Income Tax Rate 2020 Luxembourg

Personal income tax rate in luxembourg averaged 43 43 percent from 1995 until 2020 reaching an all time high of 51 30 percent in 1996 and a record low of 39 percent in 2002.

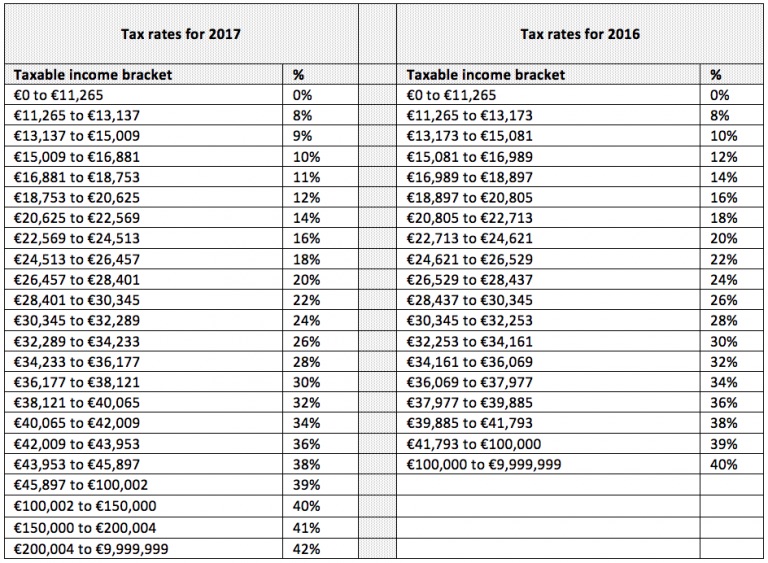

Income tax rate 2020 luxembourg. Income tax rates in luxembourg. Income tax in luxembourg is charged on a progressive scale with 23 brackets which range from 0 to 42. Individual income tax is levied on the worldwide income of individuals residing in luxembourg as well as on luxembourg source income of non residents. The number of days worked in luxembourg.

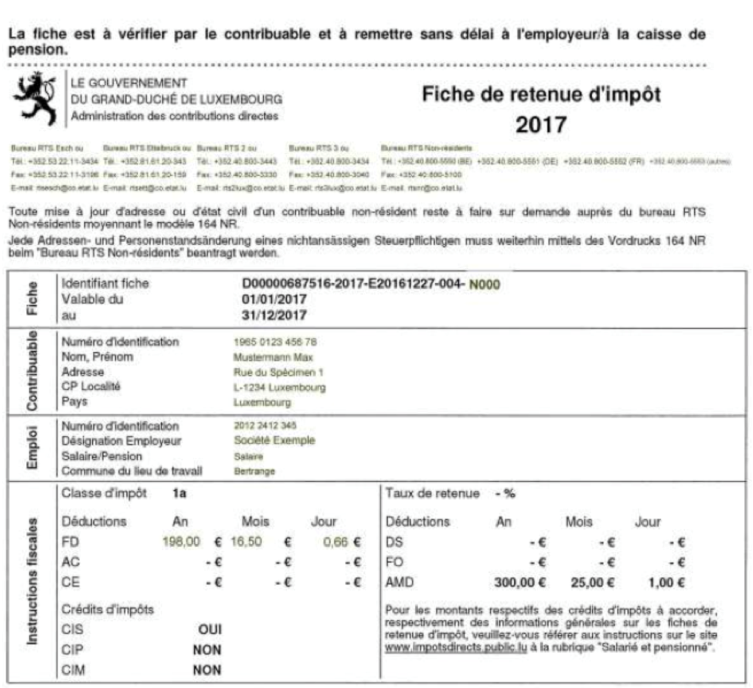

Corporate tax rates. How am i taxable as a non resident taxpayer. 31 december 2021 deadline for filing the simplified request for the 2020 tax year withholding tax adjustment 31 march 2021 deadline for filing tax returns for the 2020 tax year 1. Luxembourg income tax liability is based on the individual s personal situation e g.

September 4 2020 guide to supermarkets and grocery. Review the 2020 luxembourg income tax rates and thresholds to allow calculation of salary after tax in 2020 when factoring in health insurance contributions pension contributions and other salary taxes in luxembourg. Personal income tax rates. Eur26 250 plus 31 for income above eur175 000 and below eur200.

With this in mind we have created a brochure to guide you through the taxation of individuals for the new tax year 2020. Icalculator lu excellent free online calculators for personal and business use. The cit rate of 17 for income over eur200 000. As from 2019 the general combined cit rate for luxembourg tax resident companies is 24 94.

Xavier martinez partner tel. Luxembourg personal income tax rate was 48 78 in 2020. An additional 300 nonwastable tax credit is available. The personal income tax rate in luxembourg stands at 45 78 percent.

What are the basic principles of income taxation in luxembourg. This page provides luxembourg personal income tax rate actual values historical data forecast chart statistics economic calendar and news. 352 621 87 5345 xavier martinez kpmg lu. Luxembourg income tax guide 2020.

For this purpose individuals are granted a tax class. Luxembourg income tax allowance luxembourg provides most taxpayers with an income tax allowance of 1 416 which can be kept as a tax free personal allowance. Luxembourg s tax credit is a basic fixed allowance available to all single taxpayers without dependents. September 17 2020 top 10 must have apps in luxembourg.

Find answers to these questions and many more in the new 2020 issue of our luxembourg income tax guide. 1whether a fixed tax rate has been applied through payroll. Workers must also pay between 7 and 9 as an additional contribution to the employment fund. For corporate income below that threshold the applicable cit rate is as follows.