Income Tax Brackets 2020 Michigan

Includes tax due and extension payments.

Income tax brackets 2020 michigan. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in april 2020. State individual income tax rates and brackets for 2020 key findings. 4 750 2020 michigan income tax withholding tables. The state levies a single rate income tax on individuals.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. 4 25 personal exemption. 4 25 personal exemption. Covid 19 updates for individual income tax.

Before the official 2020 michigan income tax brackets are released the brackets used on this page are an estimate based on the previous year s brackets. Michigan s income tax rates were last changed ten years ago for tax year 2010 and the tax brackets have not been changed since at least 2001. 10 tax rate up to 9 875 for singles up to 19 750 for joint filers 12 tax rate up to 40 125. With federal individual income tax provisions.

4 25 personal exemption. 1 64 average effective rate. State of michigan 2019 individual income tax return filing deadline is july 15 2020. Taxes site individual income tax.

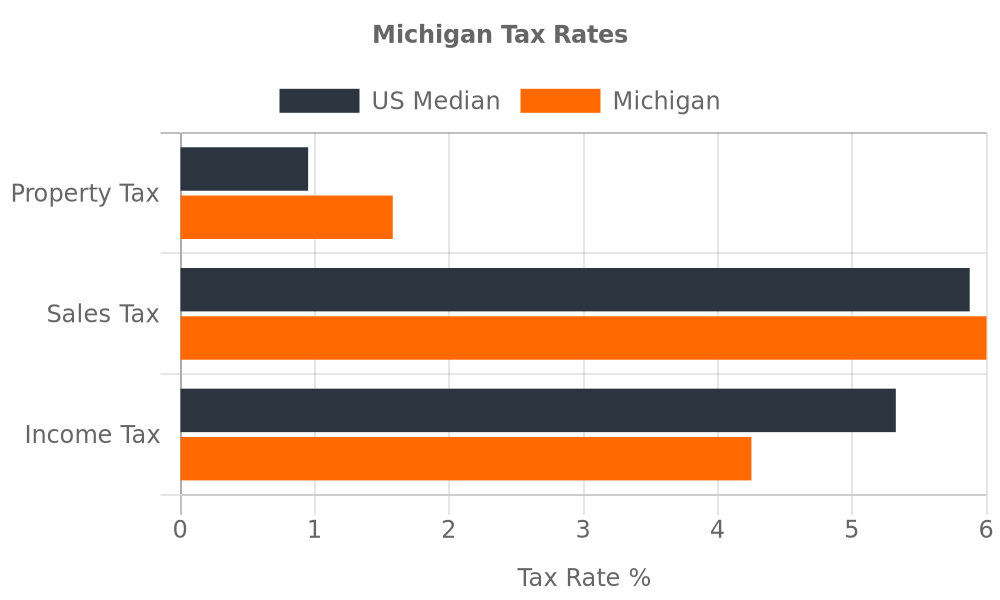

2020 michigan tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. The michigan income tax has one tax bracket with a maximum marginal income tax of 4 25 as of 2020. 41 98 cents per gallon of regular gasoline and 43 30 cents per gallon of diesel. These numbers are subject to change if new michigan tax tables are released.

4 050 2019 michigan income tax withholding tables. Detailed michigan state income tax rates and brackets are available on this page. The current tax year is 2020 and the michigan income tax brackets. For tax year 2020 michigan s personal exemption has increased from 4 400 to 4 750 as part of a four year phase in that began in tax year 2018.

Top individual income tax rate in michigan is 4 25 in 2020. By tax year 2021 the personal exemption will reach 4 900 and starting in tax. 4 400 2019 michigan income tax withholding tables.