Personal Income Tax Definition Wikipedia

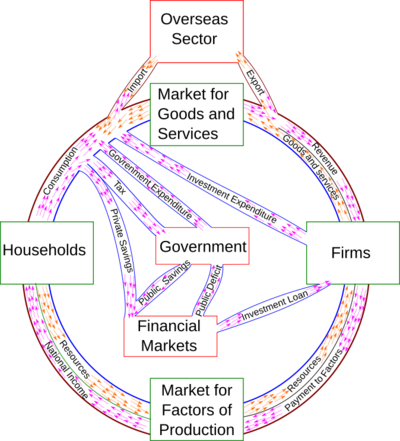

For the government income tax is a source of the government s revenue that they spend on public goods and services.

Personal income tax definition wikipedia. An income tax may be a flat tax which means that all citizens pay the same percentage of their incomes to the government most of the time however an income tax refers to a. Tax collection agreements enable different governments to levy taxes. Business income taxes apply to corporations partnerships small. Income taxes in canada constitute the majority of the annual revenues of the government of canada and of the governments of the provinces of canada in the fiscal year ending 31 march 2018 the federal government collected just over three times more revenue from personal income taxes than it did from corporate income taxes.

Personal income tax is a tax imposed on income generated by individuals. A tax on a person s individual income from wages and salary gambling winnings and some other sources. The government adjusts the tax according to the jurisdiction of a country. A tax on an individual s net income after deductions for various expenses and payments such as charitable gifts calculated on a formula which takes into consideration whether it is paid jointly by a married couple the number of dependents of the taxpayers special breaks for ages over 65 disabilities and other factors.

Income tax generally is computed as the product of a tax rate times taxable income. A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures. A failure to pay along with evasion of or resistance to taxation is punishable by law taxes consist of direct or indirect taxes and may be paid in money or as its labour. An income tax is a tax imposed on individuals or entities taxpayers that varies with respective income or profits taxable income.

Personal income tax is a type of income tax that is levied on an individual s wages salaries and other types of income. Importantly capital gains are usually excluded from income taxes and are subject to their own system of taxation. On 22 april 2009 the then chancellor alistair darling announced in the 2009 budget statement that starting in april 2010 those with annual incomes over 100 000 would see their personal allowance reduced by 1 for every 2 earned over 100 000 until the personal allowance was reduced to zero which in 2010 11 would occur at an income of 112 950. Income taxes in the united states are imposed by the federal most states and many local governments the income taxes are determined by applying a tax rate which may increase as income increases to taxable income which is the total income less allowable deductions individuals and corporations are directly taxable and estates and trusts may be taxable on undistributed income.