Create Income Statement Closing Journal

Oracle general ledger description.

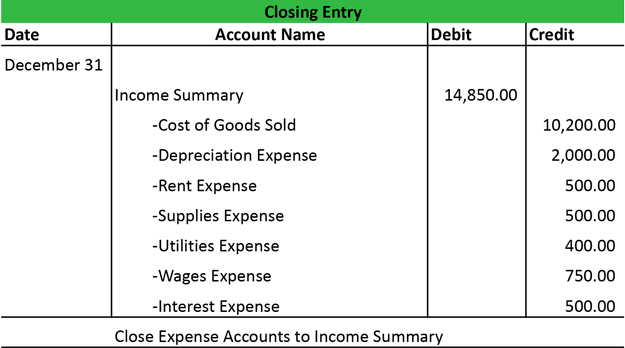

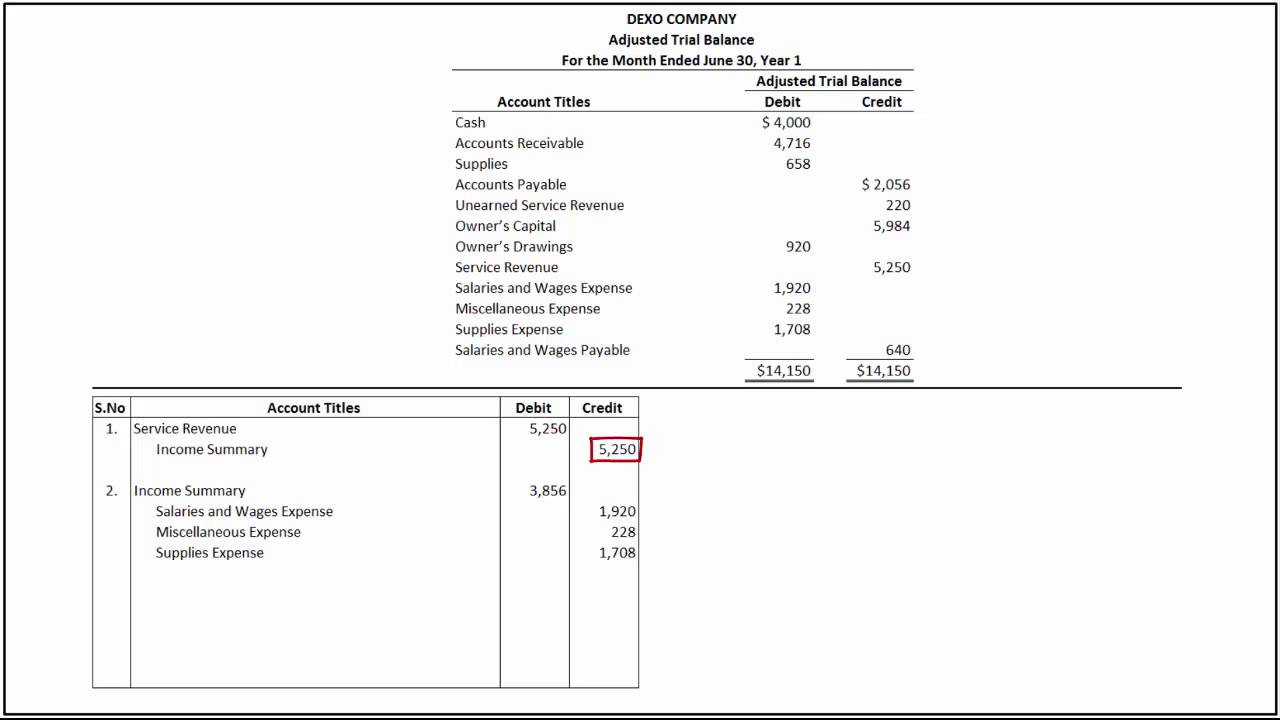

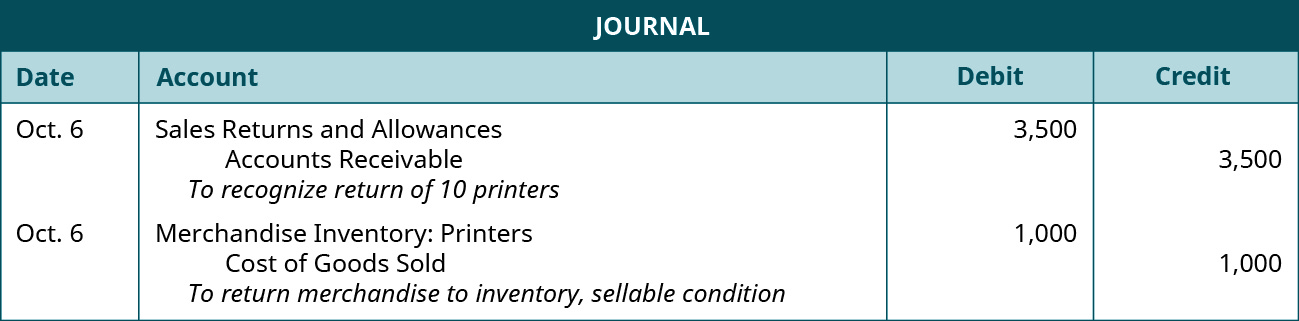

Create income statement closing journal. Accountants may perform the closing process monthly or annually. Create income statement closing journals process. In other words the income summary account is simply a placeholder for account balances at the end of the accounting period while closing entries are being made. Closing entries also called closing journal entries are entries made at the end of an accounting period to zero out all temporary accounts and transfer their balances to permanent accounts.

Oracle gl responsibility view requests submit a new request select single request click ok select name of concurrent program report. The offset amount should be calcuated when the sysetm create the income statement closing journals. Income offset account define with expense account type. Close process create income statement closing journals and balance sheet at year end.

In the request name field select close process. Close process create income statement closing journals navigation. Complete the following parameters. Use the create income statement closing journals process to meet audit requirements.

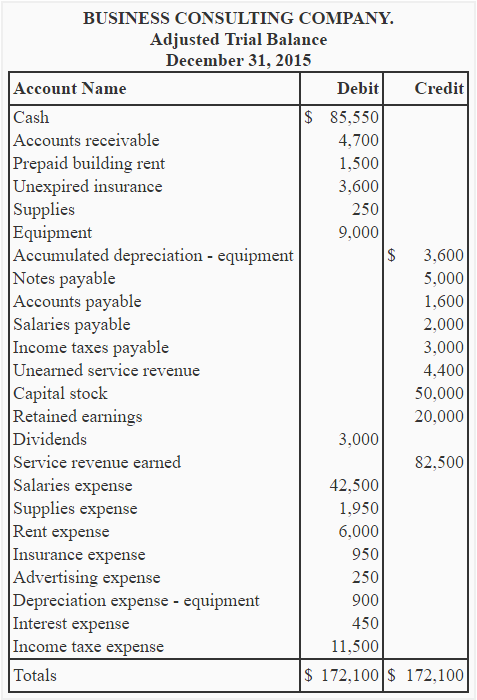

Oracle fusion general ledger cloud service version 11 12 1 0 0 and later. The books are closed by reseting the temporary accounts for the year. Enter a ledger or ledger set. The process creates a journal entry that shows the revenue and expense account balances moved to the retained earnings account.

The closing process reduces revenue expense and dividends account balances temporary accounts to zero so they are ready to receive data for the next accounting period. The closing entries are the journal entry form of the statement of retained earnings. Close process create income statement closing journals with the balances of last period every month. The income summary account is a temporary account used to store income statement account balances revenue and expense accounts during the closing entry step of the accounting cycle.

Oracle e business suite mosc general ledger ebs mosc 5 replies. Alternatively you can post the reciprocal of the net income balance to an income statement offset account instead of zeroing out each revenue and expense. General ledger provides two options for the income statement closing journals. This question is not answered.

If your data access set has a default ledger and you have full access to the default ledger this ledger is defaulted. Actual behavior create income statement closing journals with the balances of last. You can choose to zero out each income statement account and post the balance to the retained earnings account. Parameter ledger or ledger set does not have any values for data access set that does not have full access to the ledger or ledger sets doc id 2304343 1 last updated on october 23 2019.