Income Tax Quick Definition

Income tax in india is a tax paid by individuals or entities depending on the level of earnings or gains during a.

Income tax quick definition. Wondering what is income tax and how does it work. Income tax simple definition. Income tax is usually paid on a progressive scale see progressive tax. These include itr1 itr2 itr3 itr4 itr5 itr6 and itr7.

Income tax return itr is a form in which an assessee furnishes information regarding his income earned during the previous year. Income tax is used to fund public services pay government. Income tax is listed on the income statement and is simply the amount of taxes owed by the company from the income they generated. Meaning pronunciation translations and examples.

A withholding tax takes a set amount of money out of an employee s paycheck and pays it to the government. Tax liability taxable income x applicable tax rate quick deduction. It also mentions the tax calculated thereupon to the income tax department. Citizens residents and some foreigners must file and pay federal income tax.

Sc kit03 explanation of income tax. The amount of total taxes the company owes from income generated. There are various types of itr forms. Income tax is the money paid by individuals to federal state and in some cases local governments and includes taxation of ordinary income and capital gains.

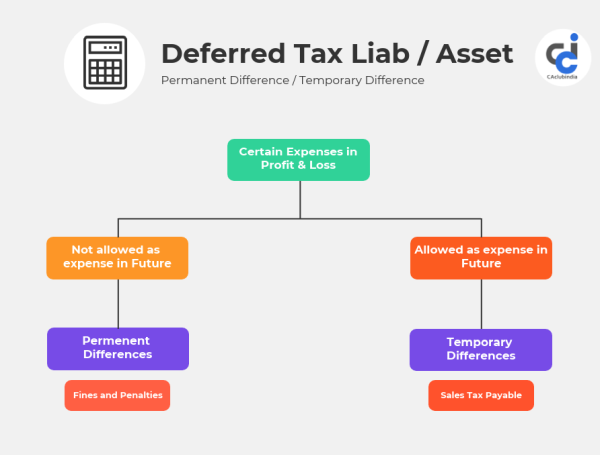

A tax on an individual s net income after deductions for various expenses and payments such as charitable gifts calculated on a formula which takes into consideration whether it is paid jointly by a married couple the number of dependents of the taxpayers special breaks for ages over 65 disabilities and other factors. Income tax a direct tax levied by the government on the income wages rent dividends received by households in order to raise revenue and as an instrument of fiscal policy. Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction. Grossed up taxable income taxable income subject to gross up quick deduction b 100 percent applicable tax rate b tax liability grossed up taxable income x applicable.