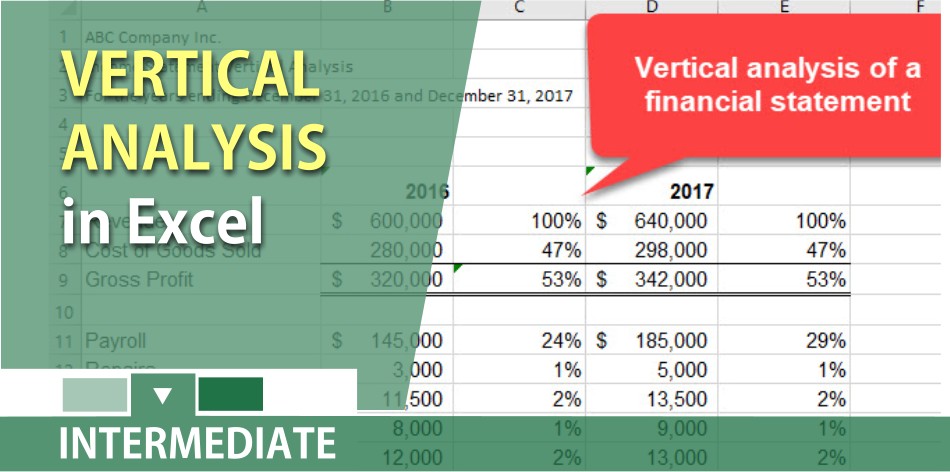

Common Size Income Statement Excel Formula

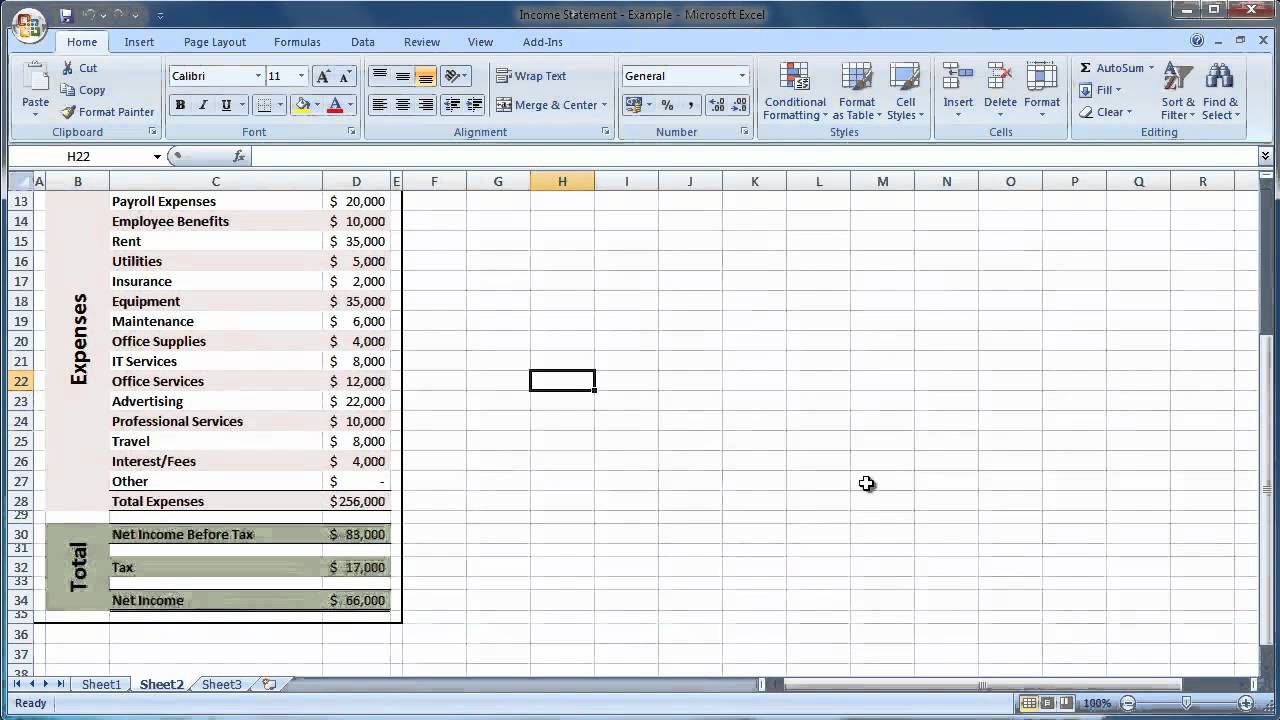

Besides the profit and loss page you also get a comparative balance sheet additional ratio and simple ratio.

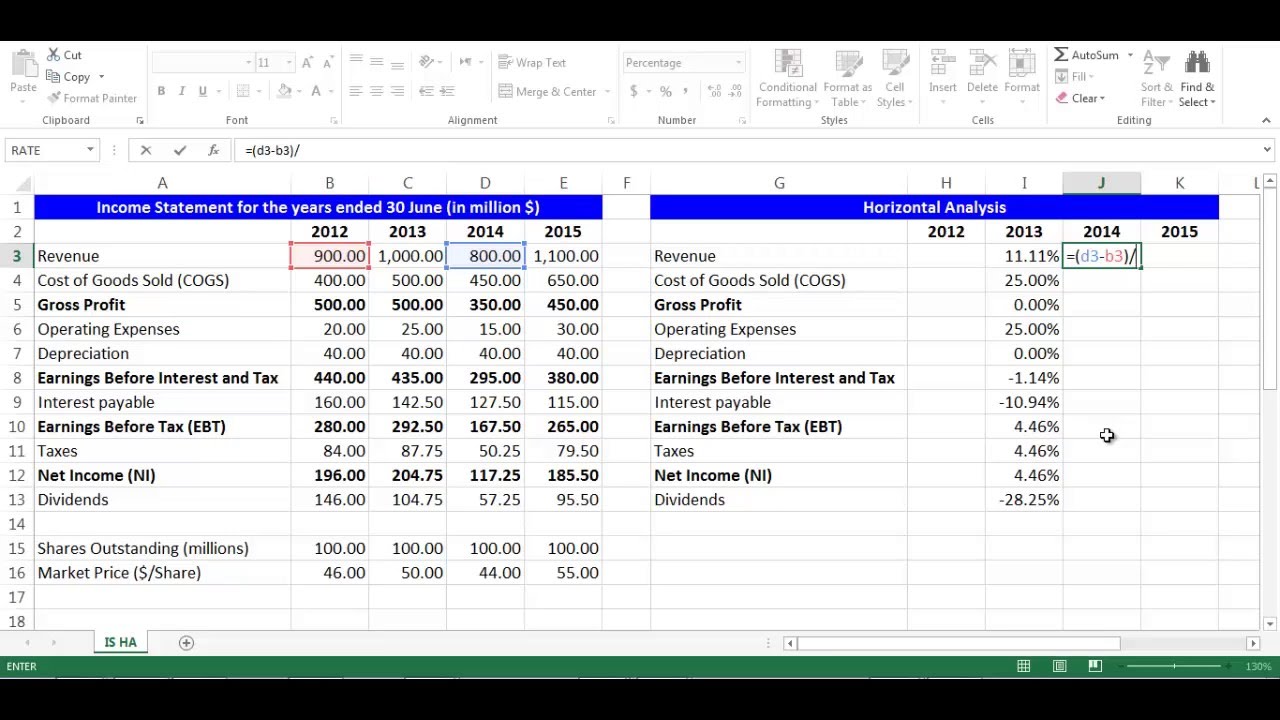

Common size income statement excel formula. The formula to calculate the growth rate is. Formula for common size analysis. It is presented in terms of percentage. It would be good to know how much the sales figure has changed.

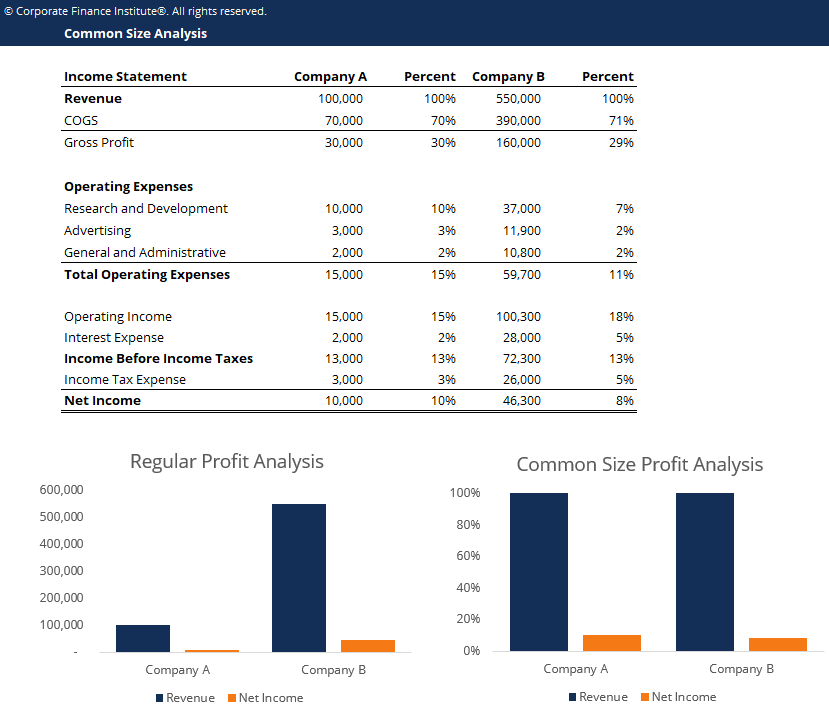

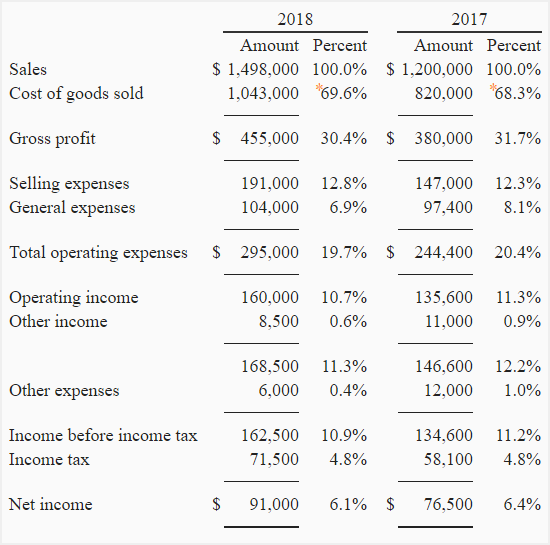

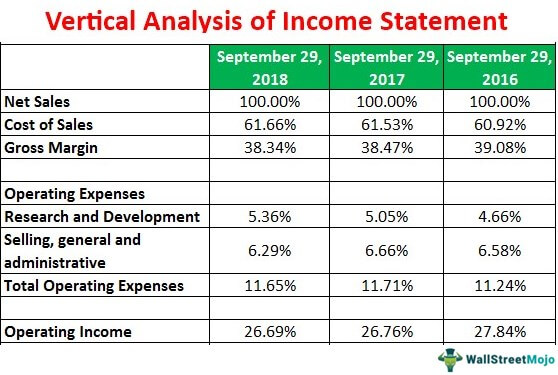

These three core statements are intricately. Common size financial statement analysis is computed using the following formula. The gross profit margin of colgate has always remained above 50 in all these years. By looking at the income statement you can see that sales changed by 110 000 from 1 000 000 to 1 110 000.

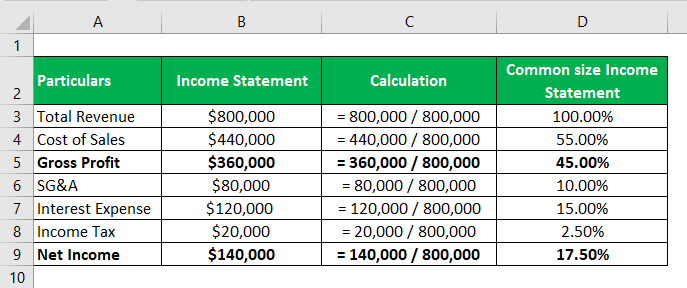

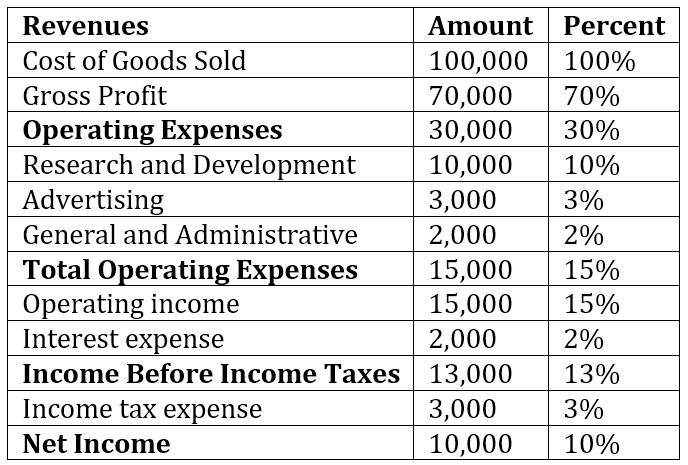

In the balance sheet the common base item to which other line items are expressed is total assets while in the income statement it is total revenues. The common size income statement is a four section template that you can rely on for an accurate financial analysis. The below table provides a brief illustration. Net income decreased substantially to less than 10.

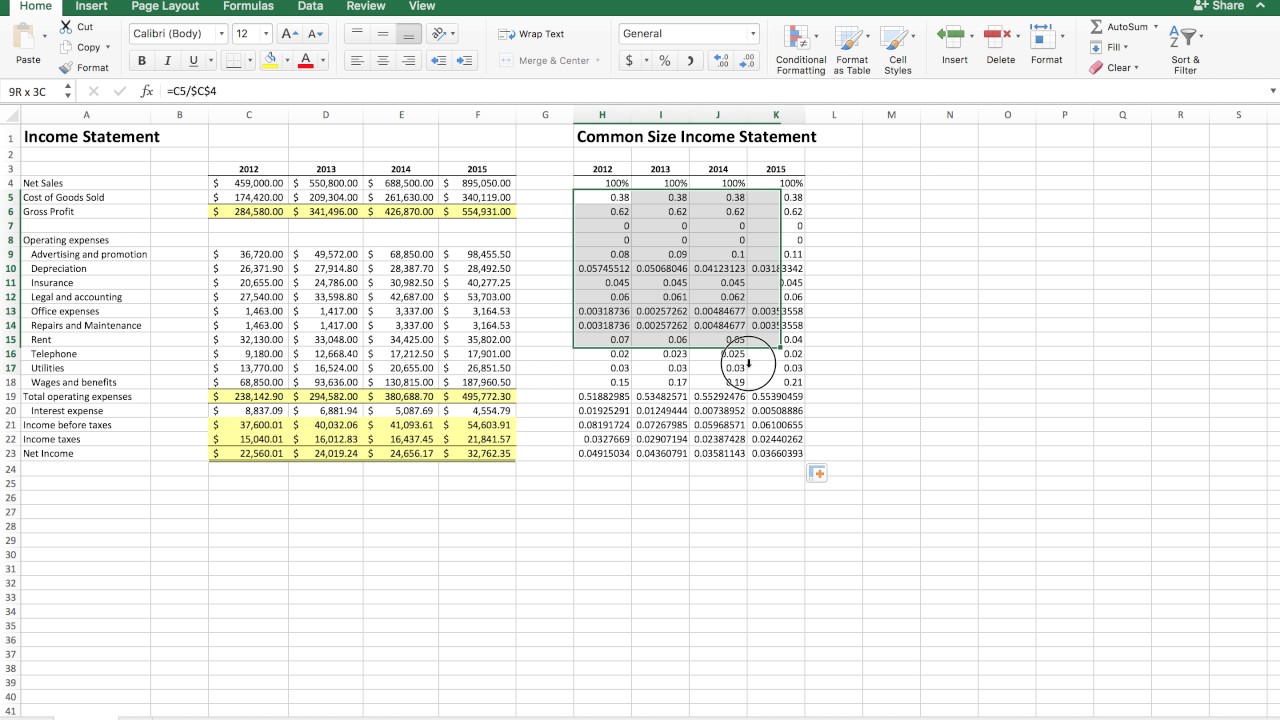

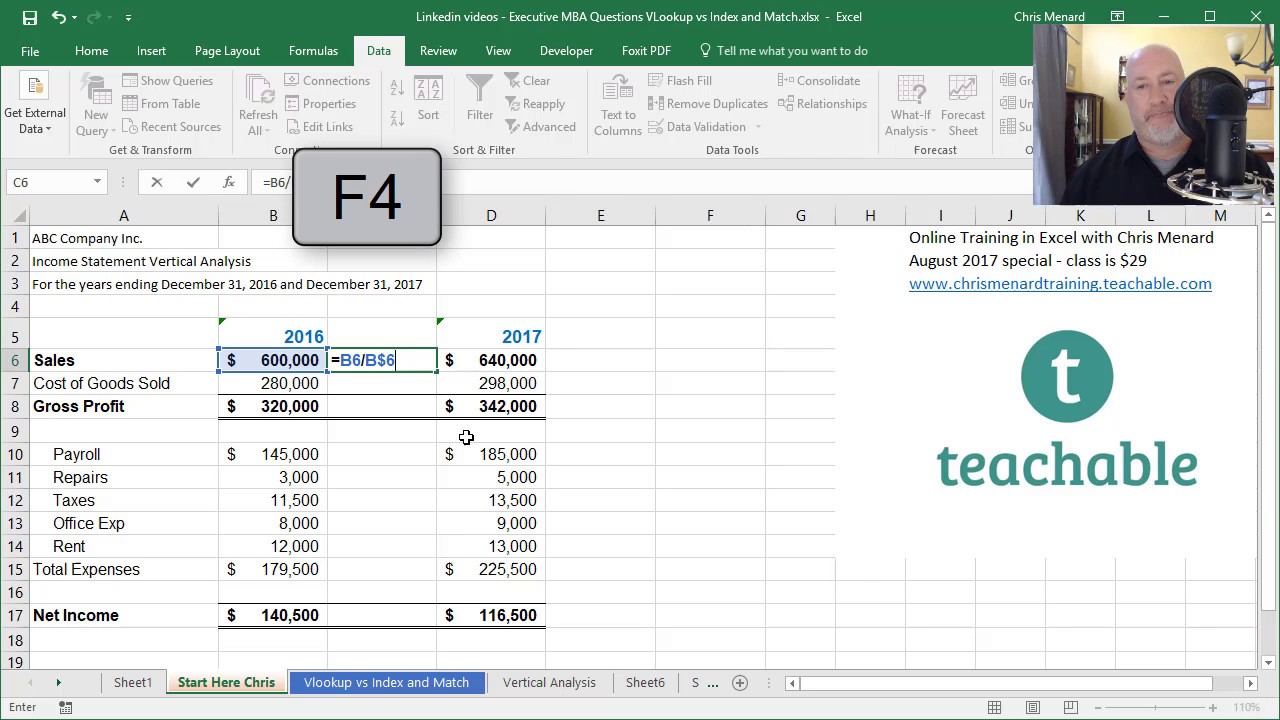

Operating income dropped significantly in 2015. There is no such formula for deriving a common size income statement rather it is a method wherein a separate column is created and all the line items in the income statement are divided by the total sales and placed in the corresponding adjacent separate cell. In microsoft excel common size financial statements compare cells against the balance total to determine what percent those figures have increased or decreased. Excel creates a new blank column.

Advantages of common size income statement. Types of common size analysis. Effective tax rates increased to 44 in 2015 as compared to an average of 32 33 in earlier years. Common size income statement excel template.

A common size income statement is an income statement in which each line item is expressed as a percentage of the value of sales to make analysis easier. Since we are doing a common size analysis we want the growth rate in sales stated as a percentage. Detail screenshot of the excel template with formula common size of colgate s balance sheet cash and cash equivalents as a percentage of total assets increased substantially from 5 6 in 2008 to 8 1 in 2014.

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)