Usda Income Verification Form

Usda allows the following to be deducted from the gross annual income for qualifying household members to determine program income eligibility.

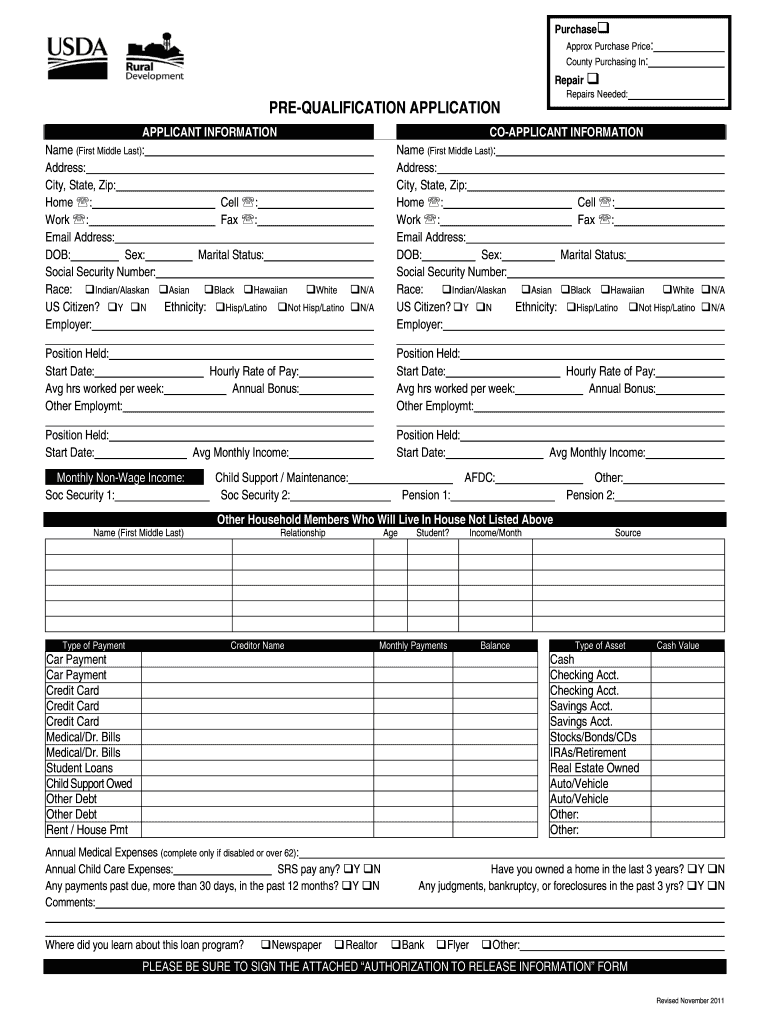

Usda income verification form. Form rd 1910 5 request for verification of employment or an equivalent hud va fannie mae or freddie mac form may be utilized to verify the current year to date ytd and previous year s employment earnings. Number of full time students 18 and over. However getting households to respond to verification requests can be challenging for sfa staff. Number of persons under 18 in household.

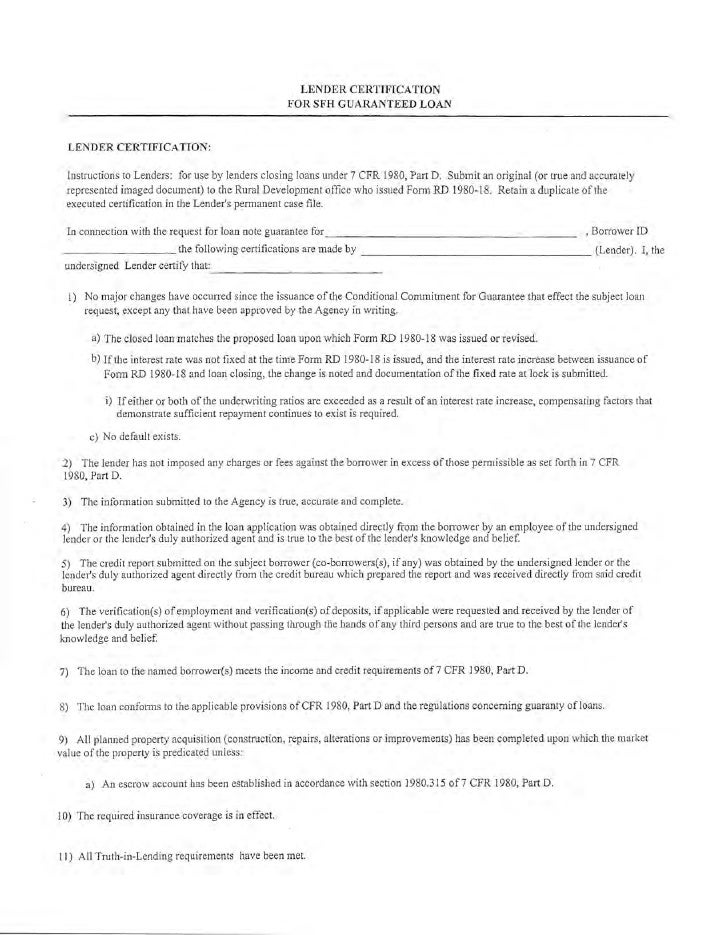

The symbol or logo may not be used by anyone outside of usda without permission. The guaranteed rural housing loan is documented with both rural development and fnma forms. Have the applicant complete item 8 and sign. Usda symbols or logos are intended for official usda use only.

X 480 3. Single family housing income eligibility. This verification must confirm base income wages bonus overtime commissions and other income sources earned as applicable. Usda loans income verification requirements.

They are expressly excluded from any application that would imply or endorse a commercial product or service. Forms referenced in this handbook forms form rd 443 16 assignment of income from real estate security form rd 465 1 application for partial release subordination or consent form rd 1910 5 request for verification of employment form rd 1924 10 release by claimants form rd 1924 12 inspection report. Payment eligibility and adjusted gross income. School food authorities sfas participating in the national school lunch program and school breakfast program are required to verify income for a small percentage of households approved for free or reduced price meals each school year.

Income column deductions. You can complete the forms online and submit the forms electronically to your local service center. You will be able to save the forms to use again and you can package multiple forms together to submit all at one time. You will need to obtain a usda eauthentication id and password with level 2 access which you can do by registering below.

The 2014 farm bill required the implementation of an average adjusted gross income agi limitation of 900 000 for payment eligibility for the 2014 through 2018 programs years. Complete items 1 through 7. Rural development forms are provided in the forms section of this manual all sources of income must be verified using fnma form 1005 verification of employment. Average adjusted gross income certification and verification processes.