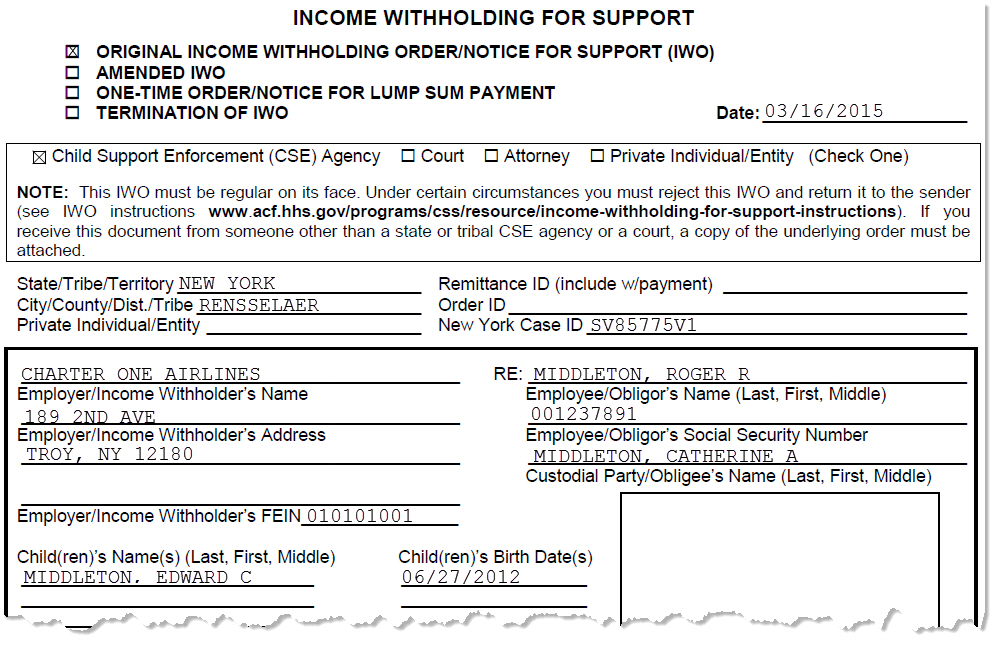

By Income Withholding Directly To Me

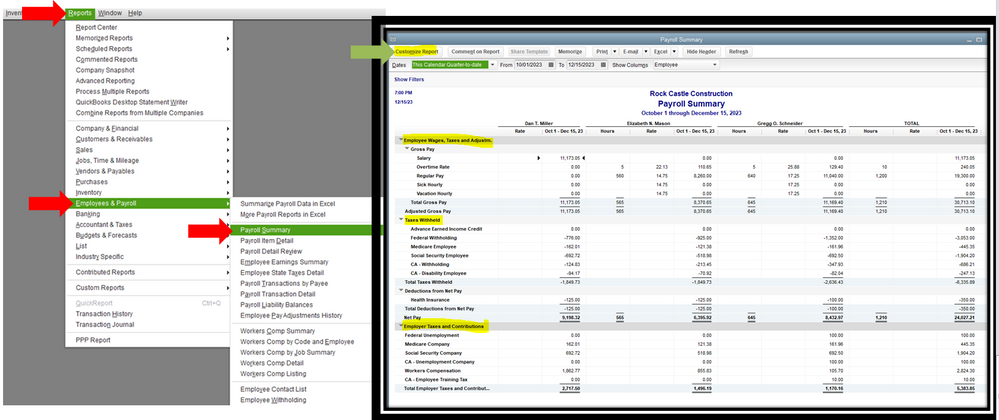

It s simply a collection estimate based on the information filled out in your w 4 and formula provided by the irs.

By income withholding directly to me. With the yearly salary of 36 000 his monthly income comes to 3 000 36 000 12. The irs urges everyone to do a paycheck checkup in 2019 even if they did one. Taxpayers pay the tax as they earn or receive income during the year. Bonus lump sum reporting answers to employers questions.

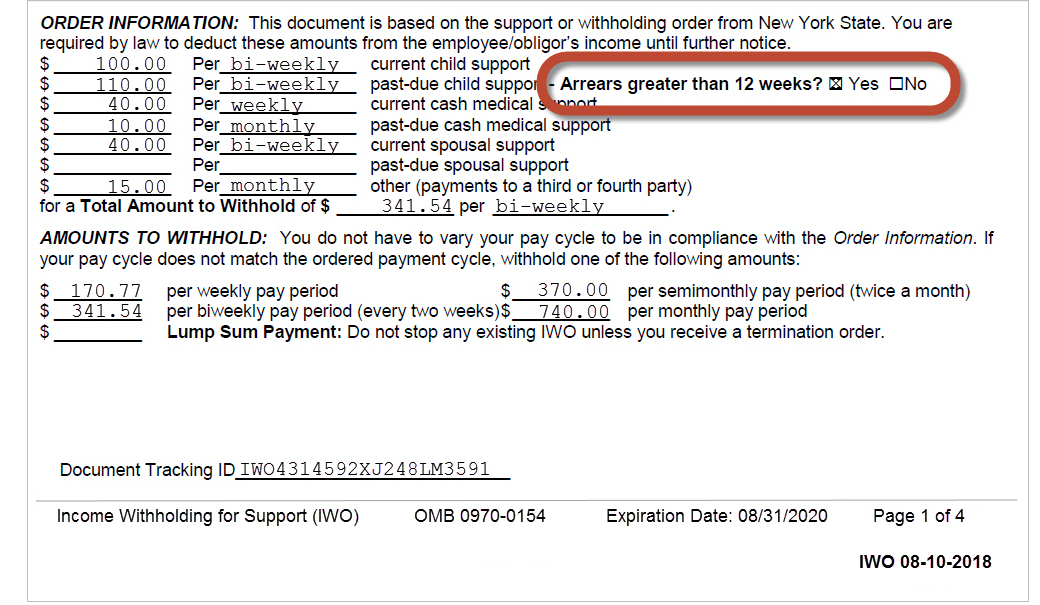

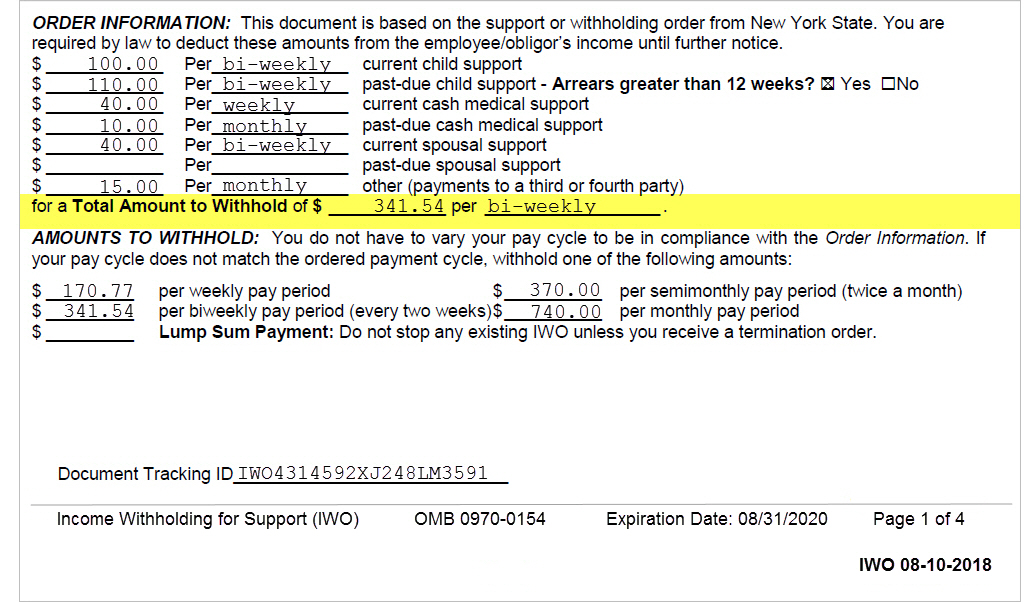

Using the withholding estimator and expected income. The amount withheld is a credit against the income. X earns a salary of 36 000 per year. Iwo form and instructions.

In contrast retention tax on an individual is calculated on various regular income as well as lottery betting etc. Fs 2019 4 march 2019 the federal income tax is a pay as you go tax. This includes but is not limited to courts. The beginnings of withholding tax dates back to 1862 when it was used to help fund the civil war.

Taxpayers can avoid a surprise at tax time by checking their withholding amount. A withholding tax is an amount that an employer withholds from employees wages and pays directly to the government. What is a withholding tax. Income withholding answers to employers questions.

Withholding tax is income tax collected from wages when an employer pays an employee.