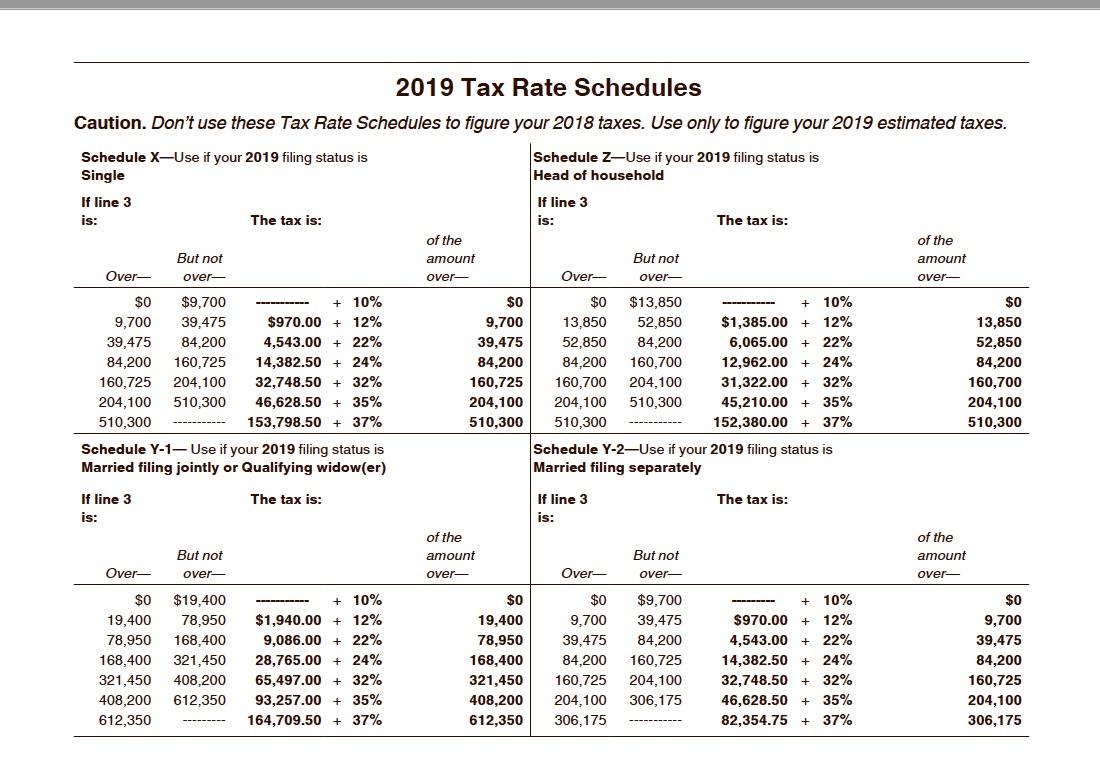

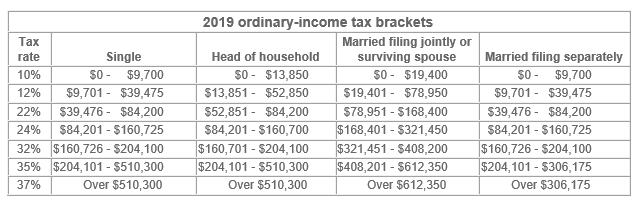

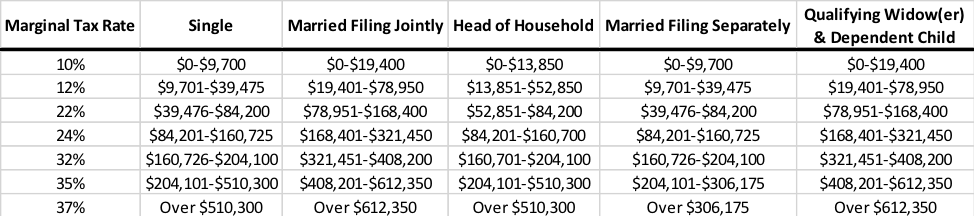

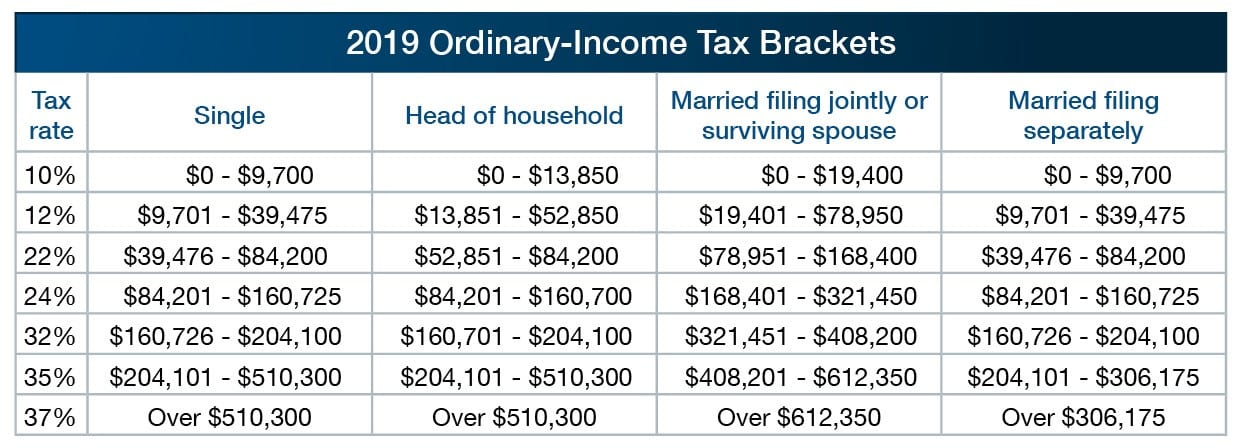

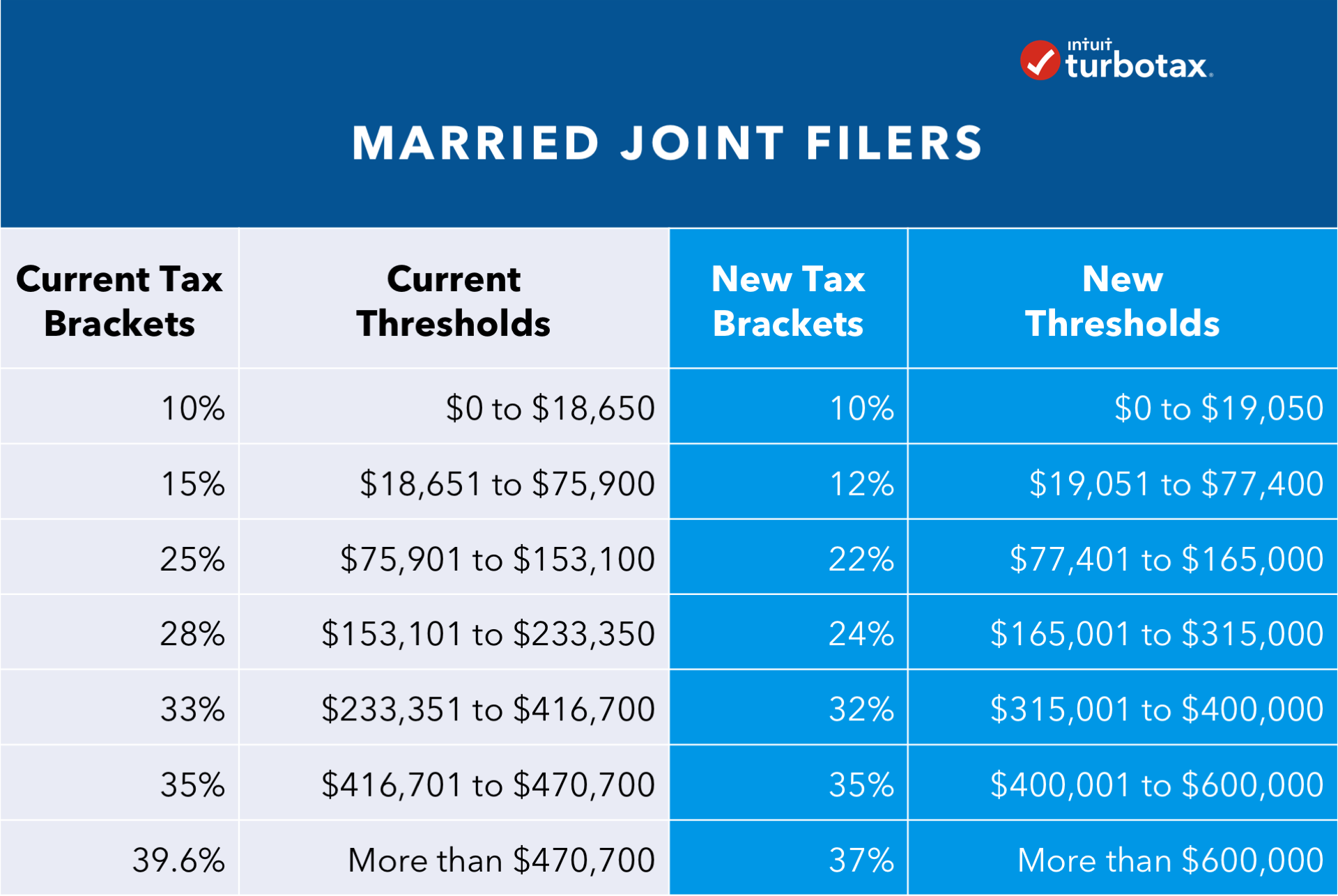

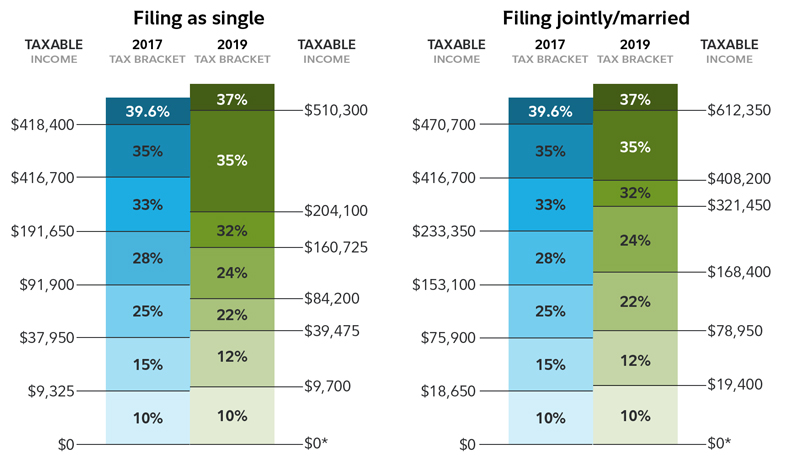

Income Tax Rates 2019 Married Filing Jointly

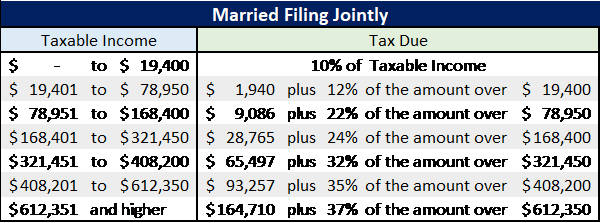

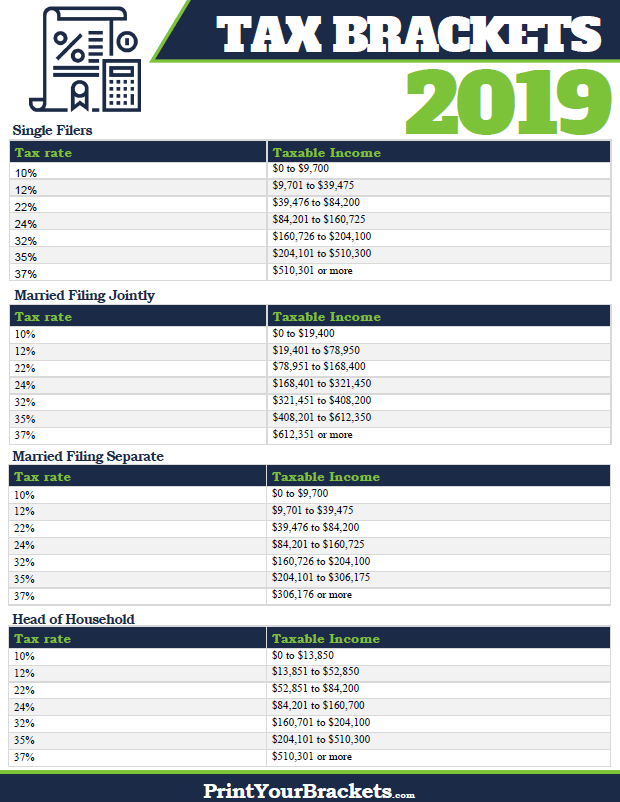

Anything below 19 400 means you pay a 10 tax rate.

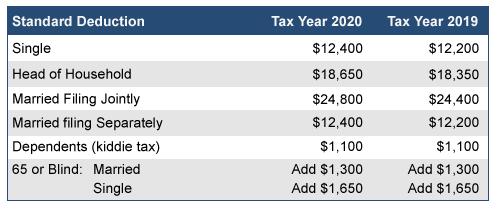

Income tax rates 2019 married filing jointly. 22 for incomes over 78 950. 35 for incomes over 408 200. Married filing jointly and read down the column. Both the spouses income whether earned or unearned income can be added on married filing jointly tax return in turn a primary tax payer can claim a standard deduction amount of 24400 on tax returns.

The other tax brackets for married taxpayers filing jointly are. Married filing jointly tax brackets. In 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1. Even if one spouse has income and the other does not still a husband and wife can file their filing status as mfj.

32 for incomes over 321 450. This is the tax amount they should enter in the entry space on form 1040 line 12a. To qualify for the top rate of tax you must have earned more than 612 350. 12 for incomes over 19 400.

Income tax brackets and rates. Married filing jointly mfj. 24 for incomes over 168 400.

:max_bytes(150000):strip_icc()/TaxRates-marriedfilingseparately2-c08c527d8c98486d800ae561f3012d66.jpg)