes of axs. M 1 に基づき発布された2004 年7 月30 日付け発効の 所得税法施行規則 guidelines for the new income tax regulations.

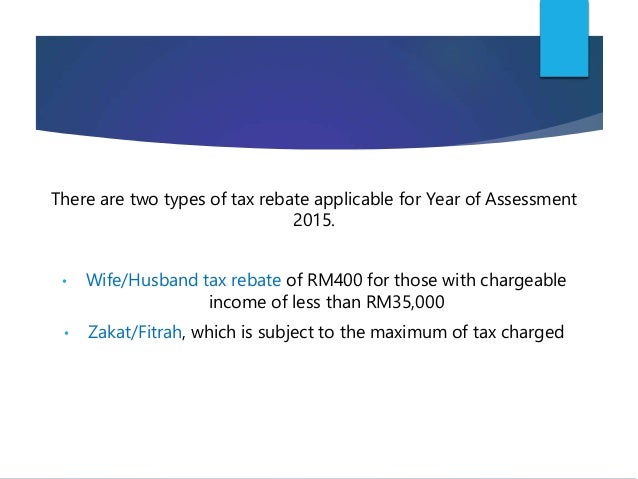

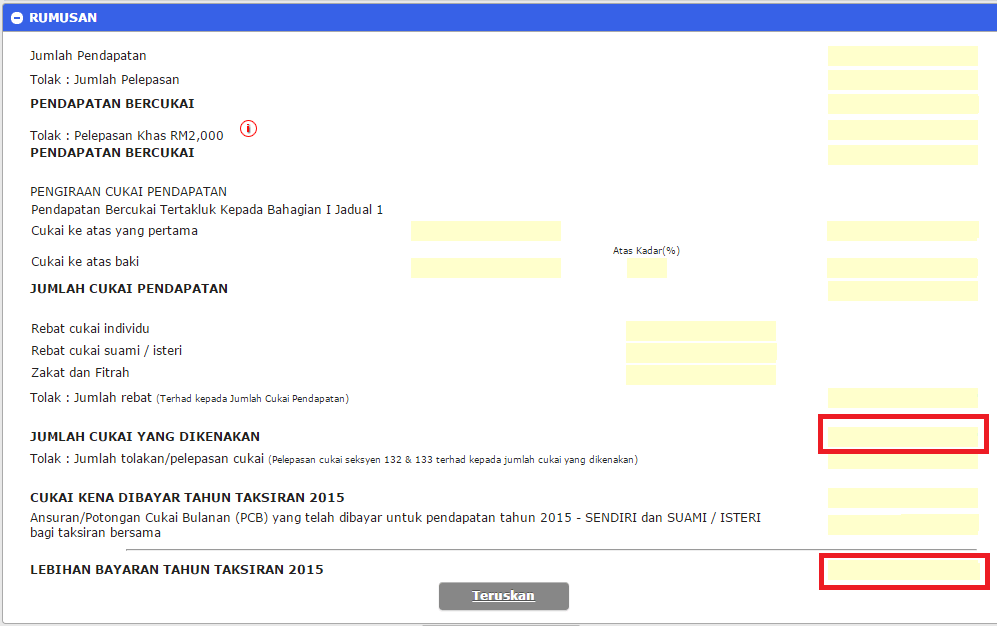

It does not qualify for 2 5 times tax deduction for the applicable period. According to iras zakat is treated as an expense under section 14 of the income tax act and this is set off against the employment income of that individual. Wife husband tax rebate of rm400 for those with chargeable income of less than rm35 000 zakat fitrah which is subject to the maximum of tax charged a compulsory payment for charity. Vat is applied in more than 160 countries around the world as a reliable source of.