Income Tax Act Zimbabwe 2020 Pdf

Paragraph a of this clause will enable miners to deduct.

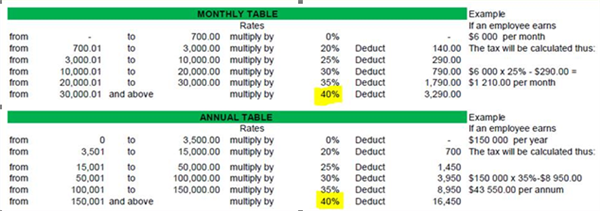

Income tax act zimbabwe 2020 pdf. Highlights of budget 2020. Zimbabwe amendments to the income tax act and introduction of new transfer pricing regulations february 2019 the new minister of finance issued a number of proposals to the income tax act chapter 23 06 most of which take effect from 1 january 2019. Income tax act chapter 23 06 updated income tax act chapter 23 06 updated pdf download details income tax bill 2012 income tax bill 2012 pdf download details income tax transitional period provisions act chapter 23. Part ll 02 income tax review of increase of unpaid tax and balance of unpaid tax currently failure to remit the tax due and payable within the stipulated time will result in a penalty equivalent to 10 of the.

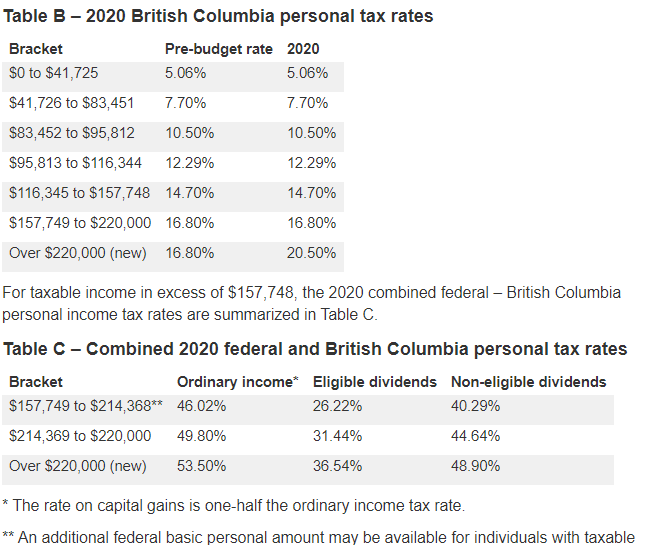

Following the president s assent the honorable minister for finance budget and. 1 july 1962 english text signed by the state president as amended by income tax amendment act 90 of 1962 income tax. Income tax federal and provincial thereon 50 644 52 499 50 368 less. 34 8 1973 part ii 21 1973 23 1974 32 1975 38.

10 39 1969 32 1970 2 1971 41 1971 20 1972 57 1972 s. Non refundable tax credits 8 480 8 579 8 065 total income tax 42 165 43 920 42 303 employee contribution to pension plan 2 356 2 426 2 480 891 914. Gaz 17 1 2020 final pdf download details 63547 y constitution of zimbabwe amendment hb. On 13 january 2020 his excellency president muhammadu buhari gcfr signed the finance bill 2019 into law to become the finance act 2020.

Income derived or deemed to be derived from sources within zimbabwe is subject to tax. Finance no 2 ii clause 14 section 15 of the income tax act sets out amounts that are to be deducted from taxpayers income for the purpose of determining their taxable income. Income tax act 58 of 1962 assented to 25 may 1962 date of commencement. 23 2019 63547 y constitution of zimbabwe amendment hb.